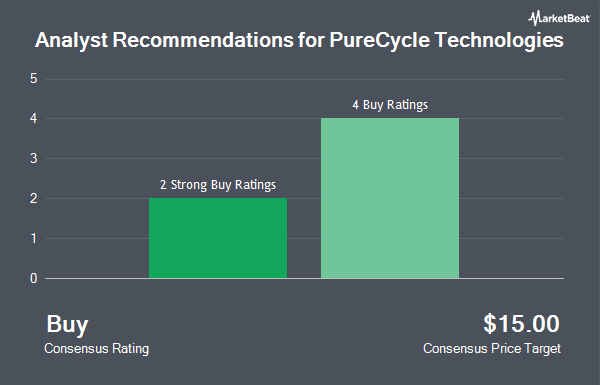

PureCycle Technologies, Inc. (NASDAQ:PCT - Get Free Report) has been assigned a consensus recommendation of "Moderate Buy" from the six brokerages that are currently covering the firm, MarketBeat.com reports. Three investment analysts have rated the stock with a hold recommendation and three have given a buy recommendation to the company. The average 1-year price objective among brokerages that have updated their coverage on the stock in the last year is $10.60.

A number of analysts recently weighed in on PCT shares. TD Cowen upped their target price on shares of PureCycle Technologies from $10.00 to $15.00 and gave the stock a "buy" rating in a research note on Wednesday, November 20th. Stifel Nicolaus lifted their price objective on shares of PureCycle Technologies from $8.00 to $15.00 and gave the stock a "buy" rating in a research report on Tuesday, November 12th. Finally, Cantor Fitzgerald reiterated an "overweight" rating and set a $14.00 target price on shares of PureCycle Technologies in a research note on Tuesday, November 19th.

Read Our Latest Research Report on PureCycle Technologies

PureCycle Technologies Stock Down 1.7 %

PCT traded down $0.20 on Tuesday, hitting $11.68. 1,481,118 shares of the company were exchanged, compared to its average volume of 2,370,775. The firm has a 50-day moving average price of $12.07 and a two-hundred day moving average price of $8.52. The company has a current ratio of 1.74, a quick ratio of 1.63 and a debt-to-equity ratio of 1.36. PureCycle Technologies has a twelve month low of $2.38 and a twelve month high of $15.58. The company has a market cap of $2.03 billion, a price-to-earnings ratio of -7.89 and a beta of 1.53.

Institutional Trading of PureCycle Technologies

Several institutional investors have recently modified their holdings of PCT. Sylebra Capital LLC boosted its position in shares of PureCycle Technologies by 14.6% in the 3rd quarter. Sylebra Capital LLC now owns 33,457,649 shares of the company's stock valued at $317,848,000 after purchasing an additional 4,264,393 shares during the period. Longview Asset Management LLC purchased a new stake in PureCycle Technologies in the second quarter valued at approximately $57,521,000. Appian Way Asset Management LP boosted its holdings in shares of PureCycle Technologies by 12.9% in the third quarter. Appian Way Asset Management LP now owns 5,674,168 shares of the company's stock valued at $53,905,000 after acquiring an additional 650,426 shares during the period. Gladstone Institutional Advisory LLC grew its position in shares of PureCycle Technologies by 1.4% during the third quarter. Gladstone Institutional Advisory LLC now owns 3,339,952 shares of the company's stock worth $31,730,000 after acquiring an additional 44,571 shares during the last quarter. Finally, Geode Capital Management LLC grew its position in shares of PureCycle Technologies by 3.0% during the third quarter. Geode Capital Management LLC now owns 3,124,445 shares of the company's stock worth $29,688,000 after acquiring an additional 92,469 shares during the last quarter. Hedge funds and other institutional investors own 63.01% of the company's stock.

About PureCycle Technologies

(

Get Free ReportPureCycle Technologies, Inc engages in the production of recycled polypropylene (PP). The company holds a license for restoring waste PP into ultra-pure recycled polypropylene resin that has multiple applications, including packaging and labeling for consumer products, piping, ropes, cabling, and plastic parts for various industries.

See Also

Before you consider PureCycle Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PureCycle Technologies wasn't on the list.

While PureCycle Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.