Public Employees Retirement System of Ohio acquired a new stake in Southern Copper Co. (NYSE:SCCO - Free Report) during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm acquired 66,868 shares of the basic materials company's stock, valued at approximately $7,735,000.

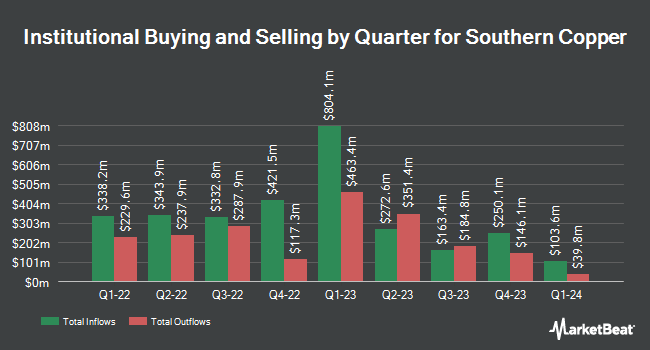

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Connor Clark & Lunn Investment Management Ltd. boosted its stake in Southern Copper by 7.2% during the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 230,495 shares of the basic materials company's stock worth $26,661,000 after acquiring an additional 15,386 shares during the last quarter. Gateway Advisory LLC acquired a new stake in Southern Copper in the second quarter worth $625,000. Morse Asset Management Inc bought a new position in shares of Southern Copper during the third quarter worth $1,397,000. BNP Paribas Financial Markets grew its holdings in shares of Southern Copper by 1,601.3% in the 3rd quarter. BNP Paribas Financial Markets now owns 192,571 shares of the basic materials company's stock valued at $22,275,000 after buying an additional 181,252 shares during the period. Finally, Two Sigma Advisers LP increased its position in shares of Southern Copper by 384.4% in the 3rd quarter. Two Sigma Advisers LP now owns 90,173 shares of the basic materials company's stock valued at $10,430,000 after buying an additional 71,558 shares in the last quarter. 7.94% of the stock is owned by institutional investors.

Southern Copper Stock Down 1.5 %

NYSE:SCCO traded down $1.53 during trading hours on Friday, reaching $100.00. 710,578 shares of the stock were exchanged, compared to its average volume of 1,120,740. The company has a debt-to-equity ratio of 0.64, a current ratio of 2.77 and a quick ratio of 2.31. Southern Copper Co. has a twelve month low of $77.14 and a twelve month high of $129.79. The stock has a market cap of $78.55 billion, a PE ratio of 25.74, a PEG ratio of 1.61 and a beta of 1.14. The firm has a 50 day moving average of $107.70 and a 200 day moving average of $107.23.

Southern Copper Dividend Announcement

The firm also recently announced a -- dividend, which was paid on Thursday, November 21st. Investors of record on Wednesday, November 6th were given a $0.62 dividend. This represents a yield of 2.1%. The ex-dividend date of this dividend was Wednesday, November 6th. Southern Copper's dividend payout ratio (DPR) is currently 72.16%.

Wall Street Analysts Forecast Growth

SCCO has been the topic of several recent analyst reports. Morgan Stanley upgraded Southern Copper from an "underweight" rating to an "equal weight" rating and reduced their target price for the stock from $106.30 to $102.00 in a report on Thursday. Citigroup lifted their price objective on Southern Copper from $99.44 to $100.00 and gave the company a "sell" rating in a report on Wednesday, October 2nd. JPMorgan Chase & Co. upgraded Southern Copper from an "underweight" rating to a "neutral" rating and set a $92.50 price objective for the company in a research report on Monday, December 2nd. Finally, Scotiabank dropped their target price on shares of Southern Copper from $54.00 to $52.00 and set a "sector underperform" rating on the stock in a report on Tuesday, October 15th. Four research analysts have rated the stock with a sell rating, three have issued a hold rating and three have issued a buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $94.81.

Check Out Our Latest Analysis on Southern Copper

Southern Copper Profile

(

Free Report)

Southern Copper Corporation engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrate and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc, copper, molybdenum, silver, gold, and lead.

Read More

Before you consider Southern Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southern Copper wasn't on the list.

While Southern Copper currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.