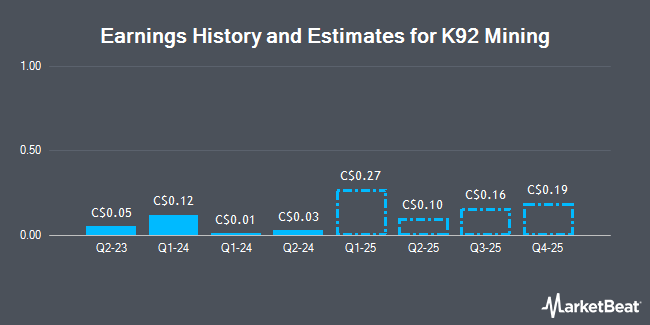

K92 Mining Inc. (TSE:KNT - Free Report) - Analysts at Cormark issued their Q1 2025 earnings estimates for K92 Mining in a research report issued on Tuesday, April 22nd. Cormark analyst N. Dion anticipates that the company will post earnings per share of $0.28 for the quarter. The consensus estimate for K92 Mining's current full-year earnings is $0.73 per share.

Several other research firms have also recently commented on KNT. TD Securities raised K92 Mining to a "strong-buy" rating in a report on Tuesday, February 4th. Stifel Canada raised K92 Mining to a "strong-buy" rating in a research note on Wednesday, March 19th.

Read Our Latest Stock Analysis on KNT

K92 Mining Stock Down 2.3 %

KNT stock opened at C$12.77 on Wednesday. The company has a current ratio of 2.83, a quick ratio of 3.15 and a debt-to-equity ratio of 12.66. The firm has a 50-day moving average of C$11.26 and a two-hundred day moving average of C$9.96. K92 Mining has a 12 month low of C$6.83 and a 12 month high of C$13.58. The company has a market cap of C$2.15 billion, a price-to-earnings ratio of 28.13 and a beta of 1.07.

About K92 Mining

(

Get Free Report)

K92 Mining Inc engages in the mining, exploration, and development of mineral deposits in Papua New Guinea. The company produces gold, copper, and silver. The company's mineral properties include the Kainantu gold mine project that covers an area of approximately 836 square kilometers located in the Eastern Highlands province of Papua New Guinea; and the Blue Lake gold-copper porphyry deposit located in the southwest of the Kora and Judd intrusion.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider K92 Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and K92 Mining wasn't on the list.

While K92 Mining currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.