Charles Schwab Investment Management Inc. raised its holdings in Procore Technologies, Inc. (NYSE:PCOR - Free Report) by 16.6% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 682,303 shares of the company's stock after buying an additional 97,117 shares during the period. Charles Schwab Investment Management Inc. owned 0.46% of Procore Technologies worth $42,112,000 at the end of the most recent reporting period.

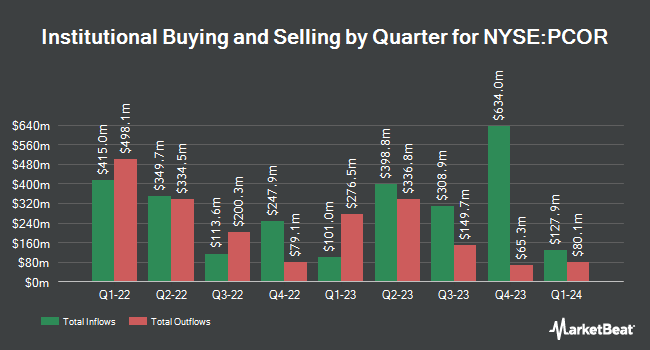

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. GAMMA Investing LLC boosted its holdings in shares of Procore Technologies by 76.4% in the 3rd quarter. GAMMA Investing LLC now owns 404 shares of the company's stock valued at $25,000 after buying an additional 175 shares during the last quarter. V Square Quantitative Management LLC acquired a new stake in Procore Technologies in the third quarter valued at $26,000. Signaturefd LLC grew its position in shares of Procore Technologies by 52.0% in the 2nd quarter. Signaturefd LLC now owns 631 shares of the company's stock valued at $42,000 after acquiring an additional 216 shares during the period. Rothschild Investment LLC acquired a new position in shares of Procore Technologies during the 2nd quarter worth about $51,000. Finally, International Assets Investment Management LLC raised its holdings in shares of Procore Technologies by 6,069.2% in the 3rd quarter. International Assets Investment Management LLC now owns 802 shares of the company's stock valued at $49,000 after purchasing an additional 789 shares during the period. 81.10% of the stock is owned by institutional investors.

Insider Buying and Selling at Procore Technologies

In other Procore Technologies news, Director Kathryn Bueker sold 6,500 shares of the firm's stock in a transaction on Monday, November 25th. The shares were sold at an average price of $78.01, for a total value of $507,065.00. Following the completion of the sale, the director now directly owns 23,932 shares in the company, valued at approximately $1,866,935.32. This trade represents a 21.36 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Connor Kevin J. O sold 5,128 shares of the company's stock in a transaction dated Thursday, September 19th. The shares were sold at an average price of $58.48, for a total transaction of $299,885.44. Following the transaction, the director now owns 1,360,848 shares in the company, valued at $79,582,391.04. This represents a 0.38 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 115,553 shares of company stock valued at $7,933,974. 29.00% of the stock is currently owned by insiders.

Procore Technologies Price Performance

PCOR stock traded down $0.38 during midday trading on Monday, reaching $80.82. 2,282,780 shares of the stock were exchanged, compared to its average volume of 1,611,488. Procore Technologies, Inc. has a 52 week low of $49.46 and a 52 week high of $83.35. The company has a fifty day moving average price of $66.45 and a 200 day moving average price of $64.35. The company has a debt-to-equity ratio of 0.03, a current ratio of 1.57 and a quick ratio of 1.57. The stock has a market capitalization of $12.02 billion, a PE ratio of -161.00 and a beta of 0.71.

Procore Technologies (NYSE:PCOR - Get Free Report) last announced its earnings results on Wednesday, October 30th. The company reported ($0.11) earnings per share (EPS) for the quarter, hitting the consensus estimate of ($0.11). Procore Technologies had a negative return on equity of 2.51% and a negative net margin of 6.59%. The business had revenue of $295.89 million during the quarter, compared to analyst estimates of $287.42 million. As a group, analysts expect that Procore Technologies, Inc. will post -0.23 EPS for the current fiscal year.

Wall Street Analyst Weigh In

A number of research firms recently weighed in on PCOR. KeyCorp increased their price target on Procore Technologies from $68.00 to $85.00 and gave the company an "overweight" rating in a research note on Friday, November 22nd. BMO Capital Markets raised their target price on shares of Procore Technologies from $71.00 to $85.00 and gave the stock an "outperform" rating in a research note on Friday, November 22nd. JPMorgan Chase & Co. upped their price target on shares of Procore Technologies from $75.00 to $85.00 and gave the company an "overweight" rating in a research note on Friday, November 22nd. JMP Securities raised their price objective on shares of Procore Technologies from $75.00 to $90.00 and gave the stock a "market outperform" rating in a research report on Monday. Finally, Piper Sandler upped their target price on Procore Technologies from $70.00 to $90.00 and gave the company an "overweight" rating in a research report on Friday, November 22nd. Five investment analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, Procore Technologies has an average rating of "Moderate Buy" and a consensus price target of $81.65.

View Our Latest Research Report on Procore Technologies

About Procore Technologies

(

Free Report)

Procore Technologies, Inc engages in the provision of a cloud-based construction management platform and related software products in the United States and internationally. The company's platform enables owners, general and specialty contractors, architects, and engineers to collaborate on construction projects.

Read More

Before you consider Procore Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procore Technologies wasn't on the list.

While Procore Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.