Prudential Financial Inc. trimmed its holdings in Unisys Co. (NYSE:UIS - Free Report) by 22.6% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 261,407 shares of the information technology services provider's stock after selling 76,500 shares during the quarter. Prudential Financial Inc. owned about 0.38% of Unisys worth $1,655,000 at the end of the most recent reporting period.

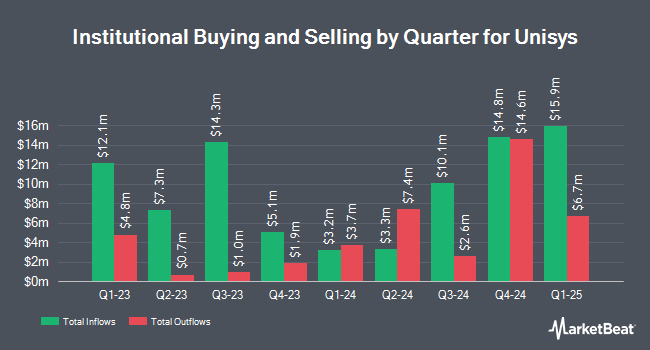

A number of other institutional investors and hedge funds have also added to or reduced their stakes in UIS. Vanguard Group Inc. lifted its position in shares of Unisys by 2.3% during the 4th quarter. Vanguard Group Inc. now owns 7,096,464 shares of the information technology services provider's stock valued at $44,921,000 after acquiring an additional 157,919 shares during the last quarter. LPL Financial LLC lifted its position in shares of Unisys by 3.2% during the 4th quarter. LPL Financial LLC now owns 160,384 shares of the information technology services provider's stock valued at $1,015,000 after acquiring an additional 5,033 shares during the last quarter. Sei Investments Co. lifted its position in shares of Unisys by 91.6% during the 4th quarter. Sei Investments Co. now owns 78,827 shares of the information technology services provider's stock valued at $499,000 after acquiring an additional 37,692 shares during the last quarter. Quantbot Technologies LP lifted its position in shares of Unisys by 961.7% during the 4th quarter. Quantbot Technologies LP now owns 21,074 shares of the information technology services provider's stock valued at $133,000 after acquiring an additional 19,089 shares during the last quarter. Finally, Summit Global Investments acquired a new stake in shares of Unisys during the 4th quarter valued at $407,000. 86.87% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several analysts recently issued reports on UIS shares. Canaccord Genuity Group cut their price objective on Unisys from $7.00 to $6.50 and set a "hold" rating for the company in a report on Thursday, February 20th. StockNews.com raised Unisys from a "hold" rating to a "buy" rating in a research report on Thursday, February 13th.

Check Out Our Latest Report on UIS

Unisys Trading Down 3.3 %

Shares of UIS stock traded down $0.13 on Thursday, hitting $3.83. The stock had a trading volume of 66,711 shares, compared to its average volume of 535,447. Unisys Co. has a twelve month low of $3.32 and a twelve month high of $8.93. The firm has a market cap of $272.19 million, a P/E ratio of -1.35, a PEG ratio of 0.56 and a beta of 1.14. The company has a fifty day moving average price of $4.92 and a two-hundred day moving average price of $6.16.

Unisys (NYSE:UIS - Get Free Report) last issued its quarterly earnings results on Tuesday, February 18th. The information technology services provider reported $0.33 EPS for the quarter, topping the consensus estimate of $0.30 by $0.03. Unisys had a negative net margin of 9.63% and a negative return on equity of 16.84%. The firm had revenue of $545.40 million for the quarter, compared to analysts' expectations of $550.93 million. During the same period in the previous year, the firm posted $0.51 EPS. On average, analysts expect that Unisys Co. will post 0.61 earnings per share for the current year.

Unisys Company Profile

(

Free Report)

Unisys Corporation, together with its subsidiaries, operates as an information technology solutions company in the United States and internationally. It operates in three segments: Digital Workplace Solutions (DWS); Cloud, Applications & Infrastructure Solutions (CA&I); and Enterprise Computing Solutions.

Further Reading

Before you consider Unisys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unisys wasn't on the list.

While Unisys currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.