PTC Therapeutics (NASDAQ:PTCT - Get Free Report) was downgraded by analysts at StockNews.com from a "buy" rating to a "hold" rating in a note issued to investors on Wednesday.

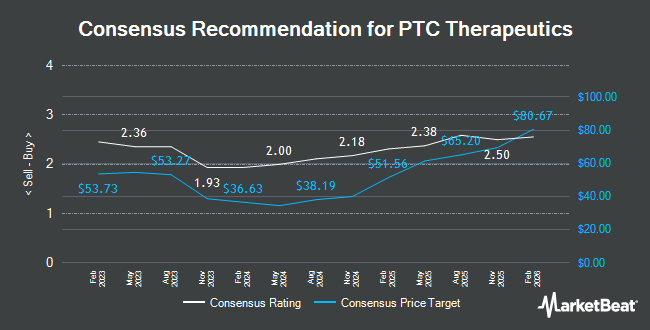

Several other research firms have also recently commented on PTCT. Morgan Stanley raised PTC Therapeutics from an "equal weight" rating to an "overweight" rating and raised their target price for the stock from $45.00 to $67.00 in a research note on Friday, December 13th. The Goldman Sachs Group increased their price target on PTC Therapeutics from $32.00 to $42.00 and gave the stock a "sell" rating in a report on Wednesday, December 4th. JPMorgan Chase & Co. lifted their price objective on shares of PTC Therapeutics from $51.00 to $62.00 and gave the company an "overweight" rating in a research note on Tuesday, November 19th. Barclays increased their target price on shares of PTC Therapeutics from $45.00 to $56.00 and gave the stock an "equal weight" rating in a research note on Tuesday, December 3rd. Finally, Robert W. Baird lifted their price target on shares of PTC Therapeutics from $52.00 to $70.00 and gave the company an "outperform" rating in a research note on Tuesday, December 3rd. Three equities research analysts have rated the stock with a sell rating, four have given a hold rating, eight have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, PTC Therapeutics has a consensus rating of "Hold" and an average price target of $54.08.

Check Out Our Latest Analysis on PTC Therapeutics

PTC Therapeutics Stock Down 3.3 %

PTCT traded down $1.56 during trading on Wednesday, reaching $45.46. 602,395 shares of the stock traded hands, compared to its average volume of 848,170. The stock's 50-day moving average is $43.11 and its 200 day moving average is $37.35. PTC Therapeutics has a 12 month low of $23.58 and a 12 month high of $54.16. The stock has a market capitalization of $3.51 billion, a PE ratio of -7.65 and a beta of 0.63.

Insider Buying and Selling at PTC Therapeutics

In other news, Director Jerome B. Zeldis sold 24,000 shares of the stock in a transaction dated Monday, December 2nd. The shares were sold at an average price of $51.50, for a total value of $1,236,000.00. Following the completion of the sale, the director now owns 14,500 shares in the company, valued at $746,750. This represents a 62.34 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CAO Christine Marie Utter sold 17,800 shares of the firm's stock in a transaction dated Monday, December 2nd. The shares were sold at an average price of $51.77, for a total transaction of $921,506.00. Following the transaction, the chief accounting officer now directly owns 52,428 shares in the company, valued at $2,714,197.56. The trade was a 25.35 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 196,950 shares of company stock worth $10,251,735. Insiders own 5.50% of the company's stock.

Institutional Inflows and Outflows

A number of institutional investors have recently bought and sold shares of the business. KBC Group NV boosted its holdings in shares of PTC Therapeutics by 29.2% in the 3rd quarter. KBC Group NV now owns 2,232 shares of the biopharmaceutical company's stock worth $83,000 after buying an additional 504 shares during the last quarter. CWM LLC boosted its stake in PTC Therapeutics by 354.7% in the third quarter. CWM LLC now owns 2,687 shares of the biopharmaceutical company's stock valued at $100,000 after acquiring an additional 2,096 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. boosted its stake in PTC Therapeutics by 21.5% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,782 shares of the biopharmaceutical company's stock valued at $104,000 after acquiring an additional 492 shares during the last quarter. Quest Partners LLC bought a new position in shares of PTC Therapeutics during the 2nd quarter valued at approximately $128,000. Finally, Quarry LP increased its stake in shares of PTC Therapeutics by 100.0% during the 2nd quarter. Quarry LP now owns 5,000 shares of the biopharmaceutical company's stock worth $153,000 after purchasing an additional 2,500 shares during the last quarter.

About PTC Therapeutics

(

Get Free Report)

PTC Therapeutics, Inc, a biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to patients with rare disorders in the United States and internationally. The company offers Translarna and Emflaza for the treatment of Duchenne muscular dystrophy; Upstaza to treat aromatic l-amino acid decarboxylas (AADC) deficiency, a central nervous system disorder; Tegsedi and Waylivra for the treatment of rare diseases; and Evrysdi to treat spinal muscular atrophy (SMA) in adults and children.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PTC Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PTC Therapeutics wasn't on the list.

While PTC Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.