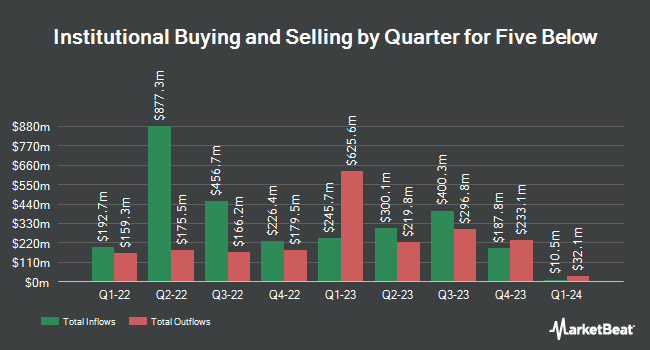

Proficio Capital Partners LLC bought a new stake in Five Below, Inc. (NASDAQ:FIVE - Free Report) during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor bought 30,858 shares of the specialty retailer's stock, valued at approximately $31,000. Proficio Capital Partners LLC owned about 0.06% of Five Below as of its most recent SEC filing.

Several other hedge funds and other institutional investors also recently bought and sold shares of FIVE. Brooklyn Investment Group purchased a new stake in shares of Five Below in the 3rd quarter valued at $30,000. UMB Bank n.a. lifted its position in Five Below by 156.9% during the fourth quarter. UMB Bank n.a. now owns 334 shares of the specialty retailer's stock valued at $35,000 after purchasing an additional 204 shares during the period. Wilmington Savings Fund Society FSB purchased a new stake in Five Below in the third quarter valued at $42,000. R Squared Ltd acquired a new stake in Five Below during the 4th quarter worth about $68,000. Finally, GAMMA Investing LLC raised its stake in shares of Five Below by 149.1% during the 4th quarter. GAMMA Investing LLC now owns 1,360 shares of the specialty retailer's stock valued at $143,000 after buying an additional 814 shares during the last quarter.

Five Below Stock Performance

NASDAQ FIVE opened at $72.25 on Friday. The business has a fifty day moving average price of $91.37 and a 200 day moving average price of $92.84. The company has a market cap of $3.97 billion, a P/E ratio of 14.90, a P/E/G ratio of 1.19 and a beta of 1.11. Five Below, Inc. has a one year low of $64.87 and a one year high of $209.79.

Insider Transactions at Five Below

In related news, CAO Eric M. Specter sold 5,494 shares of the stock in a transaction that occurred on Thursday, January 16th. The stock was sold at an average price of $90.76, for a total value of $498,635.44. Following the completion of the transaction, the chief accounting officer now directly owns 57,267 shares in the company, valued at approximately $5,197,552.92. This represents a 8.75 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Insiders own 1.90% of the company's stock.

Analysts Set New Price Targets

A number of analysts have recently commented on the company. Morgan Stanley upped their target price on Five Below from $100.00 to $120.00 and gave the stock an "equal weight" rating in a research note on Thursday, December 5th. Wells Fargo & Company upped their price objective on Five Below from $115.00 to $135.00 and gave the stock an "overweight" rating in a research report on Thursday, December 5th. Citigroup lifted their target price on shares of Five Below from $85.00 to $96.00 and gave the company a "neutral" rating in a report on Monday, December 2nd. StockNews.com downgraded shares of Five Below from a "hold" rating to a "sell" rating in a report on Friday, December 13th. Finally, Telsey Advisory Group reaffirmed a "market perform" rating and issued a $115.00 price objective on shares of Five Below in a report on Tuesday, January 14th. Three investment analysts have rated the stock with a sell rating, twelve have assigned a hold rating and six have given a buy rating to the company. According to data from MarketBeat.com, Five Below has a consensus rating of "Hold" and a consensus target price of $111.32.

Get Our Latest Stock Analysis on Five Below

Five Below Profile

(

Free Report)

Five Below, Inc operates as a specialty value retailer in the United States. The company offers range of accessories, which includes novelty socks, sunglasses, jewelry, scarves, gloves, hair accessories, athletic tops and bottoms, and t-shirts, as well as nail polish, lip gloss, fragrance, and branded cosmetics; and personalized living space products, such as lamps, posters, frames, fleece blankets, plush items, pillows, candles, incense, lighting, novelty décor, accent furniture, and related items, as well as provides storage options.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Five Below, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five Below wasn't on the list.

While Five Below currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.