Public Employees Retirement System of Ohio trimmed its stake in Yum! Brands, Inc. (NYSE:YUM - Free Report) by 4.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 102,352 shares of the restaurant operator's stock after selling 5,099 shares during the period. Public Employees Retirement System of Ohio's holdings in Yum! Brands were worth $14,300,000 as of its most recent SEC filing.

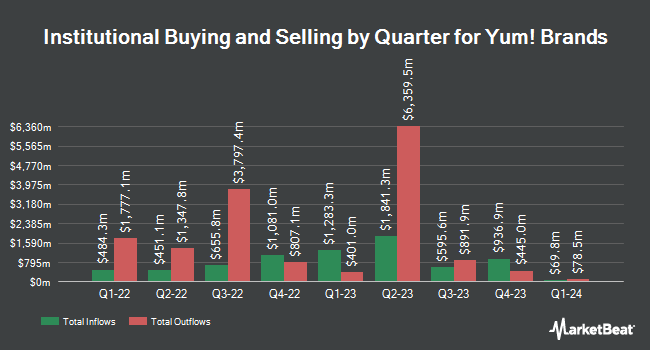

Other hedge funds and other institutional investors also recently modified their holdings of the company. Legal & General Group Plc boosted its position in Yum! Brands by 3.4% during the 2nd quarter. Legal & General Group Plc now owns 3,164,159 shares of the restaurant operator's stock valued at $419,123,000 after acquiring an additional 104,328 shares in the last quarter. Marshall Wace LLP purchased a new position in shares of Yum! Brands in the 2nd quarter valued at approximately $7,645,000. Canada Pension Plan Investment Board boosted its position in shares of Yum! Brands by 140.1% during the second quarter. Canada Pension Plan Investment Board now owns 126,550 shares of the restaurant operator's stock valued at $16,763,000 after purchasing an additional 73,844 shares in the last quarter. Wealth Enhancement Advisory Services LLC raised its holdings in Yum! Brands by 18.2% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 50,807 shares of the restaurant operator's stock worth $6,730,000 after purchasing an additional 7,814 shares in the last quarter. Finally, DoubleLine ETF Adviser LP purchased a new position in Yum! Brands during the second quarter valued at $984,000. Hedge funds and other institutional investors own 82.37% of the company's stock.

Insider Activity at Yum! Brands

In other Yum! Brands news, CEO David W. Gibbs sold 7,005 shares of the business's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $134.43, for a total transaction of $941,682.15. Following the completion of the sale, the chief executive officer now owns 155,883 shares of the company's stock, valued at approximately $20,955,351.69. The trade was a 4.30 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Over the last ninety days, insiders sold 21,069 shares of company stock worth $2,842,965. 0.31% of the stock is owned by company insiders.

Yum! Brands Price Performance

Yum! Brands stock traded up $0.32 during midday trading on Wednesday, reaching $138.54. 1,305,560 shares of the company traded hands, compared to its average volume of 1,919,065. Yum! Brands, Inc. has a 12 month low of $124.76 and a 12 month high of $143.20. The business has a 50 day moving average of $135.43 and a two-hundred day moving average of $134.45. The firm has a market capitalization of $38.66 billion, a price-to-earnings ratio of 25.82, a price-to-earnings-growth ratio of 2.38 and a beta of 1.10.

Yum! Brands (NYSE:YUM - Get Free Report) last issued its quarterly earnings data on Tuesday, November 5th. The restaurant operator reported $1.37 EPS for the quarter, missing the consensus estimate of $1.41 by ($0.04). The firm had revenue of $1.83 billion during the quarter, compared to the consensus estimate of $1.90 billion. Yum! Brands had a negative return on equity of 18.93% and a net margin of 21.13%. The business's revenue was up 6.9% on a year-over-year basis. During the same period in the previous year, the firm earned $1.44 EPS. As a group, equities analysts forecast that Yum! Brands, Inc. will post 5.47 EPS for the current year.

Yum! Brands Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Monday, December 2nd will be issued a $0.67 dividend. This represents a $2.68 dividend on an annualized basis and a dividend yield of 1.93%. The ex-dividend date is Monday, December 2nd. Yum! Brands's payout ratio is 50.09%.

Analysts Set New Price Targets

YUM has been the topic of a number of recent research reports. TD Cowen reaffirmed a "hold" rating and issued a $145.00 target price on shares of Yum! Brands in a research report on Wednesday, November 6th. JPMorgan Chase & Co. upped their price objective on shares of Yum! Brands from $137.00 to $144.00 and gave the stock a "neutral" rating in a report on Monday, September 16th. Deutsche Bank Aktiengesellschaft lowered their target price on shares of Yum! Brands from $147.00 to $145.00 and set a "hold" rating for the company in a report on Wednesday, November 6th. Bank of America cut their price target on Yum! Brands from $147.00 to $145.00 and set a "neutral" rating on the stock in a research note on Tuesday, October 22nd. Finally, Redburn Atlantic cut Yum! Brands from a "strong-buy" rating to a "hold" rating in a research note on Monday, November 11th. Twelve research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $145.94.

Get Our Latest Research Report on Yum! Brands

Yum! Brands Profile

(

Free Report)

Yum! Brands, Inc, together with its subsidiaries, develops, operates, and franchises quick service restaurants worldwide. The company operates through the KFC Division, the Taco Bell Division, the Pizza Hut Division, and the Habit Burger Grill Division segments. It also operates restaurants under the KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill brands, which specialize in chicken, pizza, made-to-order chargrilled burgers, sandwiches, Mexican-style food categories, and other food products.

Further Reading

Before you consider Yum! Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yum! Brands wasn't on the list.

While Yum! Brands currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.