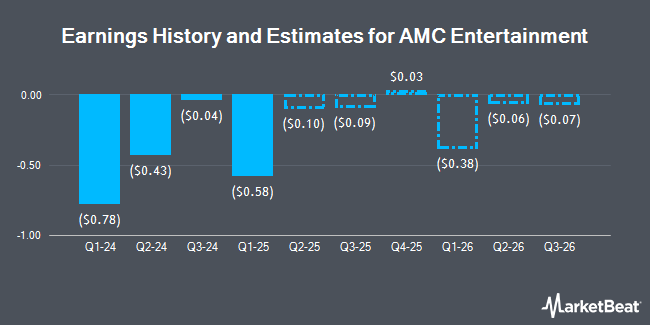

AMC Entertainment Holdings, Inc. (NYSE:AMC - Free Report) - Equities researchers at Barrington Research issued their Q1 2025 earnings estimates for shares of AMC Entertainment in a report issued on Wednesday, February 26th. Barrington Research analyst P. Sholl anticipates that the company will post earnings per share of ($0.48) for the quarter. The consensus estimate for AMC Entertainment's current full-year earnings is ($1.38) per share. Barrington Research also issued estimates for AMC Entertainment's Q2 2025 earnings at ($0.20) EPS, Q3 2025 earnings at ($0.02) EPS, Q4 2025 earnings at ($0.02) EPS, FY2025 earnings at ($0.72) EPS and FY2026 earnings at ($0.48) EPS.

Several other analysts have also issued reports on AMC. B. Riley reduced their target price on shares of AMC Entertainment from $8.00 to $6.00 and set a "neutral" rating for the company in a research note on Thursday, November 7th. Citigroup decreased their price objective on shares of AMC Entertainment from $2.90 to $2.80 and set a "sell" rating for the company in a report on Friday. Macquarie reissued a "neutral" rating and set a $4.00 price objective on shares of AMC Entertainment in a report on Wednesday, February 26th. Roth Capital set a $3.25 price objective on AMC Entertainment in a research note on Tuesday, February 4th. Finally, Roth Mkm raised shares of AMC Entertainment from a "sell" rating to a "neutral" rating and cut their price objective for the stock from $4.00 to $3.25 in a report on Tuesday, February 4th. Three investment analysts have rated the stock with a sell rating and six have given a hold rating to the stock. Based on data from MarketBeat, AMC Entertainment has an average rating of "Hold" and an average target price of $4.76.

Read Our Latest Report on AMC

AMC Entertainment Stock Performance

AMC traded up $0.02 during midday trading on Monday, reaching $3.03. 3,181,021 shares of the company were exchanged, compared to its average volume of 10,466,219. The company has a market cap of $1.14 billion, a price-to-earnings ratio of -1.88 and a beta of 1.88. AMC Entertainment has a one year low of $2.38 and a one year high of $11.88. The company's fifty day moving average price is $3.47 and its 200 day moving average price is $4.17.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Vanguard Group Inc. raised its position in AMC Entertainment by 4.4% during the fourth quarter. Vanguard Group Inc. now owns 36,854,559 shares of the company's stock valued at $146,681,000 after purchasing an additional 1,558,554 shares in the last quarter. Geode Capital Management LLC raised its position in AMC Entertainment by 2.8% in the 4th quarter. Geode Capital Management LLC now owns 8,271,059 shares of the company's stock worth $32,927,000 after purchasing an additional 223,877 shares during the period. State Street Corp lifted its stake in AMC Entertainment by 14.6% in the third quarter. State Street Corp now owns 7,353,442 shares of the company's stock worth $33,458,000 after purchasing an additional 936,618 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its position in AMC Entertainment by 8.8% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 4,032,519 shares of the company's stock valued at $16,049,000 after buying an additional 327,019 shares during the period. Finally, Northern Trust Corp grew its stake in shares of AMC Entertainment by 12.6% during the fourth quarter. Northern Trust Corp now owns 3,318,281 shares of the company's stock valued at $13,207,000 after buying an additional 370,408 shares during the last quarter. 28.80% of the stock is currently owned by hedge funds and other institutional investors.

About AMC Entertainment

(

Get Free Report)

AMC Entertainment Holdings, Inc, through its subsidiaries, engages in the theatrical exhibition business. It owns, operates, or has interests in theatres in the United States and Europe. The company was founded in 1920 and is headquartered in Leawood, Kansas.

Featured Articles

Before you consider AMC Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMC Entertainment wasn't on the list.

While AMC Entertainment currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.