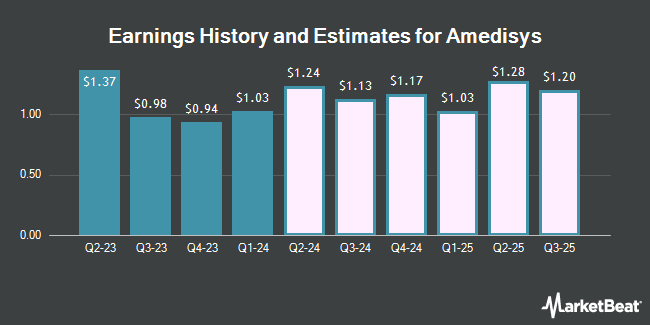

Amedisys, Inc. (NASDAQ:AMED - Free Report) - William Blair issued their Q1 2025 earnings per share (EPS) estimates for Amedisys in a report issued on Thursday, November 7th. William Blair analyst M. Larew expects that the health services provider will post earnings of $1.05 per share for the quarter. The consensus estimate for Amedisys' current full-year earnings is $4.65 per share. William Blair also issued estimates for Amedisys' Q2 2025 earnings at $1.40 EPS, Q4 2025 earnings at $1.26 EPS and FY2025 earnings at $4.80 EPS.

A number of other equities research analysts have also issued reports on AMED. Deutsche Bank Aktiengesellschaft lowered shares of Amedisys from a "buy" rating to a "hold" rating and set a $101.00 target price on the stock. in a research note on Monday, July 29th. Cantor Fitzgerald restated a "neutral" rating and set a $101.00 price objective on shares of Amedisys in a research note on Thursday, July 25th. Four analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. Based on data from MarketBeat.com, Amedisys currently has an average rating of "Hold" and a consensus price target of $100.67.

View Our Latest Report on Amedisys

Amedisys Stock Down 0.1 %

AMED traded down $0.09 during trading on Friday, hitting $96.71. The company had a trading volume of 547,375 shares, compared to its average volume of 339,080. Amedisys has a 1-year low of $89.55 and a 1-year high of $98.95. The company has a debt-to-equity ratio of 0.30, a current ratio of 1.16 and a quick ratio of 1.16. The company has a market cap of $3.17 billion, a PE ratio of 34.57, a P/E/G ratio of 1.87 and a beta of 0.78. The business has a 50-day moving average of $96.73 and a 200-day moving average of $95.78.

Amedisys (NASDAQ:AMED - Get Free Report) last announced its earnings results on Wednesday, November 6th. The health services provider reported $1.00 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.19 by ($0.19). Amedisys had a net margin of 4.02% and a return on equity of 12.39%. The business had revenue of $587.67 million during the quarter, compared to analyst estimates of $586.75 million. During the same period in the previous year, the company earned $0.98 earnings per share. The business's revenue for the quarter was up 5.7% on a year-over-year basis.

Institutional Trading of Amedisys

Several hedge funds have recently made changes to their positions in AMED. SG Americas Securities LLC boosted its holdings in shares of Amedisys by 41.6% during the second quarter. SG Americas Securities LLC now owns 38,315 shares of the health services provider's stock valued at $3,517,000 after acquiring an additional 11,264 shares during the period. BNP Paribas Financial Markets increased its stake in shares of Amedisys by 111.7% in the first quarter. BNP Paribas Financial Markets now owns 12,050 shares of the health services provider's stock valued at $1,111,000 after purchasing an additional 6,358 shares during the period. Dimensional Fund Advisors LP raised its holdings in shares of Amedisys by 4.0% during the second quarter. Dimensional Fund Advisors LP now owns 514,166 shares of the health services provider's stock valued at $47,202,000 after buying an additional 19,660 shares during the last quarter. California State Teachers Retirement System grew its holdings in Amedisys by 65.8% in the 1st quarter. California State Teachers Retirement System now owns 54,592 shares of the health services provider's stock worth $5,031,000 after buying an additional 21,671 shares in the last quarter. Finally, Cetera Advisors LLC acquired a new stake in Amedisys in the 1st quarter valued at approximately $1,556,000. Institutional investors own 94.36% of the company's stock.

About Amedisys

(

Get Free Report)

Amedisys, Inc, together with its subsidiaries, provides healthcare services in the United States. It operates through three segments: Home Health, Hospice, and High Acuity Care. The Home Health segment offers a range of services in the homes of individuals for the recovery of patients from surgery, chronic disability, or terminal illness, as well as prevents avoidable hospital readmissions through its skilled nurses; nursing services, rehabilitation therapists specialized in physical, speech, and occupational therapy; and social workers and aides for assisting its patients.

Read More

Before you consider Amedisys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amedisys wasn't on the list.

While Amedisys currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.