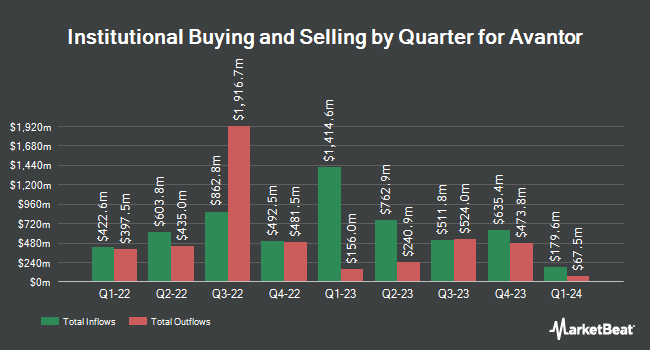

Public Employees Retirement System of Ohio increased its position in Avantor, Inc. (NYSE:AVTR - Free Report) by 34.1% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 346,822 shares of the company's stock after purchasing an additional 88,205 shares during the quarter. Public Employees Retirement System of Ohio owned approximately 0.05% of Avantor worth $8,972,000 as of its most recent SEC filing.

Other institutional investors and hedge funds have also bought and sold shares of the company. Nomura Asset Management Co. Ltd. lifted its position in shares of Avantor by 7.1% in the 3rd quarter. Nomura Asset Management Co. Ltd. now owns 196,539 shares of the company's stock worth $5,084,000 after purchasing an additional 13,000 shares during the period. MML Investors Services LLC raised its stake in Avantor by 7.4% in the third quarter. MML Investors Services LLC now owns 50,793 shares of the company's stock worth $1,314,000 after buying an additional 3,492 shares in the last quarter. Orion Portfolio Solutions LLC boosted its position in Avantor by 6.3% during the 3rd quarter. Orion Portfolio Solutions LLC now owns 146,684 shares of the company's stock valued at $3,795,000 after acquiring an additional 8,696 shares in the last quarter. XTX Topco Ltd boosted its position in Avantor by 130.0% during the 3rd quarter. XTX Topco Ltd now owns 96,417 shares of the company's stock valued at $2,494,000 after acquiring an additional 54,489 shares in the last quarter. Finally, United Services Automobile Association purchased a new position in shares of Avantor in the 3rd quarter valued at $1,151,000. 95.08% of the stock is owned by institutional investors.

Avantor Stock Performance

NYSE:AVTR traded down $0.20 during mid-day trading on Friday, hitting $22.33. The company's stock had a trading volume of 3,576,960 shares, compared to its average volume of 6,472,614. The business's fifty day moving average is $22.53 and its two-hundred day moving average is $23.54. The stock has a market cap of $15.20 billion, a price-to-earnings ratio of 48.98, a PEG ratio of 2.75 and a beta of 1.29. Avantor, Inc. has a 1 year low of $19.59 and a 1 year high of $28.00. The company has a debt-to-equity ratio of 0.84, a current ratio of 1.54 and a quick ratio of 1.06.

Analyst Upgrades and Downgrades

Several equities analysts have issued reports on the company. UBS Group cut their target price on Avantor from $30.00 to $29.00 and set a "buy" rating on the stock in a research note on Tuesday, October 8th. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $34.00 price objective on shares of Avantor in a research report on Thursday, September 26th. Barclays decreased their target price on shares of Avantor from $28.00 to $25.00 and set an "overweight" rating for the company in a research report on Friday, October 25th. Wells Fargo & Company reduced their price target on Avantor from $30.00 to $28.00 and set an "overweight" rating on the stock in a research report on Monday, October 28th. Finally, Robert W. Baird lowered their price objective on Avantor from $27.00 to $26.00 and set an "outperform" rating for the company in a research report on Monday, October 28th. Three equities research analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $27.69.

View Our Latest Stock Analysis on Avantor

About Avantor

(

Free Report)

Avantor, Inc engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa. The company offers materials and consumables, such as purity chemicals and reagents, lab products and supplies, formulated silicone materials, customized excipients, customized single-use assemblies, process chromatography resins and columns, analytical sample prep kits, education and microbiology products, clinical trial kits, peristaltic pumps, and fluid handling tips.

Recommended Stories

Before you consider Avantor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avantor wasn't on the list.

While Avantor currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.