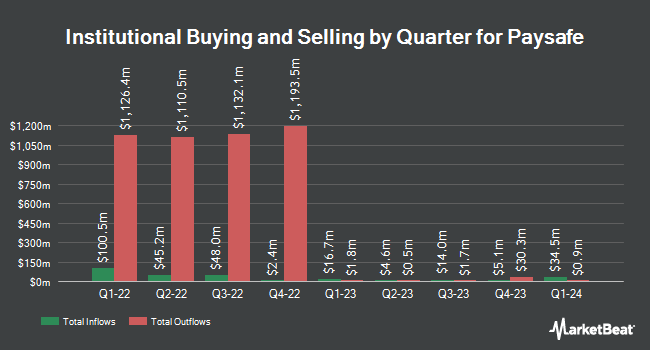

Private Management Group Inc. bought a new position in shares of Paysafe Limited (NYSE:PSFE - Free Report) during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 496,437 shares of the company's stock, valued at approximately $8,489,000. Private Management Group Inc. owned 0.82% of Paysafe as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other hedge funds have also recently added to or reduced their stakes in the company. Principal Financial Group Inc. acquired a new position in shares of Paysafe during the 3rd quarter worth about $764,000. Foundry Partners LLC purchased a new stake in Paysafe during the third quarter worth approximately $5,450,000. Barclays PLC boosted its holdings in Paysafe by 273.6% in the third quarter. Barclays PLC now owns 42,167 shares of the company's stock valued at $946,000 after purchasing an additional 30,881 shares in the last quarter. JPMorgan Chase & Co. increased its stake in Paysafe by 5.8% in the third quarter. JPMorgan Chase & Co. now owns 15,183 shares of the company's stock valued at $341,000 after purchasing an additional 835 shares during the last quarter. Finally, Public Employees Retirement System of Ohio acquired a new stake in Paysafe during the third quarter worth approximately $1,105,000. Institutional investors and hedge funds own 54.39% of the company's stock.

Paysafe Trading Up 0.9 %

Shares of PSFE stock traded up $0.20 during trading hours on Friday, hitting $23.27. The stock had a trading volume of 482,241 shares, compared to its average volume of 274,325. The company has a debt-to-equity ratio of 2.76, a current ratio of 1.14 and a quick ratio of 1.14. The stock's 50 day moving average is $18.49 and its 200 day moving average is $20.27. Paysafe Limited has a twelve month low of $11.94 and a twelve month high of $26.25.

Wall Street Analysts Forecast Growth

Several brokerages have recently issued reports on PSFE. Royal Bank of Canada lowered their target price on shares of Paysafe from $25.00 to $21.00 and set a "sector perform" rating for the company in a report on Thursday, November 14th. Susquehanna decreased their price objective on shares of Paysafe from $23.00 to $21.00 and set a "neutral" rating for the company in a research note on Thursday, November 14th.

View Our Latest Analysis on PSFE

Paysafe Profile

(

Free Report)

Paysafe Limited provides end-to-end payment solutions in the United States, Germany, the United Kingdom, and internationally. Its payments platform offers a range of payment solutions comprising credit and debit card processing, digital wallet, eCash, and real-time banking solutions for entertainment verticals, such as iGaming, including online betting related to sports, e-sports, fantasy sports, poker, and other casino games, as well as travel, streaming/video gaming, retail/hospitality, and digital assets.

Recommended Stories

Before you consider Paysafe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paysafe wasn't on the list.

While Paysafe currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.