Entropy Technologies LP boosted its position in shares of Procore Technologies, Inc. (NYSE:PCOR - Free Report) by 111.2% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 27,790 shares of the company's stock after purchasing an additional 14,634 shares during the period. Entropy Technologies LP's holdings in Procore Technologies were worth $1,715,000 at the end of the most recent quarter.

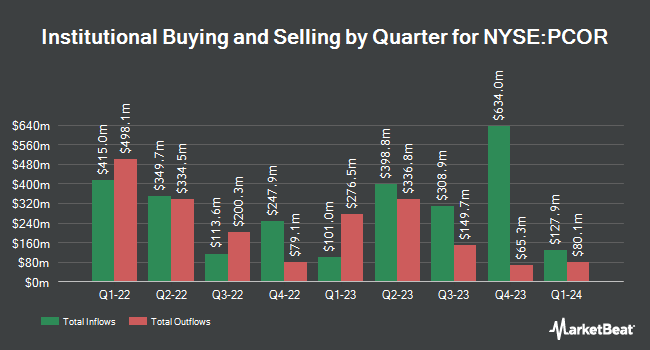

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Lountzis Asset Management LLC acquired a new position in Procore Technologies in the third quarter worth $6,160,000. Atria Investments Inc lifted its position in Procore Technologies by 11.9% during the 3rd quarter. Atria Investments Inc now owns 4,950 shares of the company's stock worth $306,000 after buying an additional 527 shares in the last quarter. Kornitzer Capital Management Inc. KS grew its holdings in Procore Technologies by 24.9% during the 3rd quarter. Kornitzer Capital Management Inc. KS now owns 175,800 shares of the company's stock worth $10,850,000 after acquiring an additional 35,000 shares during the last quarter. Olympiad Research LP increased its position in Procore Technologies by 42.4% in the 3rd quarter. Olympiad Research LP now owns 9,899 shares of the company's stock valued at $611,000 after acquiring an additional 2,947 shares in the last quarter. Finally, WoodTrust Financial Corp bought a new position in shares of Procore Technologies in the third quarter worth about $201,000. 81.10% of the stock is currently owned by institutional investors and hedge funds.

Procore Technologies Price Performance

NYSE PCOR traded up $1.84 during trading hours on Wednesday, reaching $72.83. 1,970,369 shares of the company's stock were exchanged, compared to its average volume of 1,559,346. The company has a debt-to-equity ratio of 0.03, a current ratio of 1.57 and a quick ratio of 1.57. Procore Technologies, Inc. has a one year low of $49.46 and a one year high of $83.35. The company's 50-day moving average is $61.55 and its two-hundred day moving average is $63.73.

Procore Technologies (NYSE:PCOR - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The company reported ($0.11) earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of ($0.11). Procore Technologies had a negative return on equity of 2.51% and a negative net margin of 6.59%. The business had revenue of $295.89 million during the quarter, compared to the consensus estimate of $287.42 million. Equities research analysts forecast that Procore Technologies, Inc. will post -0.23 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of analysts recently weighed in on PCOR shares. Stifel Nicolaus lowered their price target on shares of Procore Technologies from $85.00 to $63.00 and set a "buy" rating for the company in a report on Friday, August 2nd. Macquarie reissued a "neutral" rating and issued a $70.00 target price on shares of Procore Technologies in a research note on Tuesday, July 30th. The Goldman Sachs Group cut their price target on Procore Technologies from $85.00 to $73.00 and set a "buy" rating on the stock in a research note on Friday, August 2nd. Barclays raised their price target on Procore Technologies from $64.00 to $66.00 and gave the company an "equal weight" rating in a report on Thursday, October 31st. Finally, TD Cowen upped their target price on shares of Procore Technologies from $65.00 to $70.00 and gave the company a "buy" rating in a research report on Monday, October 28th. Five analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $69.94.

Read Our Latest Analysis on Procore Technologies

Insider Activity at Procore Technologies

In other news, CFO Howard Fu sold 1,500 shares of the business's stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $71.75, for a total transaction of $107,625.00. Following the transaction, the chief financial officer now directly owns 171,997 shares in the company, valued at $12,340,784.75. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. In other Procore Technologies news, CFO Howard Fu sold 1,500 shares of Procore Technologies stock in a transaction on Thursday, November 7th. The shares were sold at an average price of $71.75, for a total transaction of $107,625.00. Following the completion of the transaction, the chief financial officer now directly owns 171,997 shares of the company's stock, valued at $12,340,784.75. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, SVP William Fred Fleming, Jr. sold 2,707 shares of the firm's stock in a transaction dated Thursday, August 22nd. The stock was sold at an average price of $59.14, for a total transaction of $160,091.98. Following the sale, the senior vice president now owns 79,156 shares of the company's stock, valued at approximately $4,681,285.84. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 115,227 shares of company stock valued at $7,045,139. 29.00% of the stock is owned by corporate insiders.

Procore Technologies Company Profile

(

Free Report)

Procore Technologies, Inc engages in the provision of a cloud-based construction management platform and related software products in the United States and internationally. The company's platform enables owners, general and specialty contractors, architects, and engineers to collaborate on construction projects.

Read More

Before you consider Procore Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procore Technologies wasn't on the list.

While Procore Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.