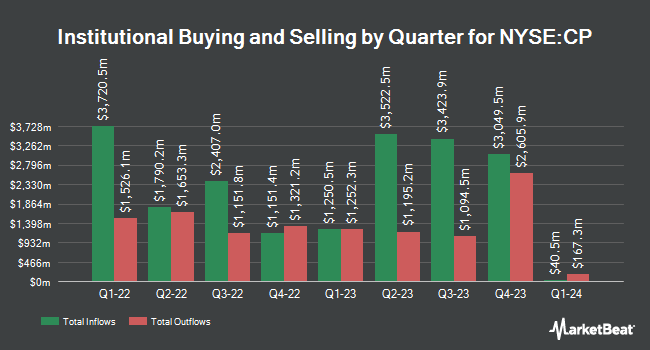

Public Employees Retirement System of Ohio acquired a new stake in Canadian Pacific Kansas City Limited (NYSE:CP - Free Report) TSE: CP in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund acquired 345,773 shares of the transportation company's stock, valued at approximately $29,595,000.

Other large investors have also recently bought and sold shares of the company. Groupama Asset Managment boosted its holdings in shares of Canadian Pacific Kansas City by 10.0% during the 3rd quarter. Groupama Asset Managment now owns 756,134 shares of the transportation company's stock worth $65,000 after buying an additional 68,487 shares during the period. MML Investors Services LLC lifted its position in Canadian Pacific Kansas City by 1.8% during the 3rd quarter. MML Investors Services LLC now owns 137,428 shares of the transportation company's stock worth $11,756,000 after acquiring an additional 2,392 shares during the last quarter. K2 Principal Fund L.P. bought a new stake in Canadian Pacific Kansas City during the third quarter valued at about $1,574,000. XTX Topco Ltd grew its position in shares of Canadian Pacific Kansas City by 138.0% in the third quarter. XTX Topco Ltd now owns 21,279 shares of the transportation company's stock valued at $1,820,000 after purchasing an additional 12,338 shares during the last quarter. Finally, National Bank of Canada FI increased its stake in shares of Canadian Pacific Kansas City by 84.4% in the third quarter. National Bank of Canada FI now owns 2,945,383 shares of the transportation company's stock worth $251,778,000 after purchasing an additional 1,348,474 shares during the period. 72.20% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several analysts recently weighed in on the company. Evercore ISI increased their target price on Canadian Pacific Kansas City from $89.00 to $91.00 and gave the company an "outperform" rating in a research note on Wednesday, September 25th. Bank of America reduced their price objective on Canadian Pacific Kansas City from $94.00 to $91.00 and set a "buy" rating for the company in a research report on Thursday, October 24th. Citigroup dropped their target price on shares of Canadian Pacific Kansas City from $98.00 to $91.00 and set a "buy" rating on the stock in a research report on Tuesday, November 12th. Sanford C. Bernstein reduced their price target on shares of Canadian Pacific Kansas City from $91.98 to $91.25 and set a "market perform" rating for the company in a report on Wednesday, October 9th. Finally, Barclays raised their price target on shares of Canadian Pacific Kansas City from $95.00 to $97.00 and gave the stock an "overweight" rating in a research report on Wednesday, September 25th. One equities research analyst has rated the stock with a sell rating, six have issued a hold rating and eleven have assigned a buy rating to the company. According to data from MarketBeat.com, Canadian Pacific Kansas City has an average rating of "Moderate Buy" and an average price target of $94.88.

Check Out Our Latest Stock Analysis on CP

Canadian Pacific Kansas City Price Performance

Shares of CP traded up $0.03 during mid-day trading on Tuesday, reaching $75.61. The company had a trading volume of 1,963,050 shares, compared to its average volume of 2,275,421. The company has a debt-to-equity ratio of 0.42, a current ratio of 0.53 and a quick ratio of 0.46. The company has a market capitalization of $70.57 billion, a P/E ratio of 27.00, a P/E/G ratio of 2.24 and a beta of 0.96. Canadian Pacific Kansas City Limited has a twelve month low of $72.22 and a twelve month high of $91.58. The company's 50-day moving average is $78.10 and its 200-day moving average is $80.00.

Canadian Pacific Kansas City (NYSE:CP - Get Free Report) TSE: CP last released its quarterly earnings data on Wednesday, October 23rd. The transportation company reported $0.99 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.01 by ($0.02). Canadian Pacific Kansas City had a return on equity of 8.78% and a net margin of 24.50%. The company had revenue of $3.55 billion for the quarter, compared to analyst estimates of $3.59 billion. During the same quarter in the prior year, the company earned $0.69 earnings per share. The business's revenue was up 6.3% compared to the same quarter last year. On average, equities analysts anticipate that Canadian Pacific Kansas City Limited will post 3.05 EPS for the current year.

Canadian Pacific Kansas City Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, January 27th. Shareholders of record on Friday, December 27th will be given a $0.14 dividend. The ex-dividend date is Friday, December 27th. This is a positive change from Canadian Pacific Kansas City's previous quarterly dividend of $0.14. This represents a $0.56 dividend on an annualized basis and a yield of 0.74%. Canadian Pacific Kansas City's payout ratio is 20.00%.

Canadian Pacific Kansas City Profile

(

Free Report)

Canadian Pacific Kansas City Limited, together with its subsidiaries, owns and operates a transcontinental freight railway in Canada, the United States, and Mexico. The company transports bulk commodities, including grain, coal, potash, fertilizers, and sulphur; merchandise freight, such as forest products, energy, chemicals and plastics, metals, minerals, consumer products, and automotive; and intermodal traffic comprising retail goods in overseas containers.

Read More

Before you consider Canadian Pacific Kansas City, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Pacific Kansas City wasn't on the list.

While Canadian Pacific Kansas City currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.