Public Employees Retirement System of Ohio cut its holdings in Pure Storage, Inc. (NYSE:PSTG - Free Report) by 17.9% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 111,903 shares of the technology company's stock after selling 24,459 shares during the quarter. Public Employees Retirement System of Ohio's holdings in Pure Storage were worth $5,622,000 as of its most recent SEC filing.

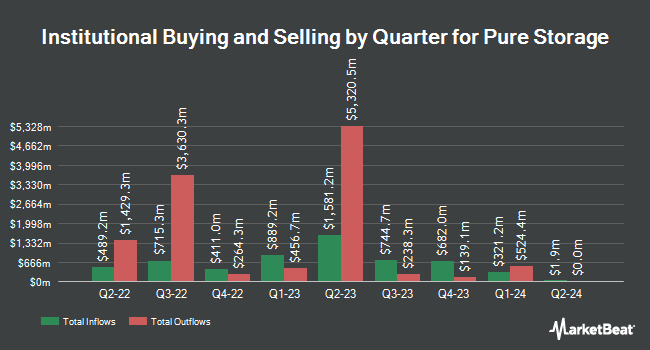

Other institutional investors also recently modified their holdings of the company. Sycomore Asset Management bought a new stake in Pure Storage in the second quarter worth $2,259,000. Citigroup Inc. boosted its stake in Pure Storage by 11.3% in the 3rd quarter. Citigroup Inc. now owns 144,005 shares of the technology company's stock worth $7,235,000 after purchasing an additional 14,659 shares in the last quarter. FMR LLC grew its position in Pure Storage by 0.8% during the 3rd quarter. FMR LLC now owns 49,153,797 shares of the technology company's stock valued at $2,469,487,000 after purchasing an additional 368,643 shares during the last quarter. Bank of Montreal Can grew its position in Pure Storage by 92.0% during the 3rd quarter. Bank of Montreal Can now owns 193,563 shares of the technology company's stock valued at $9,570,000 after purchasing an additional 92,762 shares during the last quarter. Finally, State Street Corp increased its stake in Pure Storage by 6.5% during the 3rd quarter. State Street Corp now owns 10,262,666 shares of the technology company's stock valued at $515,596,000 after purchasing an additional 626,427 shares in the last quarter. 83.42% of the stock is currently owned by institutional investors.

Pure Storage Stock Performance

NYSE:PSTG traded up $1.18 during mid-day trading on Friday, hitting $63.70. 3,645,944 shares of the company traded hands, compared to its average volume of 3,354,581. The stock's fifty day moving average price is $54.29 and its 200-day moving average price is $56.84. The company has a quick ratio of 1.74, a current ratio of 1.77 and a debt-to-equity ratio of 0.07. Pure Storage, Inc. has a one year low of $34.32 and a one year high of $70.41. The firm has a market cap of $20.87 billion, a price-to-earnings ratio of 167.64, a price-to-earnings-growth ratio of 7.69 and a beta of 1.13.

Insider Activity at Pure Storage

In other news, insider John Colgrove sold 100,000 shares of the business's stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $49.94, for a total value of $4,994,000.00. Following the transaction, the insider now directly owns 500,000 shares in the company, valued at $24,970,000. The trade was a 16.67 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CAO Mona Chu sold 25,000 shares of the stock in a transaction dated Wednesday, September 25th. The stock was sold at an average price of $50.32, for a total value of $1,258,000.00. Following the sale, the chief accounting officer now owns 96,639 shares of the company's stock, valued at $4,862,874.48. This represents a 20.55 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 454,542 shares of company stock worth $25,154,030. 6.00% of the stock is owned by company insiders.

Analyst Ratings Changes

A number of research firms have recently commented on PSTG. Guggenheim increased their price target on shares of Pure Storage from $72.00 to $93.00 and gave the company a "buy" rating in a report on Thursday, October 17th. Susquehanna reissued a "positive" rating and issued a $80.00 target price on shares of Pure Storage in a report on Monday, August 26th. Piper Sandler raised Pure Storage from a "neutral" rating to an "overweight" rating and upped their price target for the company from $56.00 to $76.00 in a report on Wednesday, December 4th. Needham & Company LLC lifted their price objective on Pure Storage from $62.00 to $75.00 and gave the stock a "buy" rating in a report on Wednesday, December 4th. Finally, Oppenheimer started coverage on shares of Pure Storage in a research note on Wednesday, November 13th. They set an "outperform" rating and a $70.00 target price on the stock. One analyst has rated the stock with a sell rating, six have assigned a hold rating and sixteen have issued a buy rating to the company's stock. According to MarketBeat, Pure Storage has an average rating of "Moderate Buy" and an average price target of $72.10.

Read Our Latest Stock Analysis on Pure Storage

Pure Storage Company Profile

(

Free Report)

Pure Storage, Inc engages in the provision of data storage and management technologies, products, and services in the United States and internationally. Its Purity software is shared across its products and provides enterprise-class data services, such as always-on data reduction, data protection, and encryption, as well as storage protocols, including block, file, and object.

Recommended Stories

Before you consider Pure Storage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pure Storage wasn't on the list.

While Pure Storage currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.