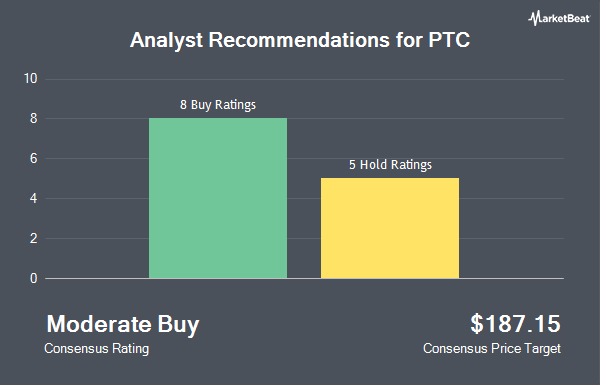

PTC Inc. (NASDAQ:PTC - Get Free Report) has been given an average rating of "Moderate Buy" by the eleven analysts that are presently covering the stock, MarketBeat.com reports. Four investment analysts have rated the stock with a hold rating and seven have issued a buy rating on the company. The average 12-month price objective among brokerages that have issued a report on the stock in the last year is $210.09.

A number of equities analysts recently commented on the stock. Rosenblatt Securities reiterated a "buy" rating and issued a $204.00 target price on shares of PTC in a research report on Tuesday, February 4th. Stifel Nicolaus boosted their target price on PTC from $200.00 to $230.00 and gave the company a "buy" rating in a research note on Wednesday, December 18th. Citigroup reduced their price target on PTC from $200.00 to $195.00 and set a "neutral" rating on the stock in a research report on Wednesday, February 5th. StockNews.com lowered PTC from a "buy" rating to a "hold" rating in a research note on Monday, March 17th. Finally, KeyCorp lifted their target price on shares of PTC from $205.00 to $211.00 and gave the stock an "overweight" rating in a research note on Thursday, February 6th.

Read Our Latest Report on PTC

PTC Price Performance

PTC traded up $0.96 on Friday, reaching $157.16. The company had a trading volume of 692,119 shares, compared to its average volume of 856,777. The company has a debt-to-equity ratio of 0.32, a quick ratio of 0.69 and a current ratio of 0.69. PTC has a 52-week low of $150.17 and a 52-week high of $203.09. The company has a market cap of $18.91 billion, a price-to-earnings ratio of 48.51, a P/E/G ratio of 2.27 and a beta of 1.22. The business has a 50 day simple moving average of $167.93 and a 200 day simple moving average of $180.66.

PTC (NASDAQ:PTC - Get Free Report) last issued its quarterly earnings results on Wednesday, February 5th. The technology company reported $0.79 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.91 by ($0.12). PTC had a return on equity of 14.49% and a net margin of 16.95%. As a group, sell-side analysts anticipate that PTC will post 4.46 EPS for the current year.

Insider Buying and Selling at PTC

In other news, Director Corinna Lathan sold 622 shares of the company's stock in a transaction dated Monday, March 17th. The shares were sold at an average price of $155.53, for a total value of $96,739.66. Following the sale, the director now directly owns 7,604 shares of the company's stock, valued at $1,182,650.12. This represents a 7.56 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Insiders own 0.32% of the company's stock.

Institutional Investors Weigh In On PTC

Several hedge funds have recently bought and sold shares of the business. Bank Julius Baer & Co. Ltd Zurich lifted its holdings in shares of PTC by 5.0% during the fourth quarter. Bank Julius Baer & Co. Ltd Zurich now owns 208,199 shares of the technology company's stock valued at $39,212,000 after purchasing an additional 9,893 shares during the last quarter. JPMorgan Chase & Co. raised its stake in PTC by 33.7% during the third quarter. JPMorgan Chase & Co. now owns 537,989 shares of the technology company's stock valued at $97,193,000 after buying an additional 135,677 shares during the last quarter. Oak Thistle LLC bought a new stake in PTC in the fourth quarter worth $1,113,000. Proficio Capital Partners LLC purchased a new stake in shares of PTC in the fourth quarter worth $8,858,000. Finally, Jones Financial Companies Lllp increased its holdings in shares of PTC by 1,140.5% during the fourth quarter. Jones Financial Companies Lllp now owns 459 shares of the technology company's stock valued at $84,000 after acquiring an additional 422 shares in the last quarter. Institutional investors own 95.14% of the company's stock.

PTC Company Profile

(

Get Free ReportPTC Inc operates as software company in the Americas, Europe, and the Asia Pacific. The company provides Windchill, a suite that manages all aspects of the product development lifecycle(PLM) that provides real-time information sharing, dynamic data visualization, collaborate across geographically distributed teams, and enabling manufacturers to elevate product development, manufacturing, and field service processes; ThingWorx, a platform for Industrial Internet of Things; ServiceMax, a field service management solutions enable companies to asset uptime with optimized in-person and remote service and technician productivity with mobile tools.

Featured Articles

Before you consider PTC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PTC wasn't on the list.

While PTC currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.