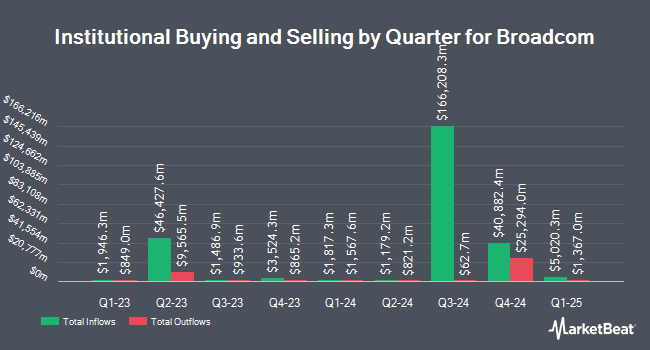

Private Trust Co. NA grew its holdings in shares of Broadcom Inc. (NASDAQ:AVGO - Free Report) by 898.0% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 45,907 shares of the semiconductor manufacturer's stock after buying an additional 41,307 shares during the quarter. Broadcom accounts for about 0.8% of Private Trust Co. NA's investment portfolio, making the stock its 14th largest holding. Private Trust Co. NA's holdings in Broadcom were worth $7,919,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds have also made changes to their positions in AVGO. Indiana Trust & Investment Management CO lifted its holdings in Broadcom by 39.5% during the 2nd quarter. Indiana Trust & Investment Management CO now owns 53 shares of the semiconductor manufacturer's stock worth $85,000 after buying an additional 15 shares during the last quarter. Creekmur Asset Management LLC boosted its holdings in Broadcom by 89.7% in the first quarter. Creekmur Asset Management LLC now owns 74 shares of the semiconductor manufacturer's stock worth $98,000 after purchasing an additional 35 shares during the period. Kiely Wealth Advisory Group Inc. bought a new stake in Broadcom during the second quarter valued at $128,000. Mark Sheptoff Financial Planning LLC acquired a new stake in shares of Broadcom during the second quarter worth $136,000. Finally, Bank & Trust Co bought a new position in shares of Broadcom in the 2nd quarter worth about $153,000. Institutional investors and hedge funds own 76.43% of the company's stock.

Broadcom Price Performance

Shares of Broadcom stock opened at $164.74 on Wednesday. Broadcom Inc. has a 52 week low of $90.31 and a 52 week high of $186.42. The company has a current ratio of 1.04, a quick ratio of 0.94 and a debt-to-equity ratio of 1.02. The stock has a market cap of $769.43 billion, a PE ratio of 143.13, a price-to-earnings-growth ratio of 1.94 and a beta of 1.17. The company's 50-day moving average price is $173.76 and its two-hundred day moving average price is $161.09.

Broadcom (NASDAQ:AVGO - Get Free Report) last released its earnings results on Thursday, September 5th. The semiconductor manufacturer reported $1.24 EPS for the quarter, beating the consensus estimate of $1.20 by $0.04. The business had revenue of $13.07 billion during the quarter, compared to analyst estimates of $12.98 billion. Broadcom had a net margin of 10.88% and a return on equity of 30.12%. The business's quarterly revenue was up 47.3% on a year-over-year basis. During the same period in the prior year, the business earned $0.95 earnings per share. As a group, sell-side analysts anticipate that Broadcom Inc. will post 3.78 EPS for the current fiscal year.

Broadcom Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, September 30th. Investors of record on Thursday, September 19th were given a $0.53 dividend. This is a positive change from Broadcom's previous quarterly dividend of $0.53. The ex-dividend date was Thursday, September 19th. This represents a $2.12 dividend on an annualized basis and a dividend yield of 1.29%. Broadcom's dividend payout ratio (DPR) is 184.19%.

Insider Buying and Selling

In other Broadcom news, CEO Hock E. Tan sold 50,000 shares of Broadcom stock in a transaction dated Tuesday, September 17th. The stock was sold at an average price of $163.37, for a total transaction of $8,168,500.00. Following the transaction, the chief executive officer now owns 1,331,910 shares of the company's stock, valued at $217,594,136.70. The trade was a 3.62 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, insider Charlie B. Kawwas sold 25,200 shares of the stock in a transaction that occurred on Thursday, September 19th. The stock was sold at an average price of $168.27, for a total transaction of $4,240,404.00. Following the completion of the sale, the insider now directly owns 753,280 shares of the company's stock, valued at $126,754,425.60. This trade represents a 3.24 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 311,080 shares of company stock valued at $53,540,590. 2.00% of the stock is owned by corporate insiders.

Analyst Ratings Changes

A number of equities research analysts recently weighed in on the stock. Cantor Fitzgerald boosted their price objective on shares of Broadcom from $200.00 to $225.00 and gave the company an "overweight" rating in a research report on Tuesday, October 8th. The Goldman Sachs Group raised their price target on Broadcom from $185.00 to $190.00 and gave the stock a "buy" rating in a report on Friday, September 6th. TD Cowen upgraded Broadcom to a "strong-buy" rating in a research note on Monday, September 16th. Mizuho increased their target price on Broadcom from $190.00 to $220.00 and gave the stock an "outperform" rating in a research report on Monday, October 14th. Finally, Morgan Stanley boosted their price target on shares of Broadcom from $176.00 to $180.00 and gave the company an "overweight" rating in a report on Friday, September 6th. Two equities research analysts have rated the stock with a hold rating, twenty-three have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $195.96.

View Our Latest Research Report on Broadcom

Broadcom Company Profile

(

Free Report)

Broadcom Inc designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide. The company operates in two segments, Semiconductor Solutions and Infrastructure Software.

Further Reading

Before you consider Broadcom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadcom wasn't on the list.

While Broadcom currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.