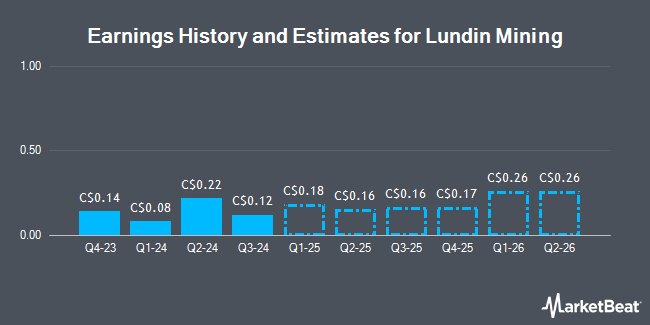

Lundin Mining Co. (TSE:LUN - Free Report) - Equities researchers at Desjardins issued their Q1 2025 earnings estimates for shares of Lundin Mining in a report issued on Tuesday, April 22nd. Desjardins analyst B. Adams anticipates that the mining company will post earnings per share of $0.18 for the quarter. Desjardins has a "Moderate Buy" rating on the stock.

LUN has been the subject of several other research reports. Canaccord Genuity Group raised shares of Lundin Mining from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, April 16th. UBS Group reduced their price target on shares of Lundin Mining from C$14.50 to C$13.50 in a research report on Wednesday, April 23rd. Scotiabank downgraded shares of Lundin Mining from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, January 15th. The Goldman Sachs Group set a C$16.60 price objective on Lundin Mining and gave the company a "buy" rating in a research note on Thursday, March 6th. Finally, Jefferies Financial Group dropped their price objective on Lundin Mining from C$20.00 to C$16.00 in a research note on Monday, January 6th. Five analysts have rated the stock with a hold rating, seven have issued a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of C$16.02.

View Our Latest Analysis on Lundin Mining

Lundin Mining Stock Down 2.5 %

TSE LUN traded down C$0.30 during mid-day trading on Friday, hitting C$11.75. The company's stock had a trading volume of 1,836,100 shares, compared to its average volume of 2,713,512. The company's 50 day simple moving average is C$11.61 and its 200 day simple moving average is C$12.57. Lundin Mining has a twelve month low of C$8.94 and a twelve month high of C$17.97. The company has a current ratio of 1.40, a quick ratio of 0.90 and a debt-to-equity ratio of 41.58. The firm has a market capitalization of C$7.18 billion, a price-to-earnings ratio of 23.32, a PEG ratio of -0.26 and a beta of 1.66.

Insiders Place Their Bets

In other news, Director Adam Ian Lundin purchased 150,000 shares of the business's stock in a transaction on Thursday, April 3rd. The shares were acquired at an average price of C$10.82 per share, with a total value of C$1,623,000.00. Also, insider Nemesia S.a.r.l. purchased 2,000,000 shares of the business's stock in a transaction on Thursday, April 3rd. The stock was purchased at an average cost of C$11.35 per share, for a total transaction of C$22,700,000.00. Insiders own 15.70% of the company's stock.

About Lundin Mining

(

Get Free Report)

Lundin Mining Corp is a diversified Canadian base metals mining company with operations in Brazil Chile Portugal Sweden and the United States of America producing copper zinc gold and nickel. Its material mineral properties include Candelaria Chapada Eagle and Neves-Corvo.

Featured Stories

Before you consider Lundin Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lundin Mining wasn't on the list.

While Lundin Mining currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.