Public Employees Retirement System of Ohio acquired a new stake in Nutrien Ltd. (NYSE:NTR - Free Report) in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund acquired 86,598 shares of the company's stock, valued at approximately $4,166,000.

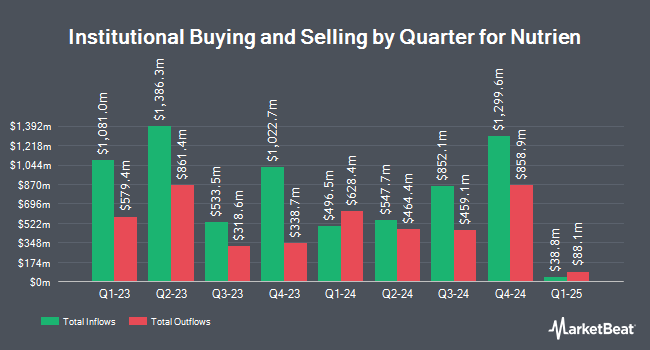

Other large investors have also modified their holdings of the company. Lester Murray Antman dba SimplyRich raised its position in Nutrien by 2.3% in the 2nd quarter. Lester Murray Antman dba SimplyRich now owns 9,069 shares of the company's stock valued at $461,000 after purchasing an additional 202 shares during the last quarter. FFT Wealth Management LLC boosted its stake in shares of Nutrien by 0.8% during the second quarter. FFT Wealth Management LLC now owns 29,220 shares of the company's stock worth $1,488,000 after buying an additional 220 shares during the period. MONECO Advisors LLC grew its holdings in shares of Nutrien by 2.4% during the second quarter. MONECO Advisors LLC now owns 9,791 shares of the company's stock worth $498,000 after buying an additional 233 shares during the last quarter. Wealth Enhancement Advisory Services LLC increased its position in Nutrien by 6.5% in the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 4,309 shares of the company's stock valued at $207,000 after acquiring an additional 263 shares during the period. Finally, Royal London Asset Management Ltd. raised its stake in Nutrien by 1.1% during the 2nd quarter. Royal London Asset Management Ltd. now owns 23,995 shares of the company's stock valued at $1,222,000 after acquiring an additional 265 shares during the last quarter. 63.10% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research analysts have weighed in on the company. TD Securities lowered their target price on Nutrien from $63.00 to $61.00 and set a "buy" rating on the stock in a research note on Tuesday, November 12th. UBS Group lowered shares of Nutrien from a "buy" rating to a "neutral" rating and decreased their target price for the stock from $66.00 to $51.00 in a research report on Thursday, October 10th. Raymond James raised shares of Nutrien from a "market perform" rating to an "outperform" rating and increased their target price for the company from $58.00 to $60.00 in a report on Tuesday, December 3rd. The Goldman Sachs Group lowered Nutrien from a "buy" rating to a "neutral" rating and decreased their price target for the stock from $69.00 to $53.00 in a research note on Tuesday, September 10th. Finally, Wells Fargo & Company cut Nutrien from an "overweight" rating to an "equal weight" rating and dropped their price target for the company from $62.00 to $50.00 in a research report on Tuesday, September 24th. Three equities research analysts have rated the stock with a sell rating, four have given a hold rating and eleven have assigned a buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $58.95.

Read Our Latest Stock Analysis on Nutrien

Nutrien Trading Up 0.5 %

NYSE:NTR traded up $0.25 during mid-day trading on Friday, reaching $48.18. The company's stock had a trading volume of 1,478,614 shares, compared to its average volume of 1,773,426. The company's fifty day simple moving average is $47.85 and its two-hundred day simple moving average is $48.96. The company has a debt-to-equity ratio of 0.38, a current ratio of 1.27 and a quick ratio of 0.82. Nutrien Ltd. has a twelve month low of $44.65 and a twelve month high of $60.87. The stock has a market cap of $23.72 billion, a P/E ratio of 32.34, a P/E/G ratio of 1.73 and a beta of 0.80.

Nutrien (NYSE:NTR - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The company reported $0.39 earnings per share for the quarter, missing analysts' consensus estimates of $0.43 by ($0.04). The company had revenue of $5.35 billion for the quarter, compared to analysts' expectations of $5.26 billion. Nutrien had a return on equity of 6.99% and a net margin of 2.79%. The business's revenue for the quarter was down 5.0% on a year-over-year basis. During the same period in the prior year, the business earned $0.35 EPS. On average, equities analysts predict that Nutrien Ltd. will post 3.5 EPS for the current year.

Nutrien Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, January 17th. Stockholders of record on Tuesday, December 31st will be given a $0.939 dividend. The ex-dividend date is Tuesday, December 31st. This represents a $3.76 annualized dividend and a dividend yield of 7.80%. This is a positive change from Nutrien's previous quarterly dividend of $0.54. Nutrien's dividend payout ratio is presently 144.97%.

About Nutrien

(

Free Report)

Nutrien Ltd. provides crop inputs and services. The company operates through four segments: Retail, Potash, Nitrogen, and Phosphate. The Retail segment distributes crop nutrients, crop protection products, seeds, and merchandise products. The Potash segment provides granular and standard potash products.

Read More

Before you consider Nutrien, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutrien wasn't on the list.

While Nutrien currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.