Privia Health Group (NASDAQ:PRVA - Get Free Report) had its target price hoisted by investment analysts at Truist Financial from $27.00 to $28.00 in a note issued to investors on Thursday,Benzinga reports. The firm currently has a "buy" rating on the stock. Truist Financial's price objective would indicate a potential upside of 16.47% from the company's previous close.

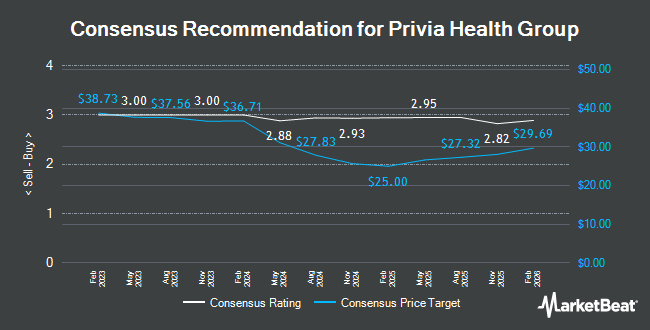

Several other brokerages have also weighed in on PRVA. Macquarie assumed coverage on Privia Health Group in a research report on Monday, December 16th. They set an "outperform" rating and a $25.00 target price on the stock. Needham & Company LLC restated a "buy" rating and issued a $30.00 price objective on shares of Privia Health Group in a research note on Friday, March 21st. Canaccord Genuity Group lifted their target price on shares of Privia Health Group from $29.00 to $30.00 and gave the company a "buy" rating in a report on Friday, February 28th. Piper Sandler raised their price target on Privia Health Group from $25.00 to $40.00 and gave the company an "overweight" rating in a report on Friday, February 28th. Finally, JMP Securities set a $29.00 price objective on Privia Health Group in a research report on Friday, February 28th. One equities research analyst has rated the stock with a hold rating, thirteen have issued a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Buy" and a consensus target price of $27.00.

View Our Latest Analysis on Privia Health Group

Privia Health Group Stock Performance

Shares of NASDAQ:PRVA traded down $0.01 during trading hours on Thursday, reaching $24.04. The stock had a trading volume of 130,278 shares, compared to its average volume of 784,615. The firm's 50 day moving average is $23.77 and its 200-day moving average is $21.56. The stock has a market capitalization of $2.92 billion, a price-to-earnings ratio of 240.42, a P/E/G ratio of 3.47 and a beta of 0.88. Privia Health Group has a 1 year low of $15.92 and a 1 year high of $26.04.

Insider Transactions at Privia Health Group

In related news, CFO David Mountcastle sold 5,630 shares of Privia Health Group stock in a transaction dated Wednesday, April 2nd. The stock was sold at an average price of $22.38, for a total transaction of $125,999.40. Following the completion of the sale, the chief financial officer now owns 179,676 shares in the company, valued at approximately $4,021,148.88. This trade represents a 3.04 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Insiders own 14.20% of the company's stock.

Institutional Trading of Privia Health Group

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the business. XTX Topco Ltd acquired a new stake in shares of Privia Health Group in the third quarter worth approximately $182,000. Barclays PLC grew its stake in shares of Privia Health Group by 240.3% during the 3rd quarter. Barclays PLC now owns 224,018 shares of the company's stock valued at $4,079,000 after buying an additional 158,188 shares during the period. Geode Capital Management LLC increased its holdings in shares of Privia Health Group by 1.0% during the 3rd quarter. Geode Capital Management LLC now owns 2,415,022 shares of the company's stock worth $43,986,000 after buying an additional 23,178 shares during the last quarter. Neo Ivy Capital Management purchased a new position in shares of Privia Health Group in the 3rd quarter worth $66,000. Finally, Virtu Financial LLC acquired a new position in Privia Health Group in the third quarter valued at $263,000. Hedge funds and other institutional investors own 94.48% of the company's stock.

Privia Health Group Company Profile

(

Get Free Report)

Privia Health Group, Inc operates as a national physician-enablement company in the United States. The company collaborates with medical groups, health plans, and health systems to optimize physician practices, enhance patient experiences, and reward doctors for delivering care in-person and virtual settings.

Recommended Stories

Before you consider Privia Health Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Privia Health Group wasn't on the list.

While Privia Health Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.