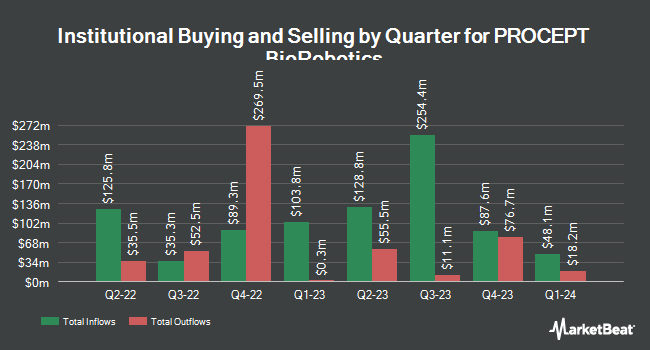

Geode Capital Management LLC raised its position in PROCEPT BioRobotics Co. (NASDAQ:PRCT - Free Report) by 8.2% during the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 1,106,588 shares of the company's stock after acquiring an additional 84,244 shares during the quarter. Geode Capital Management LLC owned approximately 2.12% of PROCEPT BioRobotics worth $88,678,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also bought and sold shares of PRCT. Westfield Capital Management Co. LP purchased a new stake in shares of PROCEPT BioRobotics during the 3rd quarter valued at about $72,563,000. Chicago Capital LLC bought a new position in PROCEPT BioRobotics in the second quarter worth approximately $14,233,000. Federated Hermes Inc. boosted its stake in shares of PROCEPT BioRobotics by 788.9% during the 2nd quarter. Federated Hermes Inc. now owns 183,420 shares of the company's stock worth $11,205,000 after acquiring an additional 162,785 shares during the last quarter. Transatlantique Private Wealth LLC bought a new stake in shares of PROCEPT BioRobotics during the 2nd quarter valued at $9,164,000. Finally, Point72 DIFC Ltd purchased a new stake in shares of PROCEPT BioRobotics in the 3rd quarter worth $11,890,000. 89.46% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several equities analysts recently weighed in on the company. Truist Financial reiterated a "buy" rating and set a $105.00 target price (up from $95.00) on shares of PROCEPT BioRobotics in a research report on Wednesday, October 30th. Wells Fargo & Company reaffirmed an "overweight" rating and set a $112.00 price objective on shares of PROCEPT BioRobotics in a research report on Tuesday, December 3rd. Jefferies Financial Group assumed coverage on shares of PROCEPT BioRobotics in a report on Thursday, November 14th. They issued a "hold" rating and a $95.00 target price for the company. TD Cowen lifted their price target on shares of PROCEPT BioRobotics from $75.00 to $99.00 and gave the company a "buy" rating in a report on Monday, September 16th. Finally, Morgan Stanley assumed coverage on shares of PROCEPT BioRobotics in a research note on Monday, December 2nd. They issued an "overweight" rating and a $105.00 price objective for the company. One investment analyst has rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $97.86.

View Our Latest Report on PRCT

PROCEPT BioRobotics Price Performance

Shares of PROCEPT BioRobotics stock traded up $0.39 on Friday, hitting $81.17. 1,287,977 shares of the company traded hands, compared to its average volume of 653,331. The company has a debt-to-equity ratio of 0.21, a quick ratio of 5.07 and a current ratio of 6.02. The business has a 50-day simple moving average of $88.25 and a 200 day simple moving average of $76.15. PROCEPT BioRobotics Co. has a 52 week low of $39.48 and a 52 week high of $103.81. The stock has a market capitalization of $4.24 billion, a P/E ratio of -41.63 and a beta of 0.99.

PROCEPT BioRobotics (NASDAQ:PRCT - Get Free Report) last announced its quarterly earnings results on Monday, October 28th. The company reported ($0.40) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.49) by $0.09. PROCEPT BioRobotics had a negative net margin of 50.07% and a negative return on equity of 38.57%. The company had revenue of $58.40 million for the quarter, compared to the consensus estimate of $53.30 million. During the same period in the previous year, the firm posted ($0.51) EPS. PROCEPT BioRobotics's revenue for the quarter was up 66.4% compared to the same quarter last year. Research analysts expect that PROCEPT BioRobotics Co. will post -1.75 earnings per share for the current fiscal year.

Insider Buying and Selling

In other PROCEPT BioRobotics news, EVP Alaleh Nouri sold 28,092 shares of PROCEPT BioRobotics stock in a transaction on Wednesday, December 4th. The shares were sold at an average price of $97.13, for a total value of $2,728,575.96. Following the completion of the transaction, the executive vice president now directly owns 52,472 shares of the company's stock, valued at $5,096,605.36. This trade represents a 34.87 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. Also, CEO Reza Zadno sold 26,423 shares of the company's stock in a transaction dated Wednesday, December 4th. The shares were sold at an average price of $97.22, for a total transaction of $2,568,844.06. Following the sale, the chief executive officer now owns 152,762 shares in the company, valued at $14,851,521.64. This represents a 14.75 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 487,816 shares of company stock worth $44,820,549. Corporate insiders own 17.40% of the company's stock.

PROCEPT BioRobotics Profile

(

Free Report)

PROCEPT BioRobotics Corporation, a surgical robotics company, focuses on developing transformative solutions in urology in the United States and internationally. The company develops, manufactures, and sells AquaBeam Robotic System, an image-guided, surgical robotic system for use in minimally invasive urologic surgery with a focus on treating benign prostatic hyperplasia (BPH).

Read More

Before you consider PROCEPT BioRobotics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PROCEPT BioRobotics wasn't on the list.

While PROCEPT BioRobotics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.