Public Employees Retirement System of Ohio bought a new stake in Global Ship Lease, Inc. (NYSE:GSL - Free Report) during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm bought 54,053 shares of the shipping company's stock, valued at approximately $1,441,000. Public Employees Retirement System of Ohio owned about 0.15% of Global Ship Lease at the end of the most recent quarter.

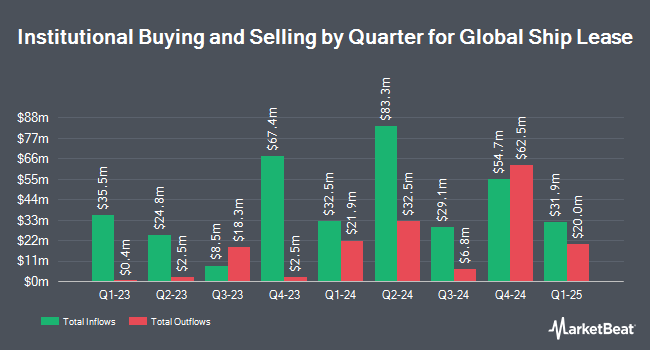

A number of other institutional investors have also recently added to or reduced their stakes in GSL. Blue Trust Inc. lifted its position in Global Ship Lease by 2,642.1% during the second quarter. Blue Trust Inc. now owns 3,126 shares of the shipping company's stock valued at $90,000 after buying an additional 3,012 shares in the last quarter. Summit Securities Group LLC lifted its holdings in shares of Global Ship Lease by 404.2% during the 2nd quarter. Summit Securities Group LLC now owns 12,100 shares of the shipping company's stock valued at $348,000 after acquiring an additional 9,700 shares in the last quarter. Signaturefd LLC lifted its holdings in shares of Global Ship Lease by 23.3% during the 2nd quarter. Signaturefd LLC now owns 2,526 shares of the shipping company's stock valued at $73,000 after acquiring an additional 477 shares in the last quarter. nVerses Capital LLC boosted its position in Global Ship Lease by 355.6% during the 2nd quarter. nVerses Capital LLC now owns 4,100 shares of the shipping company's stock worth $118,000 after purchasing an additional 3,200 shares during the period. Finally, Ritholtz Wealth Management acquired a new stake in Global Ship Lease in the 2nd quarter valued at $221,000. Hedge funds and other institutional investors own 50.08% of the company's stock.

Analyst Ratings Changes

A number of research analysts have commented on GSL shares. Clarkson Capital cut Global Ship Lease from a "buy" rating to a "neutral" rating and set a $27.00 price objective on the stock. in a research note on Thursday, November 14th. StockNews.com lowered Global Ship Lease from a "strong-buy" rating to a "buy" rating in a research report on Friday, October 25th. Finally, Jefferies Financial Group reaffirmed a "buy" rating and issued a $29.00 price objective on shares of Global Ship Lease in a research report on Monday, November 11th.

Check Out Our Latest Stock Report on Global Ship Lease

Global Ship Lease Stock Down 0.7 %

GSL stock traded down $0.14 during trading on Thursday, reaching $21.21. The stock had a trading volume of 347,779 shares, compared to its average volume of 543,550. The company has a current ratio of 1.64, a quick ratio of 1.58 and a debt-to-equity ratio of 0.38. The firm has a fifty day moving average price of $23.16 and a 200 day moving average price of $25.29. The company has a market capitalization of $781.84 million, a P/E ratio of 2.35 and a beta of 1.55. Global Ship Lease, Inc. has a 1-year low of $18.75 and a 1-year high of $30.32.

Global Ship Lease (NYSE:GSL - Get Free Report) last released its quarterly earnings results on Monday, November 11th. The shipping company reported $2.45 EPS for the quarter, topping the consensus estimate of $2.43 by $0.02. Global Ship Lease had a return on equity of 27.88% and a net margin of 46.38%. The business had revenue of $174.06 million for the quarter, compared to analysts' expectations of $175.83 million. During the same quarter in the previous year, the firm posted $2.33 earnings per share. On average, equities analysts anticipate that Global Ship Lease, Inc. will post 9.85 earnings per share for the current year.

Global Ship Lease Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Wednesday, December 4th. Stockholders of record on Friday, November 22nd were paid a dividend of $0.45 per share. This represents a $1.80 annualized dividend and a dividend yield of 8.49%. The ex-dividend date of this dividend was Friday, November 22nd. Global Ship Lease's dividend payout ratio (DPR) is currently 19.93%.

Global Ship Lease Company Profile

(

Free Report)

Global Ship Lease, Inc, together with its subsidiaries, engages in owning and chartering of containerships under fixed-rate charters to container shipping companies worldwide. As of March 11, 2024, it owned 68 mid-sized and smaller containerships, ranging from 2,207 to 11,040 twenty-foot equivalent unit (TEU), with an aggregate capacity of 375,406 TEU.

Read More

Before you consider Global Ship Lease, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Global Ship Lease wasn't on the list.

While Global Ship Lease currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.