Principal Street Partners LLC trimmed its position in Sterling Infrastructure, Inc. (NASDAQ:STRL - Free Report) by 74.6% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,389 shares of the construction company's stock after selling 4,087 shares during the period. Principal Street Partners LLC's holdings in Sterling Infrastructure were worth $201,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

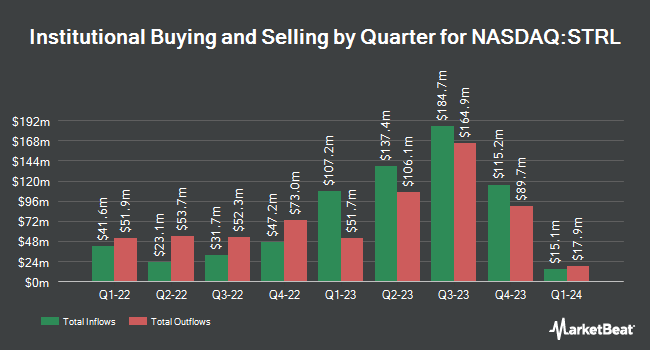

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in STRL. Capital Performance Advisors LLP acquired a new position in Sterling Infrastructure during the third quarter valued at $26,000. Huntington National Bank increased its holdings in Sterling Infrastructure by 21,300.0% in the third quarter. Huntington National Bank now owns 214 shares of the construction company's stock valued at $31,000 after buying an additional 213 shares in the last quarter. Hantz Financial Services Inc. purchased a new stake in shares of Sterling Infrastructure during the 2nd quarter worth about $30,000. Nisa Investment Advisors LLC grew its position in shares of Sterling Infrastructure by 391.1% during the 2nd quarter. Nisa Investment Advisors LLC now owns 275 shares of the construction company's stock valued at $33,000 after acquiring an additional 219 shares during the period. Finally, Crewe Advisors LLC raised its holdings in Sterling Infrastructure by 85.4% in the 2nd quarter. Crewe Advisors LLC now owns 293 shares of the construction company's stock worth $35,000 after purchasing an additional 135 shares during the period. Hedge funds and other institutional investors own 80.95% of the company's stock.

Insider Transactions at Sterling Infrastructure

In other news, EVP Ronald A. Ballschmiede sold 18,700 shares of the stock in a transaction on Thursday, September 19th. The stock was sold at an average price of $143.59, for a total transaction of $2,685,133.00. Following the completion of the transaction, the executive vice president now directly owns 248,471 shares in the company, valued at approximately $35,677,950.89. This represents a 7.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Insiders own 3.80% of the company's stock.

Analyst Ratings Changes

Separately, StockNews.com lowered Sterling Infrastructure from a "buy" rating to a "hold" rating in a report on Sunday, September 15th.

View Our Latest Report on Sterling Infrastructure

Sterling Infrastructure Price Performance

NASDAQ STRL traded down $3.62 on Wednesday, hitting $195.41. The company had a trading volume of 632,065 shares, compared to its average volume of 353,714. The company has a market capitalization of $6.00 billion, a PE ratio of 33.62, a PEG ratio of 2.20 and a beta of 1.15. Sterling Infrastructure, Inc. has a 12-month low of $62.13 and a 12-month high of $203.49. The company's fifty day moving average price is $163.21 and its 200-day moving average price is $133.44. The company has a debt-to-equity ratio of 0.41, a current ratio of 1.29 and a quick ratio of 1.29.

Sterling Infrastructure (NASDAQ:STRL - Get Free Report) last released its earnings results on Wednesday, November 6th. The construction company reported $1.97 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.68 by $0.29. The business had revenue of $593.74 million during the quarter, compared to analyst estimates of $599.90 million. Sterling Infrastructure had a net margin of 8.77% and a return on equity of 27.52%. During the same quarter in the prior year, the firm earned $1.26 earnings per share. As a group, analysts predict that Sterling Infrastructure, Inc. will post 5.96 earnings per share for the current year.

Sterling Infrastructure Profile

(

Free Report)

Sterling Infrastructure, Inc engages in the provision of e-infrastructure, transportation, and building solutions primarily in the United States. It operates through three segments: E-Infrastructure Solutions, Transportation Solutions, and Building Solutions. The E-Infrastructure Solutions segment provides site development services for the blue-chip end users in the e-commerce distribution center, data center, manufacturing, warehousing, and power generation sectors.

Further Reading

Before you consider Sterling Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sterling Infrastructure wasn't on the list.

While Sterling Infrastructure currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.