Public Sector Pension Investment Board bought a new position in QuidelOrtho Co. (NASDAQ:QDEL - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor bought 122,675 shares of the company's stock, valued at approximately $5,594,000. Public Sector Pension Investment Board owned about 0.18% of QuidelOrtho as of its most recent filing with the Securities and Exchange Commission.

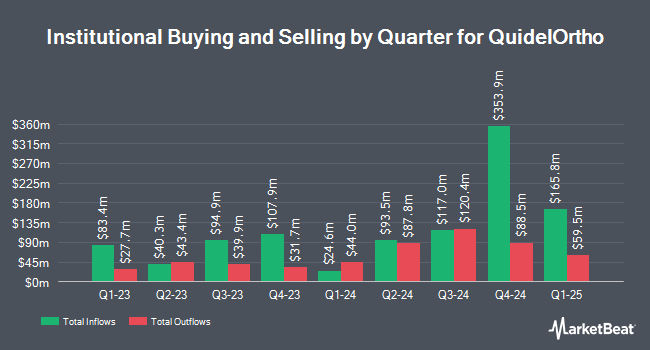

Several other institutional investors and hedge funds have also added to or reduced their stakes in the stock. Rubric Capital Management LP lifted its holdings in QuidelOrtho by 15.2% during the 3rd quarter. Rubric Capital Management LP now owns 4,200,000 shares of the company's stock valued at $191,520,000 after purchasing an additional 554,410 shares during the last quarter. Maverick Capital Ltd. increased its stake in shares of QuidelOrtho by 27.5% in the 2nd quarter. Maverick Capital Ltd. now owns 1,728,913 shares of the company's stock valued at $57,434,000 after acquiring an additional 372,662 shares in the last quarter. FMR LLC grew its position in QuidelOrtho by 28.0% in the 3rd quarter. FMR LLC now owns 1,256,356 shares of the company's stock valued at $57,290,000 after purchasing an additional 274,633 shares during the period. Private Management Group Inc. boosted its holdings in QuidelOrtho by 2.6% during the 3rd quarter. Private Management Group Inc. now owns 626,705 shares of the company's stock worth $28,578,000 after acquiring an additional 16,084 shares during the last quarter. Finally, Van Lanschot Kempen Investment Management N.V. boosted its holdings in shares of QuidelOrtho by 9.8% in the 2nd quarter. Van Lanschot Kempen Investment Management N.V. now owns 593,157 shares of the company's stock worth $19,705,000 after buying an additional 52,729 shares during the last quarter. Institutional investors and hedge funds own 99.00% of the company's stock.

Insider Transactions at QuidelOrtho

In other news, major shareholder Carlyle Group Inc. sold 8,260,183 shares of the business's stock in a transaction that occurred on Thursday, November 21st. The stock was sold at an average price of $35.31, for a total value of $291,667,061.73. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 1.00% of the company's stock.

QuidelOrtho Stock Down 0.1 %

Shares of QDEL stock traded down $0.05 during trading hours on Monday, reaching $40.95. 841,425 shares of the stock were exchanged, compared to its average volume of 994,675. QuidelOrtho Co. has a 12-month low of $29.74 and a 12-month high of $75.86. The business's fifty day moving average is $40.81 and its two-hundred day moving average is $40.19. The firm has a market capitalization of $2.75 billion, a P/E ratio of -1.47 and a beta of 0.12. The company has a debt-to-equity ratio of 0.68, a current ratio of 1.38 and a quick ratio of 0.81.

QuidelOrtho (NASDAQ:QDEL - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The company reported $0.85 earnings per share for the quarter, topping the consensus estimate of $0.30 by $0.55. The firm had revenue of $727.00 million during the quarter, compared to the consensus estimate of $642.16 million. QuidelOrtho had a positive return on equity of 4.24% and a negative net margin of 66.25%. The company's revenue for the quarter was down 2.3% on a year-over-year basis. During the same period last year, the company earned $0.90 earnings per share. As a group, research analysts expect that QuidelOrtho Co. will post 1.73 EPS for the current fiscal year.

Analysts Set New Price Targets

Several research analysts have recently commented on QDEL shares. Royal Bank of Canada reissued an "outperform" rating and set a $61.00 price objective on shares of QuidelOrtho in a report on Friday, August 16th. UBS Group assumed coverage on shares of QuidelOrtho in a research note on Thursday, September 19th. They set a "neutral" rating and a $50.00 target price on the stock. Craig Hallum upgraded QuidelOrtho from a "hold" rating to a "buy" rating and increased their price objective for the stock from $40.00 to $57.00 in a report on Thursday, September 5th. Finally, William Blair reissued a "market perform" rating on shares of QuidelOrtho in a research report on Wednesday, November 20th. One analyst has rated the stock with a sell rating, three have issued a hold rating and three have assigned a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $58.83.

Read Our Latest Analysis on QDEL

QuidelOrtho Company Profile

(

Free Report)

QuidelOrtho Corporation provides diagnostic testing solutions. The company operates through Labs, Transfusion Medicine, Point-of-Care, and Molecular Diagnostics business units. The Labs business unit provides clinical chemistry laboratory instruments and tests that measure target chemicals in bodily fluids for the evaluation of health and the clinical management of patients; immunoassay laboratory instruments and tests, which measure proteins as they act as antigens in the spread of disease, antibodies in the immune response spurred by disease, or markers of proper organ function and health; testing products to detect and monitor disease progression across a spectrum of therapeutic areas; and specialized diagnostic solutions.

See Also

Before you consider QuidelOrtho, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QuidelOrtho wasn't on the list.

While QuidelOrtho currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.