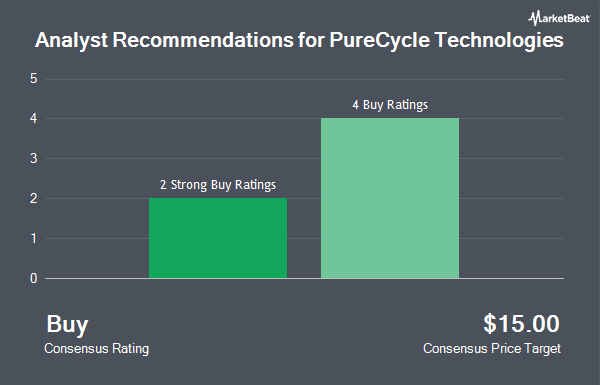

PureCycle Technologies (NASDAQ:PCT - Free Report) had its target price raised by TD Cowen from $10.00 to $15.00 in a research report report published on Wednesday morning, MarketBeat.com reports. TD Cowen currently has a buy rating on the stock.

PCT has been the subject of a number of other research reports. Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $14.00 price target on shares of PureCycle Technologies in a research note on Tuesday. Craig Hallum raised their target price on shares of PureCycle Technologies from $4.00 to $6.00 and gave the stock a "hold" rating in a research report on Friday, August 9th. Finally, Stifel Nicolaus boosted their price target on shares of PureCycle Technologies from $8.00 to $15.00 and gave the company a "buy" rating in a research report on Tuesday, November 12th. Three investment analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $10.60.

View Our Latest Research Report on PureCycle Technologies

PureCycle Technologies Trading Up 2.7 %

PCT traded up $0.32 during trading on Wednesday, hitting $11.99. 2,236,877 shares of the stock traded hands, compared to its average volume of 2,384,843. The firm has a market capitalization of $1.98 billion, a P/E ratio of -8.35 and a beta of 1.56. PureCycle Technologies has a 12-month low of $2.38 and a 12-month high of $15.58. The company has a debt-to-equity ratio of 1.06, a current ratio of 0.67 and a quick ratio of 0.54. The firm has a 50-day moving average of $10.65 and a 200 day moving average of $7.51.

Insider Buying and Selling at PureCycle Technologies

In other PureCycle Technologies news, major shareholder Sylebra Capital Llc bought 4,264,393 shares of the business's stock in a transaction on Friday, September 13th. The shares were acquired at an average cost of $4.69 per share, for a total transaction of $20,000,003.17. Following the purchase, the insider now owns 33,050,456 shares in the company, valued at approximately $155,006,638.64. This trade represents a 14.81 % increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 2.09% of the company's stock.

Institutional Trading of PureCycle Technologies

A number of hedge funds and other institutional investors have recently modified their holdings of the company. Geode Capital Management LLC increased its stake in PureCycle Technologies by 3.0% in the 3rd quarter. Geode Capital Management LLC now owns 3,124,445 shares of the company's stock worth $29,688,000 after acquiring an additional 92,469 shares during the last quarter. Sylebra Capital LLC grew its holdings in shares of PureCycle Technologies by 14.6% in the third quarter. Sylebra Capital LLC now owns 33,457,649 shares of the company's stock valued at $317,848,000 after purchasing an additional 4,264,393 shares in the last quarter. Y Intercept Hong Kong Ltd bought a new stake in PureCycle Technologies in the third quarter worth $289,000. State Street Corp raised its stake in PureCycle Technologies by 0.8% during the third quarter. State Street Corp now owns 2,809,178 shares of the company's stock valued at $26,687,000 after purchasing an additional 21,706 shares in the last quarter. Finally, IHT Wealth Management LLC bought a new position in PureCycle Technologies during the third quarter valued at $485,000. 63.01% of the stock is owned by hedge funds and other institutional investors.

About PureCycle Technologies

(

Get Free Report)

PureCycle Technologies, Inc engages in the production of recycled polypropylene (PP). The company holds a license for restoring waste PP into ultra-pure recycled polypropylene resin that has multiple applications, including packaging and labeling for consumer products, piping, ropes, cabling, and plastic parts for various industries.

See Also

Before you consider PureCycle Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PureCycle Technologies wasn't on the list.

While PureCycle Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.