Provident Financial (NASDAQ:PROV - Get Free Report) is expected to announce its Q3 2025 earnings results before the market opens on Monday, April 28th. Analysts expect the company to announce earnings of $0.24 per share and revenue of $9.86 million for the quarter.

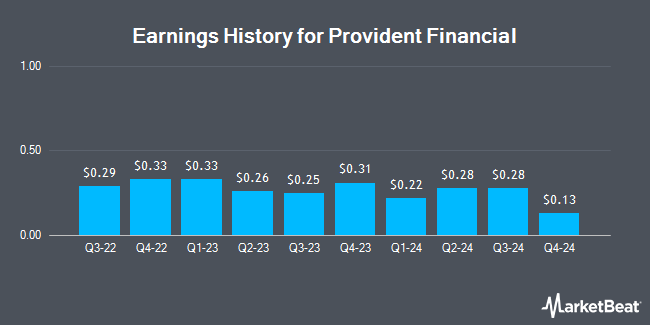

Provident Financial (NASDAQ:PROV - Get Free Report) last announced its quarterly earnings data on Tuesday, January 28th. The financial services provider reported $0.13 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.26 by ($0.13). Provident Financial had a net margin of 10.39% and a return on equity of 4.81%. During the same quarter in the previous year, the firm posted $0.31 EPS. On average, analysts expect Provident Financial to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Provident Financial Price Performance

Shares of Provident Financial stock remained flat at $14.65 on Friday. The stock had a trading volume of 155 shares, compared to its average volume of 7,515. The company has a quick ratio of 1.25, a current ratio of 1.25 and a debt-to-equity ratio of 1.91. The stock's fifty day moving average is $14.50 and its 200-day moving average is $15.29. The stock has a market cap of $98.02 million, a PE ratio of 16.10 and a beta of 0.19. Provident Financial has a fifty-two week low of $12.01 and a fifty-two week high of $16.70.

Provident Financial Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, June 5th. Shareholders of record on Thursday, May 15th will be paid a dividend of $0.14 per share. This represents a $0.56 dividend on an annualized basis and a yield of 3.82%. The ex-dividend date is Thursday, May 15th. Provident Financial's dividend payout ratio (DPR) is currently 61.54%.

Wall Street Analyst Weigh In

PROV has been the topic of several recent analyst reports. StockNews.com started coverage on shares of Provident Financial in a report on Saturday, April 19th. They issued a "hold" rating on the stock. Piper Sandler lowered their price objective on Provident Financial from $17.00 to $16.00 and set a "neutral" rating for the company in a research report on Wednesday, January 29th.

Check Out Our Latest Stock Report on Provident Financial

About Provident Financial

(

Get Free Report)

Provident Financial Holdings, Inc operates as the holding company for Provident Savings Bank, F.S.B. that provides community banking services to consumers and small to mid-sized businesses in the Inland Empire region of Southern California. The company's deposit products include checking, savings, and money market accounts, as well as time deposits; and loan portfolio consists of single-family, multi-family, commercial real estate, construction, mortgage, commercial business, and consumer loans.

Read More

Before you consider Provident Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Provident Financial wasn't on the list.

While Provident Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.