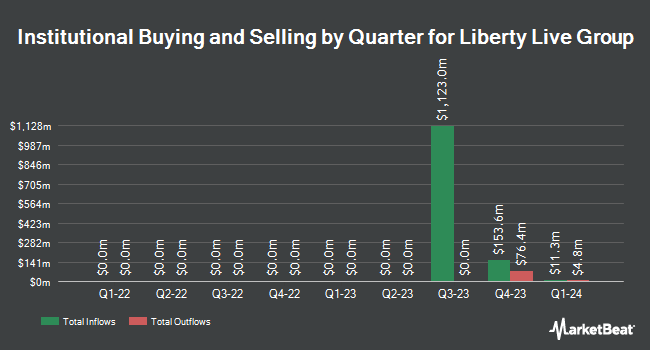

Proficio Capital Partners LLC bought a new stake in Liberty Live Group (NASDAQ:LLYVK - Free Report) during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund bought 37,025 shares of the company's stock, valued at approximately $2,520,000.

A number of other institutional investors have also modified their holdings of the stock. Point72 Asia Singapore Pte. Ltd. grew its holdings in Liberty Live Group by 1,000.0% during the third quarter. Point72 Asia Singapore Pte. Ltd. now owns 583 shares of the company's stock worth $30,000 after acquiring an additional 530 shares during the period. Franklin Resources Inc. grew its holdings in Liberty Live Group by 900.0% during the third quarter. Franklin Resources Inc. now owns 1,020 shares of the company's stock worth $56,000 after acquiring an additional 918 shares during the period. KBC Group NV grew its holdings in Liberty Live Group by 26.8% during the third quarter. KBC Group NV now owns 2,170 shares of the company's stock worth $111,000 after acquiring an additional 458 shares during the period. Simon Quick Advisors LLC acquired a new position in Liberty Live Group during the fourth quarter worth $210,000. Finally, Miracle Mile Advisors LLC acquired a new position in Liberty Live Group during the fourth quarter worth $211,000. Institutional investors and hedge funds own 60.36% of the company's stock.

Liberty Live Group Stock Down 2.6 %

LLYVK stock traded down $1.80 on Friday, reaching $66.91. 656,979 shares of the company's stock were exchanged, compared to its average volume of 273,511. The stock has a fifty day moving average of $72.70 and a 200-day moving average of $62.43. Liberty Live Group has a twelve month low of $33.50 and a twelve month high of $81.66. The firm has a market cap of $6.14 billion, a PE ratio of -196.79 and a beta of 1.55.

Insider Buying and Selling at Liberty Live Group

In other Liberty Live Group news, CEO Gregory B. Maffei sold 35,463 shares of the company's stock in a transaction on Monday, December 16th. The stock was sold at an average price of $71.53, for a total value of $2,536,668.39. Following the sale, the chief executive officer now owns 1,240,785 shares of the company's stock, valued at approximately $88,753,351.05. This represents a 2.78 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website.

Liberty Live Group Profile

(

Free Report)

Liberty Live Group operates in the media, communications, and entertainment industries primarily in North America and the United Kingdom. The company is headquartered in Englewood, Colorado.

See Also

Before you consider Liberty Live Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Liberty Live Group wasn't on the list.

While Liberty Live Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.