Prudential Financial Inc. cut its stake in shares of Acadia Realty Trust (NYSE:AKR - Free Report) by 53.9% during the 4th quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 220,670 shares of the real estate investment trust's stock after selling 258,005 shares during the period. Prudential Financial Inc. owned about 0.18% of Acadia Realty Trust worth $5,331,000 at the end of the most recent quarter.

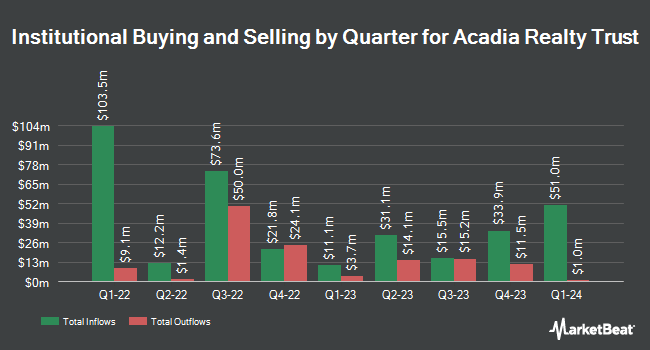

Other hedge funds have also bought and sold shares of the company. Charles Schwab Investment Management Inc. lifted its position in shares of Acadia Realty Trust by 4.5% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,930,601 shares of the real estate investment trust's stock valued at $45,331,000 after buying an additional 83,180 shares in the last quarter. Citigroup Inc. raised its stake in Acadia Realty Trust by 16.3% during the 3rd quarter. Citigroup Inc. now owns 153,764 shares of the real estate investment trust's stock worth $3,610,000 after acquiring an additional 21,532 shares during the period. The Manufacturers Life Insurance Company lifted its holdings in Acadia Realty Trust by 7.7% during the third quarter. The Manufacturers Life Insurance Company now owns 56,746 shares of the real estate investment trust's stock valued at $1,332,000 after purchasing an additional 4,049 shares in the last quarter. FMR LLC boosted its position in shares of Acadia Realty Trust by 290.3% in the third quarter. FMR LLC now owns 9,578,771 shares of the real estate investment trust's stock worth $224,910,000 after purchasing an additional 7,124,403 shares during the period. Finally, Zurcher Kantonalbank Zurich Cantonalbank increased its stake in shares of Acadia Realty Trust by 3.3% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 72,387 shares of the real estate investment trust's stock worth $1,700,000 after purchasing an additional 2,292 shares in the last quarter. Institutional investors own 97.65% of the company's stock.

Insider Buying and Selling

In related news, EVP Jason Blacksberg sold 30,000 shares of the business's stock in a transaction on Thursday, March 6th. The shares were sold at an average price of $22.81, for a total value of $684,300.00. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. 2.83% of the stock is owned by company insiders.

Acadia Realty Trust Price Performance

NYSE AKR traded down $1.17 during trading hours on Friday, reaching $18.31. The company's stock had a trading volume of 1,463,499 shares, compared to its average volume of 1,057,639. Acadia Realty Trust has a 1 year low of $16.14 and a 1 year high of $26.29. The company has a quick ratio of 0.96, a current ratio of 0.96 and a debt-to-equity ratio of 0.61. The company has a market capitalization of $2.19 billion, a price-to-earnings ratio of 101.69, a PEG ratio of 6.09 and a beta of 1.24. The firm's 50-day moving average price is $22.39 and its 200-day moving average price is $23.48.

Acadia Realty Trust (NYSE:AKR - Get Free Report) last released its earnings results on Tuesday, February 11th. The real estate investment trust reported $0.32 EPS for the quarter, topping the consensus estimate of $0.09 by $0.23. Acadia Realty Trust had a net margin of 5.74% and a return on equity of 0.88%. On average, equities research analysts predict that Acadia Realty Trust will post 1.34 EPS for the current fiscal year.

Acadia Realty Trust Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Monday, March 31st will be issued a $0.20 dividend. This represents a $0.80 annualized dividend and a dividend yield of 4.37%. This is a boost from Acadia Realty Trust's previous quarterly dividend of $0.19. The ex-dividend date of this dividend is Monday, March 31st. Acadia Realty Trust's payout ratio is 444.44%.

Analyst Ratings Changes

Separately, Truist Financial lowered their target price on shares of Acadia Realty Trust from $25.00 to $23.00 and set a "hold" rating on the stock in a research note on Tuesday. One investment analyst has rated the stock with a sell rating, two have given a hold rating and two have issued a buy rating to the company's stock. According to data from MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $22.00.

Get Our Latest Analysis on Acadia Realty Trust

Acadia Realty Trust Company Profile

(

Free Report)

Acadia Realty Trust is an equity real estate investment trust focused on delivering long-term, profitable growth via its dual Core Portfolio and Fund operating platforms and its disciplined, location-driven investment strategy. Acadia Realty Trust is accomplishing this goal by building a best-in-class core real estate portfolio with meaningful concentrations of assets in the nation's most dynamic corridors; making profitable opportunistic and value-add investments through its series of discretionary, institutional funds; and maintaining a strong balance sheet.

Featured Stories

Before you consider Acadia Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Acadia Realty Trust wasn't on the list.

While Acadia Realty Trust currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.