Prudential Financial Inc. cut its stake in Arcosa, Inc. (NYSE:ACA - Free Report) by 12.4% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 49,453 shares of the company's stock after selling 6,994 shares during the quarter. Prudential Financial Inc. owned approximately 0.10% of Arcosa worth $4,784,000 at the end of the most recent reporting period.

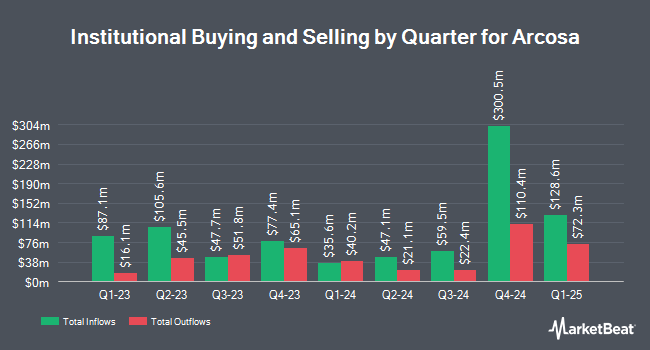

Several other institutional investors also recently bought and sold shares of ACA. Proficio Capital Partners LLC purchased a new position in shares of Arcosa in the fourth quarter valued at approximately $30,000. GAMMA Investing LLC raised its stake in Arcosa by 80.9% in the 4th quarter. GAMMA Investing LLC now owns 331 shares of the company's stock valued at $32,000 after purchasing an additional 148 shares during the last quarter. Point72 DIFC Ltd purchased a new position in Arcosa in the 3rd quarter valued at $37,000. Flagship Wealth Advisors LLC purchased a new position in Arcosa in the 4th quarter valued at $52,000. Finally, AlphaQuest LLC boosted its stake in Arcosa by 12,050.0% during the 4th quarter. AlphaQuest LLC now owns 729 shares of the company's stock worth $71,000 after purchasing an additional 723 shares during the last quarter. 90.66% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Separately, Oppenheimer raised their price target on shares of Arcosa from $105.00 to $110.00 and gave the stock an "outperform" rating in a research note on Tuesday, January 14th.

View Our Latest Research Report on ACA

Arcosa Trading Down 4.1 %

Arcosa stock traded down $3.12 during trading on Friday, reaching $72.33. 564,139 shares of the company were exchanged, compared to its average volume of 264,430. The stock's 50 day simple moving average is $89.07 and its two-hundred day simple moving average is $95.72. The company has a market capitalization of $3.53 billion, a P/E ratio of 27.50 and a beta of 0.85. The company has a debt-to-equity ratio of 0.51, a current ratio of 3.61 and a quick ratio of 2.77. Arcosa, Inc. has a 52-week low of $69.85 and a 52-week high of $113.43.

Arcosa Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, April 30th. Stockholders of record on Tuesday, April 15th will be issued a dividend of $0.05 per share. The ex-dividend date of this dividend is Tuesday, April 15th. This represents a $0.20 annualized dividend and a dividend yield of 0.28%. Arcosa's dividend payout ratio is presently 10.47%.

Arcosa Company Profile

(

Free Report)

Arcosa, Inc, together with its subsidiaries, provides infrastructure-related products and solutions for the construction, engineered structures, and transportation markets in the United States. It operates through three segments: Construction Products, Engineered Structures, and Transportation Products.

Further Reading

Before you consider Arcosa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcosa wasn't on the list.

While Arcosa currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.