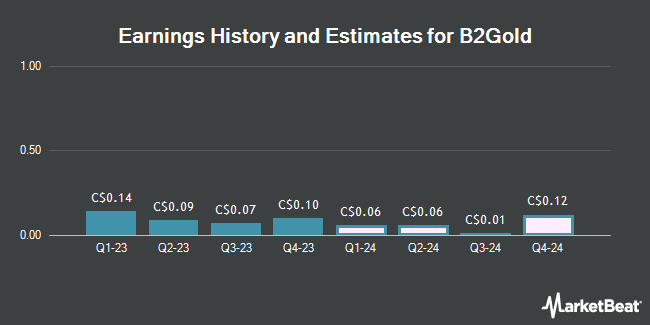

B2Gold Corp. (TSE:BTO - Free Report) NYSE: BTG - Equities research analysts at Stifel Canada issued their Q1 2025 earnings per share (EPS) estimates for shares of B2Gold in a report issued on Monday, April 21st. Stifel Canada analyst I. Rico anticipates that the company will post earnings of $0.13 per share for the quarter. The consensus estimate for B2Gold's current full-year earnings is $0.56 per share. Stifel Canada also issued estimates for B2Gold's FY2025 earnings at $0.67 EPS.

Several other equities analysts also recently commented on the company. Stifel Nicolaus raised their target price on B2Gold from C$6.50 to C$7.50 in a research report on Monday, April 21st. Scotiabank raised B2Gold from a "hold" rating to a "strong-buy" rating in a report on Monday, April 14th. BMO Capital Markets lowered their target price on shares of B2Gold from C$7.00 to C$6.50 in a report on Monday, March 31st. TD Securities downgraded shares of B2Gold from a "strong-buy" rating to a "hold" rating in a report on Tuesday, February 4th. Finally, Bank of America lowered shares of B2Gold from a "buy" rating to an "underperform" rating in a research report on Tuesday, January 14th. One analyst has rated the stock with a sell rating, two have assigned a hold rating, three have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of C$5.93.

Check Out Our Latest Stock Report on BTO

B2Gold Price Performance

BTO traded down C$0.09 during midday trading on Tuesday, reaching C$4.27. 2,034,329 shares of the company's stock were exchanged, compared to its average volume of 3,921,251. B2Gold has a one year low of C$3.16 and a one year high of C$4.88. The firm has a market capitalization of C$3.95 billion, a price-to-earnings ratio of -4.92, a price-to-earnings-growth ratio of -0.27 and a beta of 1.23. The business has a 50-day simple moving average of C$4.21 and a two-hundred day simple moving average of C$4.00. The company has a quick ratio of 3.33, a current ratio of 1.83 and a debt-to-equity ratio of 7.51.

B2Gold Cuts Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, March 20th. Stockholders of record on Thursday, March 20th were paid a dividend of $0.02 per share. The ex-dividend date was Friday, March 7th. This represents a $0.08 annualized dividend and a dividend yield of 1.87%. B2Gold's dividend payout ratio (DPR) is currently -25.32%.

Insider Activity at B2Gold

In other news, Director Clive Thomas Johnson sold 86,496 shares of the firm's stock in a transaction dated Monday, March 10th. The shares were sold at an average price of C$3.85, for a total value of C$333,009.60. Also, Director Jerry Korpan sold 120,000 shares of B2Gold stock in a transaction that occurred on Monday, April 14th. The stock was sold at an average price of C$4.63, for a total transaction of C$555,600.00. Insiders sold a total of 535,145 shares of company stock valued at $2,191,177 over the last quarter. Corporate insiders own 0.66% of the company's stock.

B2Gold Company Profile

(

Get Free Report)

B2Gold Corp. operates as a gold producer company. It operates the Fekola Mine in Mali, the Masbate Mine in the Philippines, and the Otjikoto Mine in Namibia. The company also has an 100% interest in the Gramalote gold project in Colombia; 24% interest in the Calibre Mining Corp.; and approximately 19% interest in BeMetals Corp.

Featured Articles

Before you consider B2Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and B2Gold wasn't on the list.

While B2Gold currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.