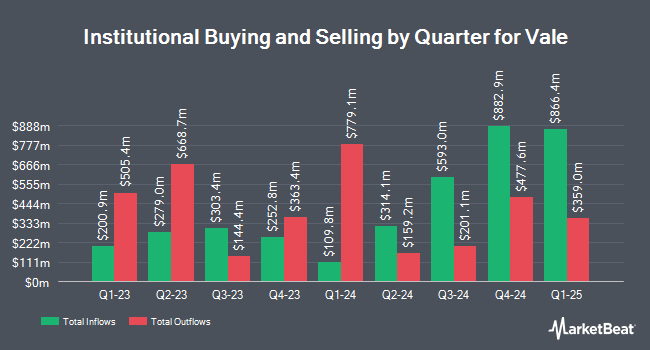

Public Employees Retirement System of Ohio purchased a new stake in shares of Vale S.A. (NYSE:VALE - Free Report) in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor purchased 868,840 shares of the basic materials company's stock, valued at approximately $10,148,000.

Several other institutional investors and hedge funds have also bought and sold shares of the business. SG Americas Securities LLC lifted its stake in Vale by 109.2% in the second quarter. SG Americas Securities LLC now owns 218,218 shares of the basic materials company's stock worth $2,437,000 after acquiring an additional 113,908 shares during the period. AdvisorNet Financial Inc lifted its position in shares of Vale by 189.7% in the 2nd quarter. AdvisorNet Financial Inc now owns 15,280 shares of the basic materials company's stock worth $171,000 after purchasing an additional 10,006 shares during the period. Blue Trust Inc. boosted its stake in shares of Vale by 34.2% during the 2nd quarter. Blue Trust Inc. now owns 14,880 shares of the basic materials company's stock valued at $181,000 after purchasing an additional 3,794 shares in the last quarter. Accordant Advisory Group Inc increased its position in shares of Vale by 522.1% during the second quarter. Accordant Advisory Group Inc now owns 21,774 shares of the basic materials company's stock valued at $243,000 after buying an additional 18,274 shares during the period. Finally, Milestone Asset Management LLC raised its stake in Vale by 359.5% in the second quarter. Milestone Asset Management LLC now owns 68,413 shares of the basic materials company's stock worth $764,000 after buying an additional 53,524 shares in the last quarter. Hedge funds and other institutional investors own 21.85% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on VALE. UBS Group cut Vale from a "buy" rating to a "neutral" rating and cut their price objective for the company from $14.00 to $11.50 in a research report on Monday, November 11th. Wolfe Research cut Vale from a "peer perform" rating to an "underperform" rating in a research note on Wednesday, October 9th. Scotiabank decreased their price objective on Vale from $16.00 to $14.00 and set a "sector perform" rating for the company in a report on Wednesday, November 20th. Barclays lowered their price objective on Vale from $16.00 to $15.25 and set an "overweight" rating for the company in a research report on Wednesday, December 4th. Finally, StockNews.com assumed coverage on shares of Vale in a research note on Friday, October 18th. They issued a "buy" rating for the company. One equities research analyst has rated the stock with a sell rating, six have issued a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat.com, Vale presently has a consensus rating of "Hold" and a consensus price target of $14.38.

Check Out Our Latest Stock Analysis on Vale

Vale Stock Down 2.8 %

VALE stock traded down $0.27 during trading on Thursday, hitting $9.47. 31,681,973 shares of the stock traded hands, compared to its average volume of 27,651,135. The company has a debt-to-equity ratio of 0.39, a current ratio of 0.91 and a quick ratio of 0.58. The stock has a market cap of $42.45 billion, a price-to-earnings ratio of 4.55, a price-to-earnings-growth ratio of 0.26 and a beta of 0.91. Vale S.A. has a 1 year low of $9.33 and a 1 year high of $16.08. The firm's 50 day moving average is $10.41 and its two-hundred day moving average is $10.77.

Vale (NYSE:VALE - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The basic materials company reported $0.56 EPS for the quarter, beating analysts' consensus estimates of $0.41 by $0.15. Vale had a net margin of 22.59% and a return on equity of 21.07%. The firm had revenue of $9.55 billion for the quarter, compared to analysts' expectations of $9.61 billion. During the same quarter in the prior year, the company posted $0.66 earnings per share. On average, sell-side analysts anticipate that Vale S.A. will post 2.08 EPS for the current year.

About Vale

(

Free Report)

Vale SA, together with its subsidiaries, produces and sells iron ore and iron ore pellets for use as raw materials in steelmaking in Brazil and internationally. The company operates through Iron Solutions and Energy Transition Materials segments. The Iron Solutions segment produces and extracts iron ore and pellets, manganese, and other ferrous products; and provides related logistic services.

Featured Stories

Before you consider Vale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vale wasn't on the list.

While Vale currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.