Prudential Financial Inc. cut its position in Enhabit, Inc. (NYSE:EHAB - Free Report) by 24.2% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 105,657 shares of the company's stock after selling 33,700 shares during the quarter. Prudential Financial Inc. owned approximately 0.21% of Enhabit worth $825,000 at the end of the most recent reporting period.

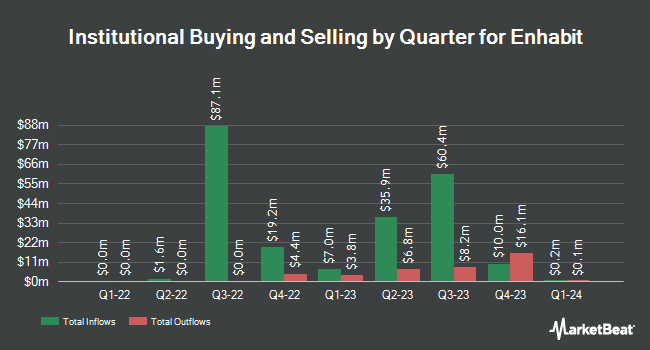

Several other institutional investors have also recently bought and sold shares of EHAB. Fox Run Management L.L.C. increased its position in Enhabit by 290.2% in the 4th quarter. Fox Run Management L.L.C. now owns 42,237 shares of the company's stock worth $330,000 after buying an additional 31,412 shares during the period. Quantbot Technologies LP bought a new position in Enhabit during the fourth quarter worth $45,000. Magnetar Financial LLC acquired a new position in Enhabit during the 4th quarter valued at $171,000. Intech Investment Management LLC boosted its holdings in Enhabit by 27.6% in the 4th quarter. Intech Investment Management LLC now owns 15,481 shares of the company's stock valued at $121,000 after purchasing an additional 3,353 shares during the period. Finally, Corient Private Wealth LLC acquired a new stake in Enhabit in the 4th quarter worth $79,000.

Enhabit Stock Performance

EHAB stock traded down $0.18 during midday trading on Friday, hitting $7.74. The stock had a trading volume of 339,551 shares, compared to its average volume of 484,311. The firm has a market capitalization of $390.46 million, a price-to-earnings ratio of -3.33 and a beta of 1.60. The company has a current ratio of 1.46, a quick ratio of 1.46 and a debt-to-equity ratio of 0.85. The stock has a 50-day simple moving average of $8.49 and a 200 day simple moving average of $8.00. Enhabit, Inc. has a 52 week low of $6.85 and a 52 week high of $10.84.

Analysts Set New Price Targets

Separately, Jefferies Financial Group reiterated a "buy" rating on shares of Enhabit in a research note on Thursday, March 6th.

Get Our Latest Research Report on Enhabit

Enhabit Profile

(

Free Report)

Enhabit, Inc provides home health and hospice services in the United States. Its home health services include patient education, pain management, wound care and dressing changes, cardiac rehabilitation, infusion therapy, pharmaceutical administration, and skilled observation and assessment services; practices to treat chronic diseases and conditions, including diabetes, hypertension, arthritis, Alzheimer's disease, low vision, spinal stenosis, Parkinson's disease, osteoporosis, complex wound care and chronic pain, along with disease-specific plans for patients with diabetes, congestive heart failure, post-orthopedic surgery, or injury and respiratory diseases; and physical, occupational and speech therapists provide therapy services.

Featured Stories

Before you consider Enhabit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enhabit wasn't on the list.

While Enhabit currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.