Public Employees Retirement System of Ohio cut its stake in Weyerhaeuser (NYSE:WY - Free Report) by 11.1% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 298,814 shares of the real estate investment trust's stock after selling 37,464 shares during the quarter. Public Employees Retirement System of Ohio's holdings in Weyerhaeuser were worth $10,118,000 at the end of the most recent quarter.

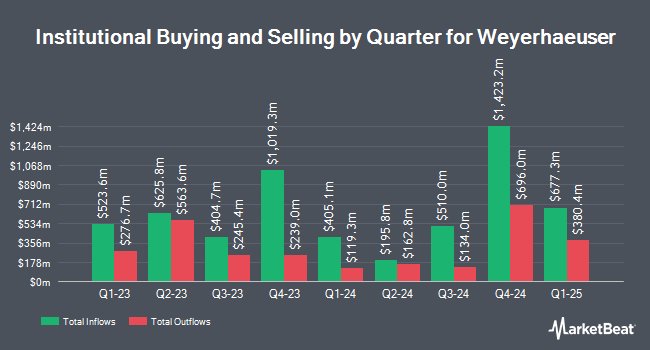

Several other large investors have also recently made changes to their positions in the stock. Groupama Asset Managment grew its position in shares of Weyerhaeuser by 2.1% in the 3rd quarter. Groupama Asset Managment now owns 58,253 shares of the real estate investment trust's stock worth $1,972,000 after buying an additional 1,199 shares during the last quarter. Nomura Asset Management Co. Ltd. boosted its stake in Weyerhaeuser by 7.5% in the third quarter. Nomura Asset Management Co. Ltd. now owns 222,000 shares of the real estate investment trust's stock valued at $7,517,000 after acquiring an additional 15,403 shares in the last quarter. MML Investors Services LLC grew its holdings in Weyerhaeuser by 7.9% in the third quarter. MML Investors Services LLC now owns 76,897 shares of the real estate investment trust's stock worth $2,604,000 after purchasing an additional 5,632 shares during the last quarter. National Bank of Canada FI increased its position in shares of Weyerhaeuser by 80.1% during the third quarter. National Bank of Canada FI now owns 381,245 shares of the real estate investment trust's stock worth $12,909,000 after purchasing an additional 169,614 shares in the last quarter. Finally, Wellington Management Group LLP lifted its holdings in shares of Weyerhaeuser by 12.7% during the 3rd quarter. Wellington Management Group LLP now owns 35,755,865 shares of the real estate investment trust's stock valued at $1,210,694,000 after purchasing an additional 4,035,048 shares during the last quarter. 82.99% of the stock is owned by institutional investors.

Weyerhaeuser Stock Performance

WY traded down $0.49 during trading on Thursday, reaching $30.40. 2,848,462 shares of the company's stock were exchanged, compared to its average volume of 3,589,979. The company has a debt-to-equity ratio of 0.49, a current ratio of 2.01 and a quick ratio of 1.41. Weyerhaeuser has a 1 year low of $26.73 and a 1 year high of $36.27. The company's fifty day simple moving average is $31.83 and its 200-day simple moving average is $30.85. The stock has a market capitalization of $22.09 billion, a P/E ratio of 41.28 and a beta of 1.40.

Weyerhaeuser (NYSE:WY - Get Free Report) last issued its earnings results on Thursday, October 24th. The real estate investment trust reported $0.05 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.02 by $0.03. The firm had revenue of $1.68 billion during the quarter, compared to analysts' expectations of $1.70 billion. Weyerhaeuser had a net margin of 7.43% and a return on equity of 4.21%. The firm's revenue was down 13.3% compared to the same quarter last year. During the same quarter last year, the company posted $0.33 earnings per share. As a group, research analysts predict that Weyerhaeuser will post 0.46 earnings per share for the current fiscal year.

Weyerhaeuser Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Friday, November 29th will be paid a $0.20 dividend. The ex-dividend date is Friday, November 29th. This represents a $0.80 dividend on an annualized basis and a dividend yield of 2.63%. Weyerhaeuser's payout ratio is 108.11%.

Wall Street Analysts Forecast Growth

Several research analysts recently weighed in on WY shares. BMO Capital Markets upgraded Weyerhaeuser from a "market perform" rating to an "outperform" rating and set a $38.00 target price on the stock in a research note on Friday, December 6th. Truist Financial boosted their price target on Weyerhaeuser from $31.00 to $34.00 and gave the stock a "hold" rating in a research note on Tuesday, October 15th. Finally, StockNews.com cut shares of Weyerhaeuser from a "hold" rating to a "sell" rating in a report on Monday, October 28th. One investment analyst has rated the stock with a sell rating, three have assigned a hold rating and four have issued a buy rating to the company. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $36.33.

Check Out Our Latest Stock Report on Weyerhaeuser

Insider Buying and Selling

In other news, Director James Calvin O'rourke bought 7,800 shares of the stock in a transaction dated Friday, September 13th. The shares were acquired at an average cost of $32.01 per share, with a total value of $249,678.00. Following the purchase, the director now directly owns 17,672 shares in the company, valued at $565,680.72. The trade was a 79.01 % increase in their position. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. 0.27% of the stock is owned by corporate insiders.

Weyerhaeuser Company Profile

(

Free Report)

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900. We own or control approximately 11 million acres of timberlands in the U.S. and manage additional timberlands under long-term licenses in Canada. We manage these timberlands on a sustainable basis in compliance with internationally recognized forestry standards.

Featured Stories

Before you consider Weyerhaeuser, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weyerhaeuser wasn't on the list.

While Weyerhaeuser currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.