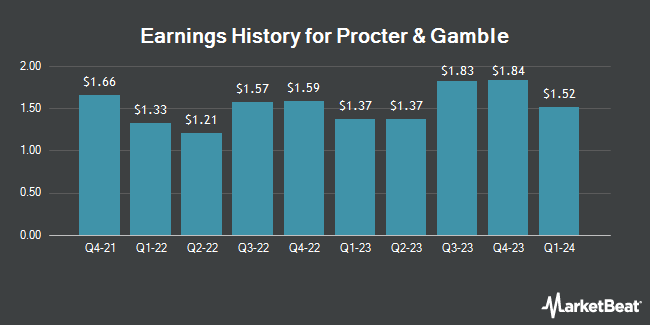

Procter & Gamble (NYSE:PG - Get Free Report) is expected to be issuing its quarterly earnings data before the market opens on Wednesday, January 22nd. Analysts expect the company to announce earnings of $1.89 per share and revenue of $21,657,595.49 billion for the quarter. Persons that wish to listen to the company's earnings conference call can do so using this link.

Procter & Gamble (NYSE:PG - Get Free Report) last announced its earnings results on Friday, October 18th. The company reported $1.93 EPS for the quarter, topping the consensus estimate of $1.90 by $0.03. The business had revenue of $21.74 billion for the quarter, compared to the consensus estimate of $21.99 billion. Procter & Gamble had a return on equity of 33.25% and a net margin of 17.07%. Procter & Gamble's revenue was down .6% compared to the same quarter last year. During the same period in the previous year, the business earned $1.83 EPS. On average, analysts expect Procter & Gamble to post $7 EPS for the current fiscal year and $7 EPS for the next fiscal year.

Procter & Gamble Price Performance

Procter & Gamble stock traded up $0.85 on Monday, reaching $161.35. The company's stock had a trading volume of 7,218,206 shares, compared to its average volume of 5,628,331. The business's fifty day moving average price is $169.19 and its 200 day moving average price is $169.46. The company has a debt-to-equity ratio of 0.50, a quick ratio of 0.55 and a current ratio of 0.75. The company has a market cap of $379.98 billion, a price-to-earnings ratio of 27.82, a PEG ratio of 3.41 and a beta of 0.45. Procter & Gamble has a twelve month low of $146.28 and a twelve month high of $180.43.

Procter & Gamble Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Tuesday, February 18th. Investors of record on Friday, January 24th will be given a dividend of $1.0065 per share. The ex-dividend date of this dividend is Friday, January 24th. This represents a $4.03 annualized dividend and a yield of 2.50%. Procter & Gamble's dividend payout ratio (DPR) is 69.48%.

Insider Activity at Procter & Gamble

In related news, insider Balaji Purushothaman sold 12,800 shares of the firm's stock in a transaction on Thursday, October 24th. The shares were sold at an average price of $168.99, for a total value of $2,163,072.00. Following the completion of the transaction, the insider now owns 11,566 shares of the company's stock, valued at approximately $1,954,538.34. This trade represents a 52.53 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CEO Gary A. Coombe sold 47,847 shares of the business's stock in a transaction dated Wednesday, November 27th. The stock was sold at an average price of $179.84, for a total transaction of $8,604,804.48. Following the sale, the chief executive officer now directly owns 39,977 shares in the company, valued at $7,189,463.68. This trade represents a 54.48 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 75,439 shares of company stock valued at $13,317,460. 0.18% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

PG has been the subject of a number of research analyst reports. Royal Bank of Canada reaffirmed a "sector perform" rating and issued a $164.00 target price on shares of Procter & Gamble in a research note on Monday, October 21st. Hsbc Global Res raised Procter & Gamble to a "strong-buy" rating in a report on Friday, October 4th. DA Davidson reissued a "buy" rating and issued a $209.00 target price on shares of Procter & Gamble in a research note on Friday, December 27th. Wells Fargo & Company lowered their price objective on Procter & Gamble from $190.00 to $176.00 and set an "overweight" rating for the company in a research report on Tuesday, January 7th. Finally, Stifel Nicolaus reduced their target price on shares of Procter & Gamble from $167.00 to $161.00 and set a "hold" rating on the stock in a research note on Friday. Eight investment analysts have rated the stock with a hold rating, fourteen have assigned a buy rating and two have given a strong buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $179.65.

View Our Latest Stock Report on Procter & Gamble

Procter & Gamble Company Profile

(

Get Free Report)

Procter & Gamble Co engages in the provision of branded consumer packaged goods. It operates through the following segments: Beauty, Grooming, Health Care, Fabric and Home Care, and Baby, Feminine and Family Care. The Beauty segment offers hair, skin, and personal care. The Grooming segment consists of shave care like female and male blades and razors, pre and post shave products, and appliances.

Featured Articles

Before you consider Procter & Gamble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procter & Gamble wasn't on the list.

While Procter & Gamble currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.