Proficio Capital Partners LLC purchased a new stake in Nokia Oyj (NYSE:NOK - Free Report) during the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund purchased 187,950 shares of the technology company's stock, valued at approximately $821,000.

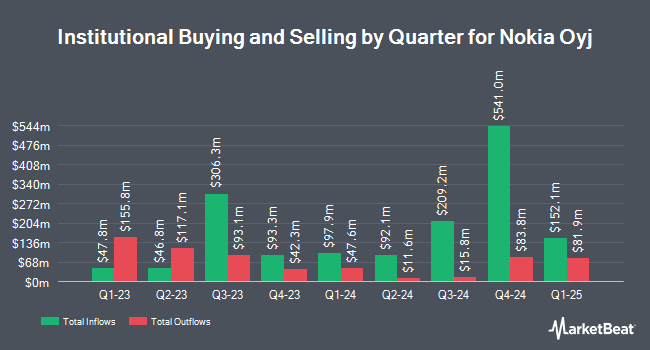

Other hedge funds also recently modified their holdings of the company. Pzena Investment Management LLC raised its stake in shares of Nokia Oyj by 22.3% in the second quarter. Pzena Investment Management LLC now owns 82,524,553 shares of the technology company's stock worth $311,943,000 after acquiring an additional 15,035,360 shares during the last quarter. Russell Investments Group Ltd. raised its position in Nokia Oyj by 98.3% in the 1st quarter. Russell Investments Group Ltd. now owns 1,749,327 shares of the technology company's stock worth $6,193,000 after purchasing an additional 867,297 shares during the last quarter. Bank of Montreal Can acquired a new position in Nokia Oyj during the 2nd quarter worth $2,501,000. Maverick Capital Ltd. acquired a new stake in shares of Nokia Oyj in the 2nd quarter valued at $1,240,000. Finally, Moloney Securities Asset Management LLC bought a new stake in shares of Nokia Oyj during the third quarter worth $1,419,000. Institutional investors and hedge funds own 5.28% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages recently commented on NOK. Craig Hallum upgraded Nokia Oyj from a "hold" rating to a "strong-buy" rating in a research report on Thursday, October 17th. JPMorgan Chase & Co. dropped their price target on shares of Nokia Oyj from $4.36 to $4.35 and set a "neutral" rating for the company in a research note on Monday, October 21st. Danske raised shares of Nokia Oyj from a "hold" rating to a "buy" rating in a report on Friday, October 18th. StockNews.com downgraded Nokia Oyj from a "strong-buy" rating to a "buy" rating in a research note on Saturday, October 26th. Finally, Northland Securities restated an "outperform" rating and issued a $6.50 price target on shares of Nokia Oyj in a research report on Friday, October 18th. Two analysts have rated the stock with a sell rating, four have assigned a hold rating, four have assigned a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, Nokia Oyj currently has a consensus rating of "Hold" and an average price target of $4.56.

Read Our Latest Analysis on NOK

Nokia Oyj Trading Down 1.1 %

Shares of NOK traded down $0.05 during trading hours on Friday, reaching $4.55. The stock had a trading volume of 18,213,401 shares, compared to its average volume of 22,448,446. The firm has a 50-day moving average of $4.45 and a 200 day moving average of $4.07. The company has a quick ratio of 1.46, a current ratio of 1.72 and a debt-to-equity ratio of 0.14. The company has a market cap of $24.81 billion, a P/E ratio of 56.88, a P/E/G ratio of 5.96 and a beta of 1.12. Nokia Oyj has a 52 week low of $2.94 and a 52 week high of $4.95.

Nokia Oyj (NYSE:NOK - Get Free Report) last released its quarterly earnings results on Thursday, October 17th. The technology company reported $0.07 EPS for the quarter, hitting analysts' consensus estimates of $0.07. Nokia Oyj had a return on equity of 8.32% and a net margin of 2.18%. The company had revenue of $4.75 billion for the quarter, compared to analyst estimates of $5.10 billion. On average, sell-side analysts expect that Nokia Oyj will post 0.34 earnings per share for the current fiscal year.

Nokia Oyj Profile

(

Free Report)

Nokia Oyj provides mobile, fixed, and cloud network solutions worldwide. The company operates through four segments: Network Infrastructure, Mobile Networks, Cloud and Network Services, and Nokia Technologies. The company provides fixed networking solutions, such as fiber and copper-based access infrastructure, in-home Wi-Fi solutions, and cloud and virtualization services; IP networking solutions, including IP access, aggregation, and edge and core routing for residential, mobile, enterprise and cloud applications; optical networks solutions that provides optical transport networks for metro, regional, and long-haul applications, and subsea applications; and submarine networks for undersea cable transmission.

Featured Stories

Before you consider Nokia Oyj, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nokia Oyj wasn't on the list.

While Nokia Oyj currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.