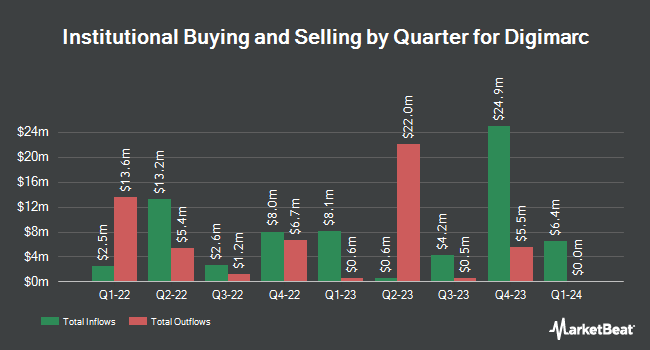

Private Advisor Group LLC boosted its holdings in shares of Digimarc Co. (NASDAQ:DMRC - Free Report) by 3.0% during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 370,394 shares of the information technology services provider's stock after buying an additional 10,680 shares during the quarter. Private Advisor Group LLC owned 1.73% of Digimarc worth $13,871,000 as of its most recent SEC filing.

Other hedge funds also recently added to or reduced their stakes in the company. SG Americas Securities LLC acquired a new stake in Digimarc during the 3rd quarter worth approximately $106,000. FMR LLC increased its position in shares of Digimarc by 201.6% in the 3rd quarter. FMR LLC now owns 4,983 shares of the information technology services provider's stock valued at $134,000 after purchasing an additional 3,331 shares during the last quarter. BNP Paribas Financial Markets increased its position in shares of Digimarc by 28.4% in the 3rd quarter. BNP Paribas Financial Markets now owns 7,800 shares of the information technology services provider's stock valued at $210,000 after purchasing an additional 1,724 shares during the last quarter. Verition Fund Management LLC purchased a new stake in shares of Digimarc in the 3rd quarter valued at approximately $216,000. Finally, JPMorgan Chase & Co. increased its position in shares of Digimarc by 41.5% in the 3rd quarter. JPMorgan Chase & Co. now owns 9,187 shares of the information technology services provider's stock valued at $247,000 after purchasing an additional 2,695 shares during the last quarter. 66.85% of the stock is currently owned by institutional investors and hedge funds.

Digimarc Trading Down 5.7 %

Shares of NASDAQ DMRC traded down $1.66 during mid-day trading on Friday, reaching $27.27. The company had a trading volume of 126,918 shares, compared to its average volume of 171,196. The firm has a 50 day simple moving average of $38.25 and a two-hundred day simple moving average of $32.84. The stock has a market cap of $584.02 million, a P/E ratio of -14.02 and a beta of 1.66. Digimarc Co. has a 52-week low of $21.00 and a 52-week high of $48.32.

Wall Street Analysts Forecast Growth

Separately, Needham & Company LLC reissued a "buy" rating and issued a $40.00 price objective on shares of Digimarc in a research report on Friday, November 15th.

View Our Latest Analysis on DMRC

Digimarc Profile

(

Free Report)

Digimarc Corporation, together with its subsidiaries, provides automatic identification solutions to commercial and government customers in the United States and internationally. The company offers Digimarc Validate protects, a cloud-based record of product authentication information; Digimarc Engage, an interactive communications channel connecting brands and consumers; and Digimarc Recycle.

Featured Stories

Before you consider Digimarc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Digimarc wasn't on the list.

While Digimarc currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.