American Century Companies Inc. decreased its position in shares of Progyny, Inc. (NASDAQ:PGNY - Free Report) by 64.8% during the fourth quarter, according to its most recent filing with the SEC. The firm owned 18,783 shares of the company's stock after selling 34,508 shares during the period. American Century Companies Inc.'s holdings in Progyny were worth $324,000 at the end of the most recent quarter.

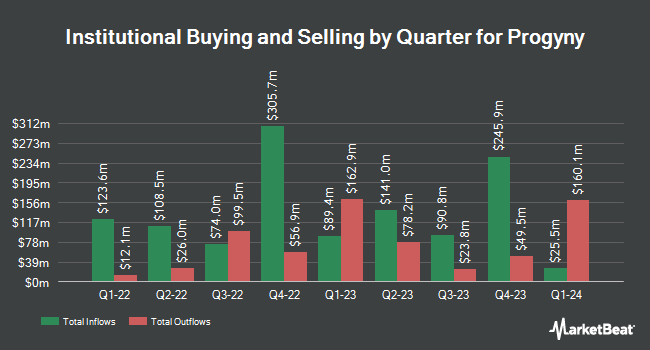

Several other hedge funds also recently made changes to their positions in the company. Signaturefd LLC boosted its stake in Progyny by 1,355.0% in the 4th quarter. Signaturefd LLC now owns 1,455 shares of the company's stock worth $25,000 after purchasing an additional 1,355 shares in the last quarter. GAMMA Investing LLC grew its holdings in shares of Progyny by 341.4% during the fourth quarter. GAMMA Investing LLC now owns 1,611 shares of the company's stock valued at $28,000 after buying an additional 1,246 shares during the last quarter. Nisa Investment Advisors LLC boosted its stake in Progyny by 108.4% during the 4th quarter. Nisa Investment Advisors LLC now owns 2,934 shares of the company's stock valued at $51,000 after purchasing an additional 1,526 shares during the last quarter. Caitlin John LLC boosted its position in shares of Progyny by 2,974.8% during the fourth quarter. Caitlin John LLC now owns 3,290 shares of the company's stock valued at $57,000 after buying an additional 3,183 shares during the last quarter. Finally, SBI Securities Co. Ltd. purchased a new stake in Progyny in the fourth quarter worth approximately $74,000. 94.93% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

Several analysts recently issued reports on PGNY shares. JPMorgan Chase & Co. boosted their target price on shares of Progyny from $17.00 to $23.00 and gave the company a "neutral" rating in a research report on Tuesday, January 28th. Bank of America boosted their price objective on Progyny from $21.00 to $25.00 and gave the company a "buy" rating in a research note on Tuesday, February 11th. BTIG Research raised shares of Progyny from a "neutral" rating to a "buy" rating and set a $28.00 price target on the stock in a report on Monday, March 31st. Finally, Canaccord Genuity Group lifted their price objective on shares of Progyny from $17.00 to $23.00 and gave the company a "hold" rating in a research report on Friday, February 28th. Eight investment analysts have rated the stock with a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $23.64.

Check Out Our Latest Analysis on PGNY

Progyny Trading Down 1.2 %

Shares of PGNY stock traded down $0.27 during trading hours on Tuesday, reaching $21.81. 1,077,203 shares of the stock were exchanged, compared to its average volume of 1,733,621. The company's 50-day moving average price is $21.99 and its 200-day moving average price is $18.76. The firm has a market capitalization of $1.86 billion, a price-to-earnings ratio of 37.60, a price-to-earnings-growth ratio of 2.39 and a beta of 1.33. Progyny, Inc. has a 12-month low of $13.39 and a 12-month high of $33.85.

Progyny Company Profile

(

Free Report)

Progyny, Inc, a benefits management company, specializes in fertility and family building benefits solutions in the United States. Its fertility benefits solution includes differentiated benefits plan design, personalized concierge-style member support services, and selective network of fertility specialists.

Read More

Before you consider Progyny, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progyny wasn't on the list.

While Progyny currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.