Public Employees Retirement System of Ohio bought a new stake in shares of Enbridge Inc. (NYSE:ENB - Free Report) TSE: ENB during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor bought 439,201 shares of the pipeline company's stock, valued at approximately $17,848,000.

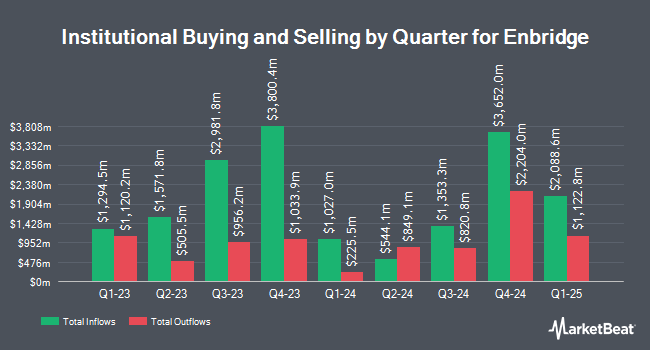

Other institutional investors have also recently made changes to their positions in the company. Richardson Financial Services Inc. boosted its stake in shares of Enbridge by 28.4% in the 3rd quarter. Richardson Financial Services Inc. now owns 1,112 shares of the pipeline company's stock worth $45,000 after buying an additional 246 shares during the last quarter. Associated Banc Corp lifted its stake in shares of Enbridge by 3.6% during the 3rd quarter. Associated Banc Corp now owns 7,091 shares of the pipeline company's stock valued at $288,000 after buying an additional 248 shares in the last quarter. Centaurus Financial Inc. increased its stake in Enbridge by 1.7% in the 3rd quarter. Centaurus Financial Inc. now owns 14,980 shares of the pipeline company's stock worth $608,000 after buying an additional 256 shares in the last quarter. First PREMIER Bank raised its holdings in Enbridge by 1.7% during the third quarter. First PREMIER Bank now owns 15,534 shares of the pipeline company's stock valued at $631,000 after acquiring an additional 257 shares during the period. Finally, Keudell Morrison Wealth Management lifted its position in shares of Enbridge by 1.4% in the third quarter. Keudell Morrison Wealth Management now owns 20,242 shares of the pipeline company's stock valued at $822,000 after acquiring an additional 277 shares in the last quarter. Hedge funds and other institutional investors own 54.60% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts recently commented on ENB shares. Wells Fargo & Company raised Enbridge from an "underweight" rating to an "equal weight" rating in a report on Wednesday, November 6th. Morgan Stanley started coverage on shares of Enbridge in a research note on Friday, October 25th. They set an "equal weight" rating for the company. Royal Bank of Canada reissued an "outperform" rating and set a $63.00 price objective (up previously from $59.00) on shares of Enbridge in a report on Wednesday, December 4th. Finally, Jefferies Financial Group cut Enbridge from a "buy" rating to a "hold" rating in a report on Monday, September 30th. Four analysts have rated the stock with a hold rating and one has issued a buy rating to the company's stock. According to MarketBeat, the company has an average rating of "Hold" and an average target price of $63.00.

View Our Latest Analysis on Enbridge

Enbridge Price Performance

ENB traded up $0.03 during trading hours on Wednesday, hitting $42.34. The company's stock had a trading volume of 4,650,110 shares, compared to its average volume of 4,883,433. The company has a current ratio of 0.62, a quick ratio of 0.54 and a debt-to-equity ratio of 1.41. Enbridge Inc. has a 12 month low of $32.85 and a 12 month high of $44.13. The business's 50-day moving average price is $41.95 and its 200-day moving average price is $39.21. The stock has a market cap of $92.22 billion, a price-to-earnings ratio of 19.60, a P/E/G ratio of 4.26 and a beta of 0.94.

Enbridge (NYSE:ENB - Get Free Report) TSE: ENB last issued its quarterly earnings data on Friday, November 1st. The pipeline company reported $0.55 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.40 by $0.15. The business had revenue of $10.91 billion for the quarter, compared to the consensus estimate of $4.54 billion. Enbridge had a return on equity of 9.94% and a net margin of 13.54%. During the same period in the prior year, the business posted $0.46 earnings per share. Sell-side analysts expect that Enbridge Inc. will post 2.03 earnings per share for the current fiscal year.

Enbridge Cuts Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Saturday, March 1st. Shareholders of record on Saturday, February 15th will be paid a dividend of $0.67 per share. This represents a $2.68 annualized dividend and a yield of 6.33%. The ex-dividend date of this dividend is Friday, February 14th. Enbridge's payout ratio is 124.07%.

Enbridge Profile

(

Free Report)

Enbridge Inc, together with its subsidiaries, operates as an energy infrastructure company. The company operates through five segments: Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storage, Renewable Power Generation, and Energy Services. The Liquids Pipelines segment operates pipelines and related terminals to transport various grades of crude oil and other liquid hydrocarbons in Canada and the United States.

Featured Stories

Before you consider Enbridge, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enbridge wasn't on the list.

While Enbridge currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.