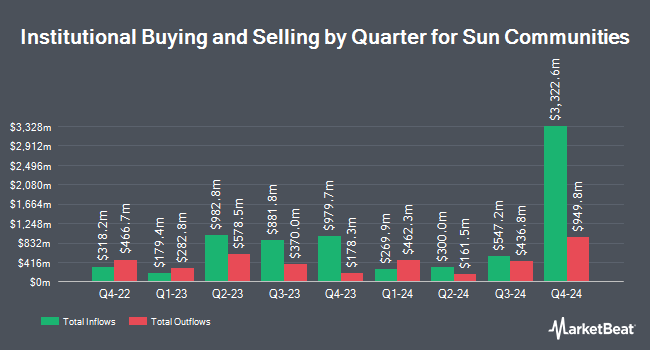

Proficio Capital Partners LLC purchased a new stake in Sun Communities, Inc. (NYSE:SUI - Free Report) in the 4th quarter, according to the company in its most recent Form 13F filing with the SEC. The fund purchased 48,081 shares of the real estate investment trust's stock, valued at approximately $5,913,000.

Other large investors have also made changes to their positions in the company. Assetmark Inc. boosted its position in Sun Communities by 2,111.1% during the third quarter. Assetmark Inc. now owns 199 shares of the real estate investment trust's stock worth $27,000 after purchasing an additional 190 shares during the period. Victory Capital Management Inc. boosted its position in Sun Communities by 6.9% during the third quarter. Victory Capital Management Inc. now owns 77,203 shares of the real estate investment trust's stock worth $10,434,000 after purchasing an additional 5,008 shares during the period. CIBC Asset Management Inc boosted its position in Sun Communities by 5.5% during the third quarter. CIBC Asset Management Inc now owns 4,401 shares of the real estate investment trust's stock worth $595,000 after purchasing an additional 228 shares during the period. Mutual of America Capital Management LLC boosted its position in Sun Communities by 58.2% during the third quarter. Mutual of America Capital Management LLC now owns 17,679 shares of the real estate investment trust's stock worth $2,389,000 after purchasing an additional 6,506 shares during the period. Finally, Thrivent Financial for Lutherans boosted its position in Sun Communities by 28.9% during the third quarter. Thrivent Financial for Lutherans now owns 82,686 shares of the real estate investment trust's stock worth $11,175,000 after purchasing an additional 18,548 shares during the period. Institutional investors own 99.59% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages have issued reports on SUI. Jefferies Financial Group decreased their target price on Sun Communities from $145.00 to $142.00 and set a "buy" rating for the company in a research report on Thursday, January 2nd. Wells Fargo & Company reduced their price objective on Sun Communities from $154.00 to $135.00 and set an "equal weight" rating for the company in a research report on Wednesday, December 11th. Royal Bank of Canada reissued an "outperform" rating on shares of Sun Communities in a research report on Friday, February 28th. StockNews.com cut Sun Communities from a "hold" rating to a "sell" rating in a research report on Wednesday, November 20th. Finally, Truist Financial increased their price objective on Sun Communities from $136.00 to $142.00 and gave the stock a "buy" rating in a research note on Monday, March 10th. Two investment analysts have rated the stock with a sell rating, six have issued a hold rating and five have given a buy rating to the company's stock. According to MarketBeat.com, Sun Communities has a consensus rating of "Hold" and an average price target of $135.55.

View Our Latest Stock Analysis on SUI

Sun Communities Stock Up 0.3 %

Shares of NYSE SUI traded up $0.46 during mid-day trading on Tuesday, reaching $132.50. 427,782 shares of the company's stock were exchanged, compared to its average volume of 787,899. The firm has a market capitalization of $16.88 billion, a price-to-earnings ratio of 71.28 and a beta of 0.90. The company has a current ratio of 1.61, a quick ratio of 1.61 and a debt-to-equity ratio of 0.93. The business has a fifty day simple moving average of $127.45 and a 200 day simple moving average of $129.52. Sun Communities, Inc. has a twelve month low of $110.98 and a twelve month high of $147.83.

Sun Communities (NYSE:SUI - Get Free Report) last released its quarterly earnings results on Wednesday, February 26th. The real estate investment trust reported $1.41 EPS for the quarter, topping analysts' consensus estimates of $1.39 by $0.02. The company had revenue of $745.90 million for the quarter, compared to analyst estimates of $724.68 million. Sun Communities had a return on equity of 3.21% and a net margin of 7.46%. As a group, equities analysts expect that Sun Communities, Inc. will post 6.77 EPS for the current fiscal year.

Sun Communities Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, April 15th. Investors of record on Monday, March 31st will be given a $0.94 dividend. This represents a $3.76 dividend on an annualized basis and a yield of 2.84%. The ex-dividend date of this dividend is Monday, March 31st. Sun Communities's dividend payout ratio is presently 508.11%.

Sun Communities Company Profile

(

Free Report)

Established in 1975, Sun Communities, Inc became a publicly owned corporation in December 1993. The Company is a fully integrated REIT listed on the New York Stock Exchange under the symbol: SUI. As of December 31, 2023, the Company owned, operated, or had an interest in a portfolio of 667 developed MH, RV and Marina properties comprising 179,310 developed sites and approximately 48,030 wet slips and dry storage spaces in the U.S., the UK and Canada.

Featured Articles

Before you consider Sun Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sun Communities wasn't on the list.

While Sun Communities currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.