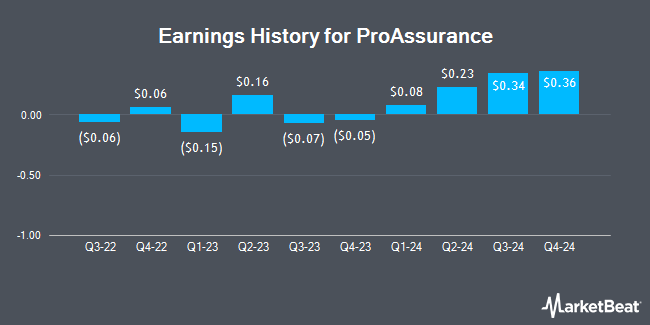

ProAssurance (NYSE:PRA - Get Free Report) is expected to announce its earnings results after the market closes on Monday, February 24th. Analysts expect the company to announce earnings of $0.17 per share and revenue of $274.56 million for the quarter. Individual that wish to register for the company's earnings conference call can do so using this link.

ProAssurance Price Performance

NYSE PRA traded down $0.43 on Friday, reaching $13.99. The company had a trading volume of 179,535 shares, compared to its average volume of 180,836. The company has a quick ratio of 0.28, a current ratio of 0.28 and a debt-to-equity ratio of 0.35. The stock has a market capitalization of $715.47 million, a PE ratio of 16.85 and a beta of 0.27. The firm's 50 day moving average price is $15.24 and its 200 day moving average price is $14.95. ProAssurance has a 12 month low of $10.76 and a 12 month high of $17.79.

Wall Street Analysts Forecast Growth

A number of analysts have issued reports on the stock. Truist Financial lifted their price target on shares of ProAssurance from $14.00 to $18.00 and gave the company a "hold" rating in a report on Tuesday, November 12th. Piper Sandler downgraded shares of ProAssurance from an "overweight" rating to a "neutral" rating and set a $18.00 target price on the stock. in a report on Monday, November 11th. Finally, StockNews.com upgraded shares of ProAssurance from a "hold" rating to a "buy" rating in a report on Thursday, December 26th.

Check Out Our Latest Analysis on PRA

About ProAssurance

(

Get Free Report)

ProAssurance Corporation, through its subsidiaries, provides property and casualty insurance, and reinsurance products in the United States. The company operates through Specialty Property and Casualty, Workers' Compensation Insurance, and Segregated Portfolio Cell Reinsurance segments. It offers professional liability insurance to healthcare providers and institutions, and attorneys and their firms; medical technology liability insurance to medical technology and life sciences companies; and custom alternative risk solutions, including assumed reinsurance, loss portfolio transfers, and captive cell programs for healthcare professional liability insureds.

Further Reading

Before you consider ProAssurance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ProAssurance wasn't on the list.

While ProAssurance currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.