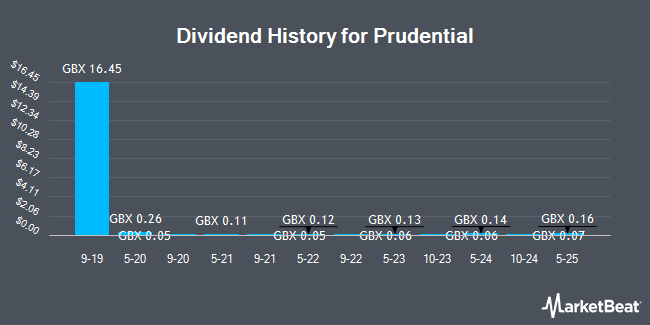

Prudential plc (LON:PRU - Get Free Report) announced a dividend on Thursday, March 20th, DividendData.Co.Uk reports. Stockholders of record on Thursday, March 27th will be paid a dividend of $0.16 per share by the financial services provider on Wednesday, May 14th. This represents a dividend yield of 1.58%. The ex-dividend date of this dividend is Thursday, March 27th. This is a 138.2% increase from Prudential's previous dividend of $0.07. The official announcement can be seen at this link.

Prudential Trading Up 0.8 %

LON:PRU traded up GBX 6.20 ($0.08) during mid-day trading on Tuesday, hitting GBX 825.40 ($10.69). 2,062,019,125 shares of the stock traded hands, compared to its average volume of 43,089,770. The company has a quick ratio of 0.67, a current ratio of 1.86 and a debt-to-equity ratio of 24.44. Prudential has a 52 week low of GBX 594.80 ($7.70) and a 52 week high of GBX 850.68 ($11.01). The stock has a market capitalization of £27.16 billion, a price-to-earnings ratio of 41.23, a PEG ratio of 0.40 and a beta of 1.20. The firm's 50 day moving average is GBX 711.42 and its two-hundred day moving average is GBX 669.20.

Analyst Upgrades and Downgrades

A number of research analysts have recently commented on the company. Bank of America reaffirmed a "buy" rating and set a GBX 1,000 ($12.95) target price on shares of Prudential in a research note on Thursday, March 20th. JPMorgan Chase & Co. reiterated an "overweight" rating and issued a GBX 950 ($12.30) target price on shares of Prudential in a research note on Thursday, March 20th. Five equities research analysts have rated the stock with a buy rating, According to MarketBeat, the stock has an average rating of "Buy" and a consensus price target of GBX 1,188 ($15.38).

Read Our Latest Report on PRU

About Prudential

(

Get Free Report)

Prudential plc provides life and health insurance and asset management in 24 markets across Asia and Africa. Prudential's mission is to be the most trusted partner and protector for this generation and generations to come, by providing simple and accessible financial and health solutions. The business has dual primary listings on the Stock Exchange of Hong Kong (2378) and the London Stock Exchange (PRU).

Featured Articles

Before you consider Prudential, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prudential wasn't on the list.

While Prudential currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.