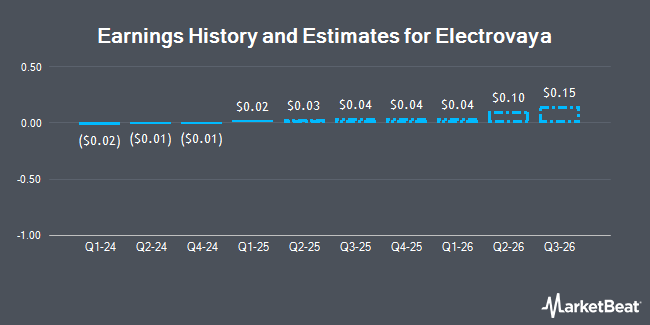

Electrovaya Inc. (NASDAQ:ELVA - Free Report) - Investment analysts at HC Wainwright issued their Q1 2025 earnings estimates for Electrovaya in a research note issued on Friday, December 13th. HC Wainwright analyst A. Dayal anticipates that the company will post earnings of $0.00 per share for the quarter. HC Wainwright has a "Buy" rating and a $10.00 price target on the stock. The consensus estimate for Electrovaya's current full-year earnings is ($0.05) per share. HC Wainwright also issued estimates for Electrovaya's Q2 2025 earnings at $0.02 EPS, Q3 2025 earnings at $0.03 EPS, Q4 2025 earnings at $0.06 EPS and FY2029 earnings at $1.00 EPS.

Separately, Alliance Global Partners assumed coverage on Electrovaya in a research note on Thursday, September 26th. They set a "buy" rating and a $5.00 price objective for the company. Five equities research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the company presently has an average rating of "Buy" and an average target price of $7.25.

Check Out Our Latest Stock Report on ELVA

Electrovaya Price Performance

NASDAQ:ELVA traded down $0.18 during trading hours on Monday, hitting $2.40. The stock had a trading volume of 90,572 shares, compared to its average volume of 40,831. The firm has a market capitalization of $81.94 million, a price-to-earnings ratio of -258.00 and a beta of 1.91. Electrovaya has a one year low of $1.67 and a one year high of $4.58. The company has a 50 day simple moving average of $2.35 and a two-hundred day simple moving average of $2.37. The company has a debt-to-equity ratio of 0.26, a current ratio of 0.99 and a quick ratio of 0.54.

Electrovaya Company Profile

(

Get Free Report)

Electrovaya Inc engages in the design, development, manufacture, and sale of lithium-ion batteries, battery management systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications in North America. It offers lithium-ion batteries and systems for materials handling electric vehicles, including forklifts and automated guided vehicles, as well as battery chargers to charge the batteries; electromotive power products for electric trucks, electric buses, and other transportation applications; industrial products for energy storage; and power solutions, such as competencies in building systems for third parties.

See Also

Before you consider Electrovaya, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Electrovaya wasn't on the list.

While Electrovaya currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.