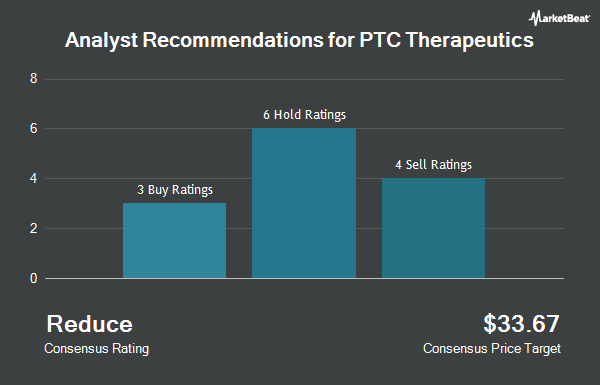

PTC Therapeutics, Inc. (NASDAQ:PTCT - Get Free Report) has been given an average rating of "Moderate Buy" by the fifteen brokerages that are presently covering the company, MarketBeat.com reports. Two investment analysts have rated the stock with a sell recommendation, four have given a hold recommendation, eight have given a buy recommendation and one has issued a strong buy recommendation on the company. The average 1-year price objective among analysts that have updated their coverage on the stock in the last year is $63.54.

A number of research firms have recently commented on PTCT. Morgan Stanley restated an "overweight" rating and issued a $70.00 price target (up from $67.00) on shares of PTC Therapeutics in a report on Friday, March 7th. Scotiabank started coverage on shares of PTC Therapeutics in a research note on Friday, March 7th. They issued a "sector perform" rating and a $55.00 target price on the stock. JPMorgan Chase & Co. decreased their price target on shares of PTC Therapeutics from $74.00 to $72.00 and set an "overweight" rating for the company in a research note on Friday, February 28th. Royal Bank of Canada boosted their price target on PTC Therapeutics from $60.00 to $63.00 and gave the company an "outperform" rating in a report on Tuesday, February 18th. Finally, UBS Group raised their price objective on PTC Therapeutics from $47.00 to $71.00 and gave the stock a "buy" rating in a report on Tuesday, December 3rd.

Check Out Our Latest Report on PTC Therapeutics

PTC Therapeutics Stock Down 1.6 %

Shares of PTC Therapeutics stock opened at $52.76 on Friday. The stock's fifty day moving average is $48.44 and its two-hundred day moving average is $43.37. PTC Therapeutics has a 52 week low of $24.00 and a 52 week high of $55.60. The company has a market capitalization of $4.16 billion, a PE ratio of -8.88 and a beta of 0.66.

Insiders Place Their Bets

In related news, Director Allan Steven Jacobson sold 1,230 shares of the business's stock in a transaction on Tuesday, March 4th. The stock was sold at an average price of $51.52, for a total transaction of $63,369.60. Following the transaction, the director now directly owns 19,118 shares in the company, valued at $984,959.36. The trade was a 6.04 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, CEO Matthew B. Klein sold 8,279 shares of the stock in a transaction dated Tuesday, December 31st. The shares were sold at an average price of $45.16, for a total value of $373,879.64. Following the completion of the sale, the chief executive officer now owns 217,528 shares of the company's stock, valued at approximately $9,823,564.48. This trade represents a 3.67 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 22,870 shares of company stock worth $1,075,657. 5.50% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On PTC Therapeutics

A number of large investors have recently modified their holdings of the business. Universal Beteiligungs und Servicegesellschaft mbH acquired a new stake in PTC Therapeutics in the 4th quarter worth approximately $4,891,000. Mackenzie Financial Corp lifted its stake in shares of PTC Therapeutics by 132.2% during the fourth quarter. Mackenzie Financial Corp now owns 22,776 shares of the biopharmaceutical company's stock worth $1,028,000 after buying an additional 12,967 shares during the period. Toronto Dominion Bank purchased a new stake in shares of PTC Therapeutics during the fourth quarter valued at $148,363,000. GF Fund Management CO. LTD. purchased a new stake in shares of PTC Therapeutics during the fourth quarter valued at $73,000. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its position in shares of PTC Therapeutics by 19.6% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 160,251 shares of the biopharmaceutical company's stock valued at $7,234,000 after acquiring an additional 26,274 shares during the period.

PTC Therapeutics Company Profile

(

Get Free ReportPTC Therapeutics, Inc, a biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to patients with rare disorders in the United States and internationally. The company offers Translarna and Emflaza for the treatment of Duchenne muscular dystrophy; Upstaza to treat aromatic l-amino acid decarboxylas (AADC) deficiency, a central nervous system disorder; Tegsedi and Waylivra for the treatment of rare diseases; and Evrysdi to treat spinal muscular atrophy (SMA) in adults and children.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PTC Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PTC Therapeutics wasn't on the list.

While PTC Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.