Sei Investments Co. cut its holdings in Protagonist Therapeutics, Inc. (NASDAQ:PTGX - Free Report) by 30.0% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 24,568 shares of the company's stock after selling 10,510 shares during the quarter. Sei Investments Co.'s holdings in Protagonist Therapeutics were worth $948,000 at the end of the most recent quarter.

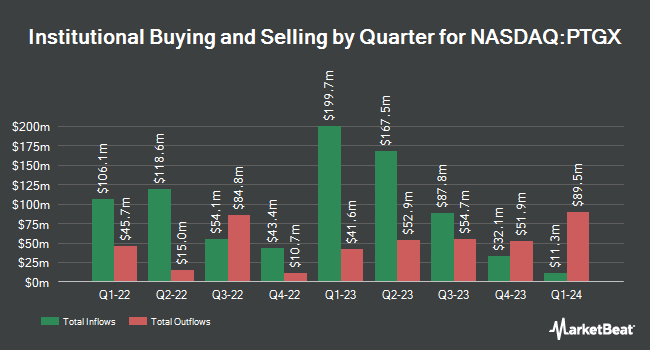

Other large investors have also recently bought and sold shares of the company. State Street Corp raised its position in shares of Protagonist Therapeutics by 52.9% in the third quarter. State Street Corp now owns 3,183,542 shares of the company's stock valued at $143,259,000 after buying an additional 1,101,218 shares during the last quarter. American Century Companies Inc. grew its stake in Protagonist Therapeutics by 61.5% in the 4th quarter. American Century Companies Inc. now owns 928,286 shares of the company's stock worth $35,832,000 after acquiring an additional 353,511 shares during the period. Principal Financial Group Inc. raised its holdings in Protagonist Therapeutics by 3,099.4% in the 3rd quarter. Principal Financial Group Inc. now owns 320,832 shares of the company's stock valued at $14,437,000 after acquiring an additional 310,804 shares during the last quarter. Raymond James Financial Inc. purchased a new position in shares of Protagonist Therapeutics during the 4th quarter worth $11,708,000. Finally, Pacer Advisors Inc. boosted its holdings in shares of Protagonist Therapeutics by 8.2% during the fourth quarter. Pacer Advisors Inc. now owns 1,876,466 shares of the company's stock worth $72,432,000 after purchasing an additional 142,376 shares during the last quarter. Institutional investors and hedge funds own 98.63% of the company's stock.

Insider Buying and Selling at Protagonist Therapeutics

In other news, Director William D. Waddill sold 4,000 shares of the stock in a transaction that occurred on Monday, March 17th. The stock was sold at an average price of $54.25, for a total transaction of $217,000.00. Following the completion of the transaction, the director now directly owns 13,130 shares in the company, valued at approximately $712,302.50. This represents a 23.35 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, CEO Dinesh V. Ph D. Patel sold 5,359 shares of the firm's stock in a transaction on Wednesday, February 19th. The stock was sold at an average price of $38.18, for a total transaction of $204,606.62. Following the transaction, the chief executive officer now directly owns 540,260 shares of the company's stock, valued at approximately $20,627,126.80. This represents a 0.98 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 64,776 shares of company stock valued at $3,585,010 over the last 90 days. 5.40% of the stock is owned by corporate insiders.

Protagonist Therapeutics Stock Performance

Shares of NASDAQ:PTGX traded up $1.73 during midday trading on Friday, hitting $42.62. 1,157,727 shares of the company's stock traded hands, compared to its average volume of 830,537. Protagonist Therapeutics, Inc. has a twelve month low of $24.22 and a twelve month high of $60.60. The company has a market cap of $2.62 billion, a PE ratio of 16.02 and a beta of 2.30. The firm's fifty day moving average price is $44.06 and its two-hundred day moving average price is $42.75.

Protagonist Therapeutics (NASDAQ:PTGX - Get Free Report) last issued its quarterly earnings data on Friday, February 21st. The company reported $1.98 EPS for the quarter, topping analysts' consensus estimates of ($0.09) by $2.07. Protagonist Therapeutics had a return on equity of 34.68% and a net margin of 52.76%. The company had revenue of $170.64 million for the quarter, compared to analysts' expectations of $56.65 million. As a group, equities research analysts anticipate that Protagonist Therapeutics, Inc. will post 2.43 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Several research firms recently weighed in on PTGX. The Goldman Sachs Group reduced their target price on Protagonist Therapeutics from $43.00 to $38.00 and set a "neutral" rating on the stock in a research report on Monday, February 24th. HC Wainwright reiterated a "buy" rating and set a $80.00 price objective on shares of Protagonist Therapeutics in a report on Thursday. Wedbush restated an "outperform" rating and issued a $70.00 target price on shares of Protagonist Therapeutics in a report on Friday, March 28th. JPMorgan Chase & Co. increased their price target on shares of Protagonist Therapeutics from $53.00 to $57.00 and gave the stock an "overweight" rating in a research note on Tuesday, March 4th. Finally, BMO Capital Markets boosted their price objective on shares of Protagonist Therapeutics from $62.00 to $72.00 and gave the company an "outperform" rating in a research note on Tuesday, March 11th. Two research analysts have rated the stock with a hold rating, seven have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $65.44.

Check Out Our Latest Research Report on PTGX

Protagonist Therapeutics Profile

(

Free Report)

Protagonist Therapeutics, Inc, a biopharmaceutical company, develops peptide-based drugs for hematology and blood disorders, and inflammatory and immunomodulatory diseases. It is developing Rusfertide (PTG-300), an injectable hepcidin mimetic that completed phase 2 clinical trials for the treatment of polycythemia vera and other blood disorders; and JNJ-2113, an orally delivered investigational drug to block biological pathways that completed phase 2b clinical trials for the treatment of moderate-to-severe plaque psoriasis; and PN-943, an orally delivered, gut-restricted alpha 4 beta 7 specific integrin antagonist completed a phase 2 clinical trials in patients with moderate to severe ulcerative colitis.

Further Reading

Before you consider Protagonist Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Protagonist Therapeutics wasn't on the list.

While Protagonist Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.