Proficio Capital Partners LLC bought a new stake in shares of Equity Residential (NYSE:EQR - Free Report) during the 4th quarter, according to its most recent Form 13F filing with the SEC. The fund bought 80,515 shares of the real estate investment trust's stock, valued at approximately $5,778,000.

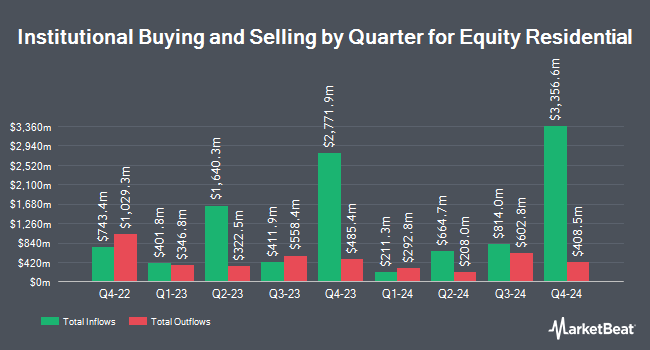

Several other large investors also recently added to or reduced their stakes in EQR. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in Equity Residential by 806.4% during the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 4,259,145 shares of the real estate investment trust's stock valued at $317,136,000 after purchasing an additional 3,789,234 shares during the period. FMR LLC grew its holdings in shares of Equity Residential by 29.0% during the 3rd quarter. FMR LLC now owns 7,746,494 shares of the real estate investment trust's stock valued at $576,804,000 after acquiring an additional 1,741,840 shares in the last quarter. Principal Financial Group Inc. grew its holdings in shares of Equity Residential by 8.3% during the 3rd quarter. Principal Financial Group Inc. now owns 7,745,615 shares of the real estate investment trust's stock valued at $576,737,000 after acquiring an additional 591,866 shares in the last quarter. Heitman Real Estate Securities LLC grew its holdings in shares of Equity Residential by 2,193.2% during the 3rd quarter. Heitman Real Estate Securities LLC now owns 416,647 shares of the real estate investment trust's stock valued at $31,024,000 after acquiring an additional 398,478 shares in the last quarter. Finally, KBC Group NV grew its holdings in shares of Equity Residential by 100.9% during the 4th quarter. KBC Group NV now owns 691,061 shares of the real estate investment trust's stock valued at $49,590,000 after acquiring an additional 347,085 shares in the last quarter. 92.68% of the stock is owned by institutional investors and hedge funds.

Insider Activity

In related news, EVP Scott Fenster sold 5,340 shares of the stock in a transaction dated Thursday, February 6th. The shares were sold at an average price of $72.06, for a total value of $384,800.40. Following the completion of the transaction, the executive vice president now owns 35,507 shares of the company's stock, valued at $2,558,634.42. This represents a 13.07 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CAO Ian Kaufman sold 642 shares of the stock in a transaction dated Thursday, February 6th. The stock was sold at an average price of $72.06, for a total transaction of $46,262.52. Following the completion of the transaction, the chief accounting officer now directly owns 25,539 shares of the company's stock, valued at $1,840,340.34. This trade represents a 2.45 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 19,763 shares of company stock valued at $1,424,217. Insiders own 1.00% of the company's stock.

Equity Residential Stock Performance

EQR stock traded down $0.63 during mid-day trading on Tuesday, reaching $69.44. 522,149 shares of the stock traded hands, compared to its average volume of 1,580,202. The company has a quick ratio of 0.36, a current ratio of 0.36 and a debt-to-equity ratio of 0.72. Equity Residential has a 52 week low of $59.48 and a 52 week high of $78.84. The business has a 50-day moving average of $70.60 and a two-hundred day moving average of $72.77. The firm has a market capitalization of $26.36 billion, a PE ratio of 25.56, a P/E/G ratio of 3.99 and a beta of 0.91.

Wall Street Analyst Weigh In

Several research firms have recently commented on EQR. Scotiabank boosted their price target on shares of Equity Residential from $78.00 to $79.00 and gave the company a "sector perform" rating in a report on Friday, February 14th. Evercore ISI boosted their price target on shares of Equity Residential from $74.00 to $76.00 and gave the company an "in-line" rating in a report on Monday, February 10th. StockNews.com upgraded shares of Equity Residential from a "sell" rating to a "hold" rating in a report on Saturday, February 8th. Barclays lowered their price target on shares of Equity Residential from $83.00 to $79.00 and set an "overweight" rating on the stock in a report on Friday, January 24th. Finally, Mizuho decreased their price objective on shares of Equity Residential from $78.00 to $74.00 and set a "neutral" rating for the company in a report on Monday, January 6th. Eleven equities research analysts have rated the stock with a hold rating and nine have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $78.51.

View Our Latest Stock Analysis on Equity Residential

Equity Residential Company Profile

(

Free Report)

Equity Residential is committed to creating communities where people thrive. The Company, a member of the S&P 500, is focused on the acquisition, development and management of residential properties located in and around dynamic cities that attract affluent long-term renters. Equity Residential owns or has investments in 305 properties consisting of 80,683 apartment units, with an established presence in Boston, New York, Washington, DC, Seattle, San Francisco and Southern California, and an expanding presence in Denver, Atlanta, Dallas/Ft.

Read More

Before you consider Equity Residential, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equity Residential wasn't on the list.

While Equity Residential currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.