Proficio Capital Partners LLC acquired a new position in shares of Alignment Healthcare, Inc. (NASDAQ:ALHC - Free Report) during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund acquired 16,380 shares of the company's stock, valued at approximately $184,000.

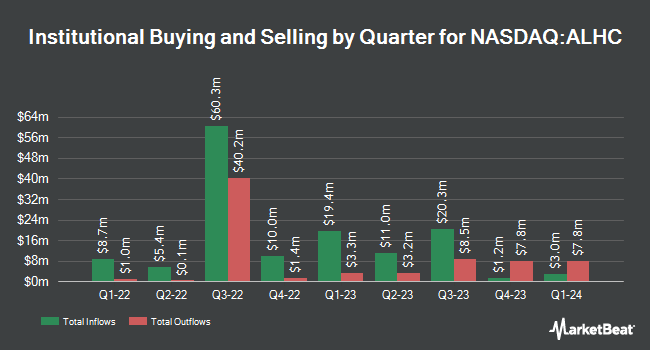

Several other institutional investors also recently modified their holdings of ALHC. New York State Common Retirement Fund grew its holdings in Alignment Healthcare by 173.8% during the fourth quarter. New York State Common Retirement Fund now owns 82,455 shares of the company's stock worth $928,000 after purchasing an additional 52,337 shares during the period. Rhumbline Advisers lifted its position in shares of Alignment Healthcare by 2.2% in the fourth quarter. Rhumbline Advisers now owns 135,704 shares of the company's stock valued at $1,527,000 after buying an additional 2,937 shares during the last quarter. Allspring Global Investments Holdings LLC boosted its stake in shares of Alignment Healthcare by 1,672.5% during the 4th quarter. Allspring Global Investments Holdings LLC now owns 656,637 shares of the company's stock worth $7,591,000 after acquiring an additional 619,592 shares during the period. R Squared Ltd acquired a new position in shares of Alignment Healthcare during the 4th quarter worth approximately $55,000. Finally, SG Americas Securities LLC raised its stake in Alignment Healthcare by 11.7% in the 4th quarter. SG Americas Securities LLC now owns 49,272 shares of the company's stock valued at $554,000 after acquiring an additional 5,163 shares during the period. 86.19% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities analysts have commented on the stock. Stifel Nicolaus upped their price objective on shares of Alignment Healthcare from $16.00 to $18.00 and gave the company a "buy" rating in a report on Friday, February 28th. Bank of America upped their price target on shares of Alignment Healthcare from $15.50 to $18.50 and gave the company a "buy" rating in a research note on Tuesday, March 4th. William Blair reissued an "outperform" rating on shares of Alignment Healthcare in a report on Friday, February 28th. Stephens restated an "overweight" rating and set a $17.00 price objective on shares of Alignment Healthcare in a report on Monday, February 24th. Finally, Barclays upped their target price on Alignment Healthcare from $8.00 to $9.00 and gave the company an "underweight" rating in a research report on Friday, February 28th. One research analyst has rated the stock with a sell rating, three have issued a hold rating, seven have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $14.83.

View Our Latest Stock Report on ALHC

Alignment Healthcare Trading Up 1.9 %

Shares of ALHC stock opened at $15.71 on Thursday. The stock has a market cap of $3.01 billion, a P/E ratio of -20.40 and a beta of 1.49. Alignment Healthcare, Inc. has a 1 year low of $4.46 and a 1 year high of $16.25. The company has a current ratio of 1.60, a quick ratio of 1.60 and a debt-to-equity ratio of 1.82. The stock has a 50 day simple moving average of $14.22 and a 200 day simple moving average of $12.34.

Insider Buying and Selling at Alignment Healthcare

In other Alignment Healthcare news, CFO Robert Thomas Freeman sold 250,000 shares of Alignment Healthcare stock in a transaction dated Tuesday, March 4th. The stock was sold at an average price of $15.58, for a total value of $3,895,000.00. Following the transaction, the chief financial officer now owns 1,635,849 shares in the company, valued at $25,486,527.42. The trade was a 13.26 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, CEO John E. Kao sold 90,000 shares of Alignment Healthcare stock in a transaction that occurred on Monday, January 13th. The shares were sold at an average price of $13.06, for a total transaction of $1,175,400.00. Following the sale, the chief executive officer now directly owns 2,273,100 shares in the company, valued at $29,686,686. This trade represents a 3.81 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 1,662,206 shares of company stock valued at $25,345,854 in the last three months. Corporate insiders own 6.60% of the company's stock.

Alignment Healthcare Profile

(

Free Report)

Alignment Healthcare, Inc, a tech-enabled Medicare advantage company, operates consumer-centric health care platform for seniors in the United States. It provides customized health care designed to meet the needs of a diverse array of seniors through its Medicare advantage plans. The company was founded in 2013 and is based in Orange, California.

See Also

Want to see what other hedge funds are holding ALHC? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Alignment Healthcare, Inc. (NASDAQ:ALHC - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alignment Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alignment Healthcare wasn't on the list.

While Alignment Healthcare currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.