Two Sigma Advisers LP boosted its holdings in PTC Therapeutics, Inc. (NASDAQ:PTCT - Free Report) by 10.3% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 429,842 shares of the biopharmaceutical company's stock after purchasing an additional 40,300 shares during the period. Two Sigma Advisers LP owned approximately 0.56% of PTC Therapeutics worth $15,947,000 at the end of the most recent reporting period.

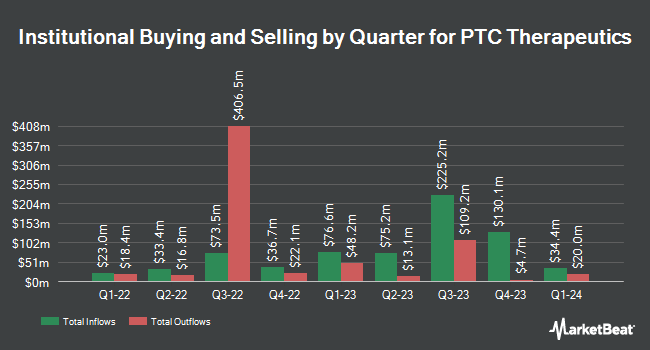

Several other institutional investors have also added to or reduced their stakes in PTCT. Diversified Trust Co grew its holdings in shares of PTC Therapeutics by 5.6% in the second quarter. Diversified Trust Co now owns 15,317 shares of the biopharmaceutical company's stock worth $468,000 after purchasing an additional 818 shares during the last quarter. Assenagon Asset Management S.A. grew its holdings in PTC Therapeutics by 21.7% in the 2nd quarter. Assenagon Asset Management S.A. now owns 372,827 shares of the biopharmaceutical company's stock worth $11,401,000 after acquiring an additional 66,596 shares during the last quarter. Neo Ivy Capital Management purchased a new position in shares of PTC Therapeutics in the second quarter valued at about $1,245,000. Sanibel Captiva Trust Company Inc. bought a new position in shares of PTC Therapeutics during the second quarter valued at about $205,000. Finally, Bank of New York Mellon Corp boosted its holdings in shares of PTC Therapeutics by 17.1% during the second quarter. Bank of New York Mellon Corp now owns 279,049 shares of the biopharmaceutical company's stock worth $8,533,000 after purchasing an additional 40,840 shares during the period.

Wall Street Analysts Forecast Growth

PTCT has been the topic of a number of research analyst reports. Robert W. Baird boosted their price target on PTC Therapeutics from $52.00 to $70.00 and gave the company an "outperform" rating in a report on Tuesday, December 3rd. The Goldman Sachs Group boosted their target price on PTC Therapeutics from $32.00 to $42.00 and gave the company a "sell" rating in a research note on Wednesday, December 4th. Morgan Stanley raised their price target on PTC Therapeutics from $32.00 to $45.00 and gave the stock an "equal weight" rating in a research note on Friday, October 11th. JPMorgan Chase & Co. boosted their price objective on shares of PTC Therapeutics from $51.00 to $62.00 and gave the company an "overweight" rating in a research report on Tuesday, November 19th. Finally, Citigroup upped their price objective on shares of PTC Therapeutics from $26.00 to $32.00 and gave the stock a "sell" rating in a report on Wednesday, December 4th. Three equities research analysts have rated the stock with a sell rating, four have issued a hold rating, eight have issued a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, PTC Therapeutics has a consensus rating of "Hold" and a consensus price target of $52.38.

Check Out Our Latest Report on PTCT

Insiders Place Their Bets

In other news, Director Jerome B. Zeldis sold 24,000 shares of the company's stock in a transaction on Monday, December 2nd. The stock was sold at an average price of $51.50, for a total transaction of $1,236,000.00. Following the transaction, the director now directly owns 14,500 shares of the company's stock, valued at $746,750. This represents a 62.34 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, CAO Christine Marie Utter sold 17,800 shares of PTC Therapeutics stock in a transaction dated Monday, December 2nd. The stock was sold at an average price of $51.77, for a total value of $921,506.00. Following the completion of the sale, the chief accounting officer now owns 52,428 shares of the company's stock, valued at $2,714,197.56. The trade was a 25.35 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 196,950 shares of company stock valued at $10,251,735. Insiders own 5.50% of the company's stock.

PTC Therapeutics Price Performance

Shares of NASDAQ:PTCT traded up $0.02 on Monday, hitting $48.06. 887,754 shares of the company traded hands, compared to its average volume of 854,889. The stock has a 50 day simple moving average of $41.49 and a 200-day simple moving average of $36.77. PTC Therapeutics, Inc. has a 52 week low of $23.58 and a 52 week high of $54.16.

PTC Therapeutics Company Profile

(

Free Report)

PTC Therapeutics, Inc, a biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to patients with rare disorders in the United States and internationally. The company offers Translarna and Emflaza for the treatment of Duchenne muscular dystrophy; Upstaza to treat aromatic l-amino acid decarboxylas (AADC) deficiency, a central nervous system disorder; Tegsedi and Waylivra for the treatment of rare diseases; and Evrysdi to treat spinal muscular atrophy (SMA) in adults and children.

Further Reading

Before you consider PTC Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PTC Therapeutics wasn't on the list.

While PTC Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.