Public Employees Retirement System of Ohio bought a new position in Himax Technologies, Inc. (NASDAQ:HIMX - Free Report) in the third quarter, according to the company in its most recent 13F filing with the SEC. The firm bought 204,570 shares of the semiconductor company's stock, valued at approximately $1,125,000. Public Employees Retirement System of Ohio owned about 0.12% of Himax Technologies at the end of the most recent reporting period.

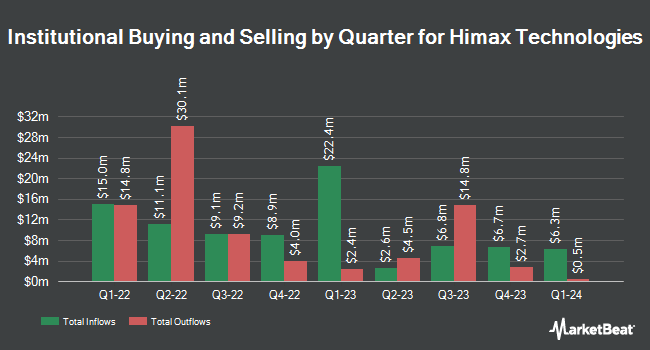

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Point72 Asset Management L.P. lifted its holdings in shares of Himax Technologies by 49.6% in the 3rd quarter. Point72 Asset Management L.P. now owns 868,500 shares of the semiconductor company's stock valued at $4,777,000 after buying an additional 288,000 shares during the period. Point72 Hong Kong Ltd purchased a new position in shares of Himax Technologies during the 2nd quarter valued at approximately $5,817,000. BNP Paribas Financial Markets lifted its stake in shares of Himax Technologies by 324.2% in the 3rd quarter. BNP Paribas Financial Markets now owns 296,210 shares of the semiconductor company's stock valued at $1,629,000 after purchasing an additional 226,386 shares during the period. Polunin Capital Partners Ltd acquired a new stake in Himax Technologies during the second quarter valued at $6,358,000. Finally, Stifel Financial Corp boosted its stake in shares of Himax Technologies by 4.8% during the 3rd quarter. Stifel Financial Corp now owns 470,526 shares of the semiconductor company's stock worth $2,588,000 after acquiring an additional 21,607 shares in the last quarter. Institutional investors and hedge funds own 69.81% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Robert W. Baird lifted their price target on Himax Technologies from $7.00 to $15.00 and gave the company an "outperform" rating in a research note on Friday, December 13th.

View Our Latest Report on Himax Technologies

Himax Technologies Price Performance

NASDAQ HIMX traded up $0.15 on Friday, hitting $7.72. The company had a trading volume of 1,540,175 shares, compared to its average volume of 941,091. The company has a debt-to-equity ratio of 0.03, a current ratio of 1.64 and a quick ratio of 1.37. The company has a market capitalization of $1.35 billion, a PE ratio of 17.55 and a beta of 2.07. Himax Technologies, Inc. has a 12-month low of $4.80 and a 12-month high of $9.80. The company's fifty day moving average price is $6.16 and its 200-day moving average price is $6.38.

Himax Technologies (NASDAQ:HIMX - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The semiconductor company reported $0.07 earnings per share for the quarter, beating analysts' consensus estimates of $0.04 by $0.03. Himax Technologies had a net margin of 8.77% and a return on equity of 9.06%. The firm had revenue of $222.40 million for the quarter, compared to analyst estimates of $205.93 million. During the same period last year, the company posted $0.06 EPS. Himax Technologies's quarterly revenue was down 6.8% compared to the same quarter last year.

Himax Technologies announced that its board has initiated a share buyback program on Wednesday, December 4th that allows the company to buyback $20.00 million in shares. This buyback authorization allows the semiconductor company to reacquire up to 1.9% of its shares through open market purchases. Shares buyback programs are usually a sign that the company's leadership believes its shares are undervalued.

Himax Technologies Company Profile

(

Free Report)

Himax Technologies, Inc, a fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States. The company operates in two segments, Driver IC and Non-Driver Products. It offers display driver integrated circuits (ICs) and timing controllers that are used in televisions, PC monitors, laptops, mobile phones, tablets, automotive, ePaper devices, industrial displays, and other products.

See Also

Before you consider Himax Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Himax Technologies wasn't on the list.

While Himax Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.