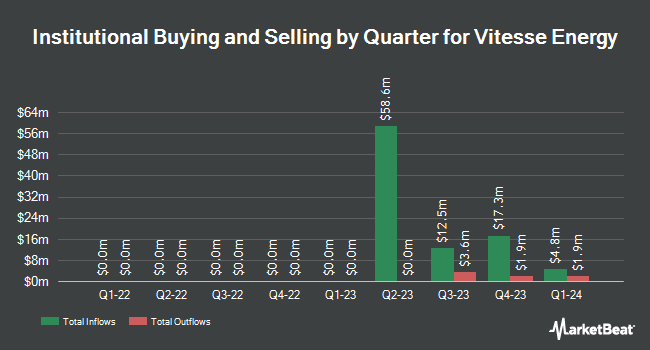

Proficio Capital Partners LLC bought a new position in shares of Vitesse Energy, Inc. (NYSE:VTS - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund bought 12,725 shares of the company's stock, valued at approximately $318,000.

Several other institutional investors and hedge funds have also made changes to their positions in the company. Charles Schwab Investment Management Inc. grew its holdings in Vitesse Energy by 112.0% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 226,909 shares of the company's stock worth $5,450,000 after acquiring an additional 119,861 shares in the last quarter. Harbor Capital Advisors Inc. lifted its holdings in Vitesse Energy by 61.7% during the 4th quarter. Harbor Capital Advisors Inc. now owns 290,554 shares of the company's stock worth $7,264,000 after buying an additional 110,830 shares during the last quarter. Barclays PLC lifted its holdings in Vitesse Energy by 325.7% during the 3rd quarter. Barclays PLC now owns 39,528 shares of the company's stock worth $950,000 after buying an additional 30,243 shares during the last quarter. Ashford Capital Management Inc. acquired a new position in shares of Vitesse Energy in the 3rd quarter worth approximately $572,000. Finally, Y Intercept Hong Kong Ltd bought a new stake in shares of Vitesse Energy in the 4th quarter valued at approximately $443,000. 51.63% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In related news, CAO Mike Morella sold 8,143 shares of Vitesse Energy stock in a transaction dated Tuesday, January 14th. The shares were sold at an average price of $26.69, for a total transaction of $217,336.67. Following the sale, the chief accounting officer now directly owns 81,615 shares in the company, valued at $2,178,304.35. The trade was a 9.07 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, VP Michael Sabol sold 6,714 shares of the company's stock in a transaction dated Tuesday, January 14th. The stock was sold at an average price of $26.70, for a total transaction of $179,263.80. Following the completion of the sale, the vice president now directly owns 63,411 shares of the company's stock, valued at $1,693,073.70. The trade was a 9.57 % decrease in their position. The disclosure for this sale can be found here. 18.15% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

Several brokerages recently issued reports on VTS. Northland Capmk upgraded Vitesse Energy to a "strong-buy" rating in a research note on Thursday, January 16th. Evercore ISI restated an "in-line" rating and issued a $28.00 price target on shares of Vitesse Energy in a research report on Wednesday, March 19th. Northland Securities boosted their price objective on shares of Vitesse Energy from $28.00 to $31.00 and gave the company an "outperform" rating in a research report on Thursday, January 16th. Finally, Alliance Global Partners raised shares of Vitesse Energy from a "neutral" rating to a "buy" rating and raised their target price for the stock from $26.00 to $29.00 in a report on Tuesday, December 17th.

View Our Latest Stock Analysis on Vitesse Energy

Vitesse Energy Stock Performance

VTS stock traded up $0.03 during mid-day trading on Friday, reaching $24.74. The company had a trading volume of 271,839 shares, compared to its average volume of 191,823. Vitesse Energy, Inc. has a one year low of $21.83 and a one year high of $28.41. The stock has a market capitalization of $954.34 million, a P/E ratio of 16.94 and a beta of 0.53. The company has a quick ratio of 0.75, a current ratio of 0.75 and a debt-to-equity ratio of 0.20. The stock's 50-day simple moving average is $25.48 and its two-hundred day simple moving average is $25.74.

Vitesse Energy Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, March 31st. Shareholders of record on Friday, March 21st will be paid a dividend of $0.5625 per share. This represents a $2.25 dividend on an annualized basis and a yield of 9.10%. This is a positive change from Vitesse Energy's previous quarterly dividend of $0.53. The ex-dividend date of this dividend is Friday, March 21st. Vitesse Energy's payout ratio is presently 351.56%.

Vitesse Energy Profile

(

Free Report)

Vitesse Energy, Inc, together with its subsidiaries, engages in the acquisition, development, and production of non-operated oil and natural gas properties in the United States. It owns and acquires non-operated working interest and royalty interest ownership in the Williston Basin properties located in North Dakota and Montana.

Featured Stories

Before you consider Vitesse Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vitesse Energy wasn't on the list.

While Vitesse Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.