Prudential Financial Inc. reduced its position in Simon Property Group, Inc. (NYSE:SPG - Free Report) by 6.5% during the fourth quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 1,336,161 shares of the real estate investment trust's stock after selling 92,205 shares during the quarter. Prudential Financial Inc. owned approximately 0.41% of Simon Property Group worth $230,100,000 as of its most recent filing with the SEC.

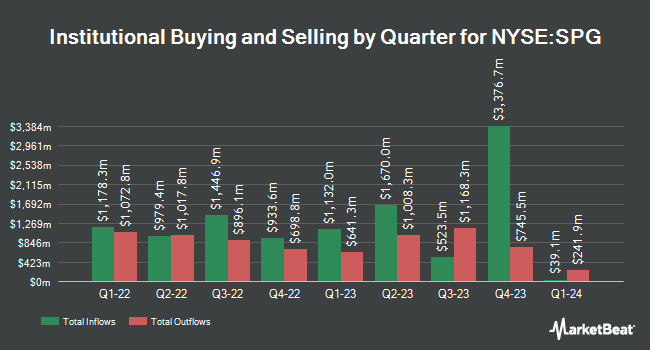

Other large investors also recently modified their holdings of the company. Childress Capital Advisors LLC raised its holdings in shares of Simon Property Group by 3.6% in the fourth quarter. Childress Capital Advisors LLC now owns 1,689 shares of the real estate investment trust's stock valued at $291,000 after purchasing an additional 58 shares during the last quarter. Global X Japan Co. Ltd. grew its position in Simon Property Group by 9.9% in the 4th quarter. Global X Japan Co. Ltd. now owns 655 shares of the real estate investment trust's stock worth $113,000 after purchasing an additional 59 shares in the last quarter. Bleakley Financial Group LLC grew its position in Simon Property Group by 1.0% in the 4th quarter. Bleakley Financial Group LLC now owns 6,237 shares of the real estate investment trust's stock worth $1,074,000 after purchasing an additional 62 shares in the last quarter. Carnegie Investment Counsel increased its stake in Simon Property Group by 4.3% in the 4th quarter. Carnegie Investment Counsel now owns 1,569 shares of the real estate investment trust's stock valued at $270,000 after buying an additional 65 shares during the last quarter. Finally, UMB Bank n.a. lifted its position in shares of Simon Property Group by 2.8% during the 4th quarter. UMB Bank n.a. now owns 2,391 shares of the real estate investment trust's stock worth $412,000 after buying an additional 66 shares in the last quarter. 93.01% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling at Simon Property Group

In related news, Director Reuben S. Leibowitz acquired 465 shares of the company's stock in a transaction that occurred on Monday, December 30th. The shares were acquired at an average price of $168.59 per share, with a total value of $78,394.35. Following the acquisition, the director now owns 55,919 shares of the company's stock, valued at approximately $9,427,384.21. This trade represents a 0.84 % increase in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Insiders own 8.50% of the company's stock.

Wall Street Analyst Weigh In

Several research firms have recently issued reports on SPG. Deutsche Bank Aktiengesellschaft began coverage on Simon Property Group in a report on Tuesday, December 17th. They issued a "hold" rating and a $195.00 target price for the company. Piper Sandler raised Simon Property Group from a "neutral" rating to an "overweight" rating and boosted their price objective for the stock from $175.00 to $205.00 in a research report on Wednesday, February 5th. Jefferies Financial Group raised Simon Property Group from a "hold" rating to a "buy" rating and raised their target price for the company from $179.00 to $198.00 in a research report on Thursday, January 2nd. StockNews.com upgraded Simon Property Group from a "hold" rating to a "buy" rating in a research note on Friday. Finally, Mizuho increased their price target on shares of Simon Property Group from $158.00 to $182.00 and gave the company a "neutral" rating in a research report on Wednesday, December 4th. Five investment analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $180.33.

Get Our Latest Report on SPG

Simon Property Group Stock Performance

Shares of SPG stock traded down $0.21 on Tuesday, hitting $165.91. 1,661,777 shares of the stock were exchanged, compared to its average volume of 1,342,980. The firm's 50 day moving average is $175.83 and its two-hundred day moving average is $174.46. Simon Property Group, Inc. has a one year low of $139.25 and a one year high of $190.14. The firm has a market capitalization of $54.13 billion, a PE ratio of 22.85, a P/E/G ratio of 10.10 and a beta of 1.78. The company has a current ratio of 1.28, a quick ratio of 2.00 and a debt-to-equity ratio of 7.19.

Simon Property Group (NYSE:SPG - Get Free Report) last issued its earnings results on Tuesday, February 4th. The real estate investment trust reported $3.68 earnings per share for the quarter, topping analysts' consensus estimates of $1.98 by $1.70. Simon Property Group had a net margin of 41.49% and a return on equity of 74.02%. Sell-side analysts expect that Simon Property Group, Inc. will post 12.54 earnings per share for the current fiscal year.

Simon Property Group Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, March 31st. Investors of record on Monday, March 10th will be paid a $2.10 dividend. The ex-dividend date is Monday, March 10th. This represents a $8.40 dividend on an annualized basis and a yield of 5.06%. Simon Property Group's dividend payout ratio is 115.70%.

Simon Property Group Company Profile

(

Free Report)

Simon Property Group, Inc NYSE: SPG is a self-administered and self-managed real estate investment trust (REIT). Simon Property Group, L.P., or the Operating Partnership, is our majority-owned partnership subsidiary that owns all of our real estate properties and other assets. In this package, the terms Simon, we, our, or the Company refer to Simon Property Group, Inc, the Operating Partnership, and its subsidiaries.

Read More

Before you consider Simon Property Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simon Property Group wasn't on the list.

While Simon Property Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.